- Techstars: Offers $220K funding for 6% equity. A 13-week program with global reach, lifetime network access, and support from over 5,500 mentors. Alumni include SendGrid and ClassPass.

- Wayra (Telefónica): Focuses on Europe and Latin America. Provides funding and enterprise pilot opportunities tailored to regional markets.

- MassChallenge: Equity-free accelerator supporting startups with grants up to $1M. Operates globally and has helped ventures like Ginkgo Bioworks.

- Antler: Invests up to $500K for 8–10% equity. Supports solo entrepreneurs and early-stage teams through a global network in 20+ cities.

- Station F: Based in Paris, it hosts corporate programs with partners like Microsoft and Meta. Terms vary by program.

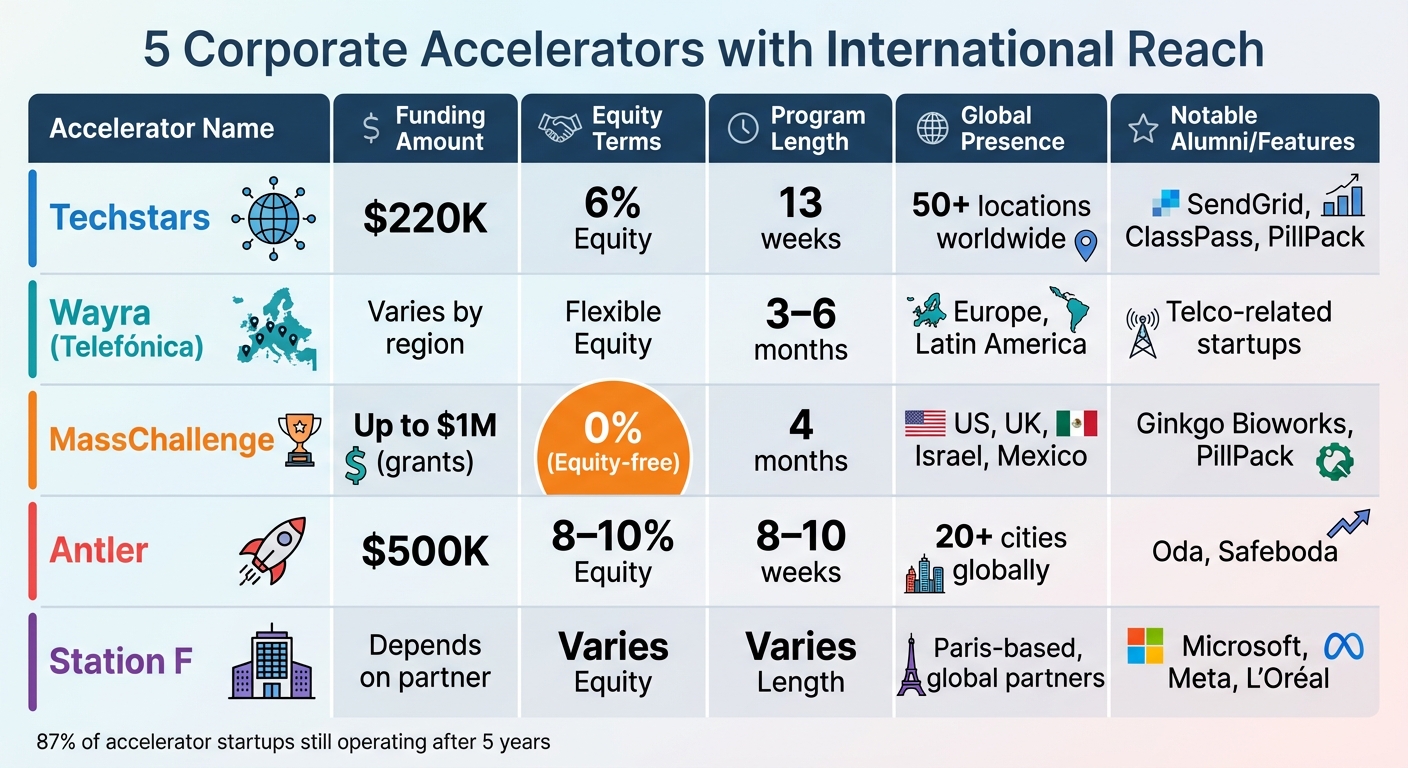

Quick Comparison

| Accelerator | Funding | Equity Terms | Program Length | Global Presence |

|---|---|---|---|---|

| Techstars | $220K | 6% | 13 weeks | 50+ locations worldwide |

| Wayra | Varies by region | Flexible | 3–6 months | Europe, Latin America |

| MassChallenge | Up to $1M (grants) | 0% | 4 months | US, UK, Israel, Mexico |

| Antler | $500K | 8–10% | 8–10 weeks | 20+ cities globally |

| Station F | Depends on partner | Varies | Varies | Paris-based, global partners |

Each accelerator offers distinct benefits, from equity-free funding to tailored mentorship. Choose based on your growth goals, funding needs, and target markets. Want to maximize your chances? Research alumni success stories and assess the fit for your startup stage.

Tip: Programs increasingly focus on AI-driven solutions. Leverage these tools to refine operations and scale faster.

Corporate Accelerators Comparison: Funding, Equity & Global Reach

1. Techstars

Techstars helps startups break into global markets with a mix of targeted funding, mentorship, and access to an international network. Want to stay updated on AI-driven global scaling? Check out our AI Acceleration Newsletter for weekly insights. Their structured approach ensures startups get the support they need to thrive – let’s dive into the details.

Funding Amounts and Equity Terms

Techstars offers $220,000 in funding to each startup through a two-part setup. The first is $20,000 provided via a Post-Money Convertible Common Equity Agreement (CEA), granting Techstars 5% ownership in common stock. The second is $200,000 through an uncapped MFN (Most Favored Nation) SAFE, which converts during the startup’s next funding round. This structure gives startups immediate capital while postponing valuation decisions until later.

Program Length and Structure

The program runs for 13 weeks, with a 4:1 staff-to-startup ratio, ensuring tailored guidance for every founder. It kicks off with two intensive in-person weeks called "Mentor Madness", where founders meet a wide range of mentors to refine their strategies. Midway through, there’s another in-person check-in week, supplemented by ongoing virtual support. The program wraps up with a Demo Day, where founders showcase their progress. Participants work full-time, packing two years of growth into just three months.

This structured timeline is just the beginning – Techstars also opens doors to a global network that lasts well beyond the program.

Global Presence and Network Access

Joining Techstars means lifetime access to a network of over 5,500 mentors and a thriving global alumni community. Participants also receive more than $2 million in perks from corporate partners, along with connections to major companies like Stanley Black & Decker for industry-specific resources and pilot opportunities. With a portfolio of over 1,000 companies boasting a combined market cap of more than $96 billion, Techstars has fostered over 20 unicorn startups.

Success Stories

In 2019, Claire Coder, CEO of Aunt Flow, joined Techstars NYC and connected with Harlem Capital during the "Mentor Madness" phase. By the program’s end, she had secured a $1.5 million seed round led by Harlem Capital. Reflecting on her experience five years later, Coder shared:

"Techstars changed the trajectory of my company and my life."

2. Wayra (Telefónica)

Wayra is Telefónica’s corporate accelerator, designed to help startups with big global goals. Leveraging Telefónica’s extensive knowledge and worldwide network, Wayra works to create strategic partnerships and push forward digital transformation in various markets. Although the specifics differ depending on the region, the program combines funding with opportunities for pilot projects and collaborations with enterprises.

Curious about how AI and strategic innovation are shaping corporate accelerators? Subscribe to our AI Acceleration Newsletter here for weekly updates on using advanced tech to drive scalable growth.

3. MassChallenge

MassChallenge is a global nonprofit accelerator designed to help startups succeed without taking any equity. This means entrepreneurs can keep full ownership of their companies while benefiting from the program’s resources. Its unique approach draws thousands of applicants each year, eager to tap into the opportunities it offers.

The program focuses on supporting early-stage ventures through personalized mentorship and hands-on workshops. While specific details, like the program’s duration, aren’t always highlighted, MassChallenge is dedicated to creating an environment where startups can refine their strategies and expand their reach. Interested in learning more about how mentorship can transform startups? Check out our AI Acceleration Newsletter for weekly tips on using AI to drive growth.

4. Antler

Founded in 2017 by Magnus Grimeland and based in Singapore, Antler stands out as a global startup generator, welcoming solo entrepreneurs – even those without a fully-formed team or a concrete idea. For tips on using international accelerator strategies with AI-driven approaches, Join the AI Acceleration Newsletter.

Funding Amounts and Equity Terms

Antler offers startups a total of $500,000 in funding, divided into two segments: $250,000 in exchange for a 9% equity stake, and another $250,000 provided as Additional Resource Capital (ARC). This upfront funding enables founders to bypass the distractions of early-stage fundraising and focus entirely on building and scaling their businesses.

Global Presence and Network Access

With offices in key cities worldwide, Antler gives startups access to an extensive international network, helping founders expand beyond their local markets. Participants gain connections to a world-class network of advisors and experts, who provide guidance on everything from team building to scaling strategies. Antler also helps solo entrepreneurs form strong, collaborative teams through structured networking – a critical step toward achieving long-term global success.

sbb-itb-32a2de3

5. Station F Corporate Programs

Station F, based in Paris, stands out as a vibrant center for startup innovation and corporate partnerships. Inspired by global initiatives like Techstars and Antler, Station F has developed its own approach to corporate collaboration. The hub offers a variety of programs designed to help startups navigate the challenges of early growth.

While the specifics of funding structures and program durations can vary, Station F is well-regarded for creating opportunities to build international connections. Its ecosystem brings together entrepreneurs, mentors, investors, and industry experts, providing startups with the tools and networks needed to expand globally. If you’re looking to explore how AI can enhance your corporate acceleration efforts, consider subscribing to our AI Acceleration Newsletter for insights and strategies.

Program Comparison

The following breakdown highlights the main distinctions among these accelerators, focusing on their approaches to funding, equity, and global reach. Each program caters to startups differently, making it essential to align your choice with your business’s stage and objectives. A key takeaway? Programs like Techstars and Antler trade equity for robust support, while options like MassChallenge let founders retain full ownership.

Techstars offers a funding package of $220,000 in exchange for 6% equity, paired with a 13-week program available in over 50 locations globally. Their alumni roster includes success stories like SendGrid, PillPack, and ClassPass.

MassChallenge stands out with its equity-free model, taking 0% ownership and providing up to $1 million in prize-based grants. This four-month program operates across the US, UK, Israel, and Mexico, having supported startups like Ginkgo Bioworks and PillPack.

Wayra, supported by Telefónica, focuses on Europe and Latin America. Its funding and equity terms are flexible and vary by regional hub. Programs typically last three to six months, with a particular focus on scaling telco-related startups.

Antler invests between $100,000 and $250,000 for 8–10% equity across its global network in 20+ cities. In the US, the program provides $200,000 for 8% equity, with an additional $300,000 available in follow-on funding. Notable companies in their portfolio include Oda and Safeboda.

Station F, based in Paris, operates differently. It hosts various corporate accelerator programs from partners like L’Oréal, Microsoft, and Meta. Funding, equity terms, and program length depend entirely on the specific corporate partner running the program.

The central trade-off boils down to equity versus support. Techstars and Antler require equity (6–10%) but deliver structured funding and extensive global networks. MassChallenge allows founders to keep full ownership while offering significant non-dilutive grants. Wayra and Station F provide industry-specific benefits with terms tailored to individual startups. These approaches reflect diverse funding strategies and underline each program’s ability to help startups expand on a global scale in today’s tech-driven world.

Conclusion

When it comes to choosing the right accelerator, it’s crucial to align with one that matches your startup’s stage and goals. Programs like Techstars and Antler offer access to global networks in exchange for 6–9% equity, while MassChallenge allows you to retain full ownership. For more targeted, market-specific support, Wayra connects startups with Telefónica’s telecom expertise, and Station F offers tailored corporate partnerships.

With acceptance rates as low as 1–3%, preparation is key. Take the time to research alumni networks, assess the mentors’ expertise in your industry, and examine investor connections to set yourself up for success in your next funding round. The numbers speak volumes: roughly 87% of startups that join accelerator programs are still in business five years later, highlighting the lasting benefits of structured guidance and mentorship. This competitive landscape also emphasizes the importance of streamlining your operations with AI tools once you’re accepted.

Scaling globally requires more than just ambition – it demands operational efficiency. Are you leveraging AI systems to sustain and scale your momentum? Subscribe to our AI Acceleration Newsletter for weekly insights and frameworks on building automated revenue systems that drive international growth.

To tackle these challenges, M Studio specializes in creating AI-driven go-to-market systems for startups scaling through accelerators. With experience supporting over 500 founders and helping secure more than $75 million in funding, we’ve seen firsthand how automation can transform results. Our systems have cut sales cycles by 50% and boosted conversion rates by 40%, turning accelerator opportunities into long-term global success. Through live sessions, we work with you to deploy revenue-driving automations immediately. Whether you’re gearing up for an accelerator or expanding post-program, Elite Founders helps replace manual processes with AI-powered systems designed to fuel sustainable growth.

FAQs

What should I look for when selecting a corporate accelerator?

When choosing a corporate accelerator, it’s crucial to look at its industry focus and expertise to ensure it aligns with your startup’s sector and current growth phase. Many accelerators concentrate on specific fields like AI, fintech, or health tech, offering mentorship and resources tailored to those industries. You should also evaluate the program’s geographic reach and network connections, as those with international ties can open doors to global markets and connect you with key investors.

Other important considerations include investment terms, the program’s duration, and the type of support offered. This could range from mentorship and technical assistance to strategies for entering the market. Some accelerators even provide equity-free funding or promotional credits, which can help cut down on costs. Lastly, take a close look at the program’s track record by researching success stories and alumni achievements to see how well it has helped startups grow and scale.

What are the differences in equity terms offered by corporate accelerators?

Equity arrangements can differ significantly between corporate accelerators and traditional startup programs. Traditional accelerators, such as Y Combinator or Techstars, generally follow a standardized model: they take 6-7% equity in exchange for seed funding, mentorship, and access to resources. This setup is typically part of a fixed investment package, leaving little room for negotiation.

Corporate accelerators, however, tend to approach equity more flexibly. In some cases, they might not require any equity at all, instead focusing on strategic partnerships, industry connections, or offering resources like mentorship and networking opportunities. Others may negotiate equity terms based on factors like the startup’s growth stage or potential value. The main distinction lies in their focus – traditional accelerators prioritize funding in return for equity, while corporate accelerators often aim for strategic alignment and fostering long-term partnerships.

What are the advantages of joining a global accelerator network?

Startups and companies that join a global accelerator network gain access to a treasure trove of resources, including mentorship, funding opportunities, and strategic partnerships. These networks act as a bridge, connecting businesses with industry experts, investors, and potential customers across the globe. This kind of access can significantly boost growth by expanding reach and building trust within the market.

Being part of such an international network also opens doors to new markets and diverse audiences. It encourages businesses to think globally, adapt to various cultural preferences, and spark new ideas through collaboration. This worldwide exposure not only increases a company’s visibility but also helps them stay ahead of industry trends, paving the way for steady growth and effective scaling. Many thriving businesses have harnessed these networks to achieve both rapid expansion and lasting success.