In the frenetic world of startup investing, it’s easy to fixate on the allure of high-profile success stories like Facebook and Google. These tech giants, which have reshaped industries and redefined the way we interact with technology, are often held up as the epitome of entrepreneurial achievement.

Yet, behind their meteoric rise lies a crucial lesson that aspiring founders and investors would do well to heed: the significance of founder equity.

The Power of Founder Equity

Founders’ equity—the ownership stake retained by those who conceive and nurture a startup—is more than just a numerical value on a balance sheet. It is a potent motivator, aligning the interests of founders with the long-term success of their venture. The story of Facebook’s Mark Zuckerberg, who famously retained a 21% ownership stake in the company he founded, and Google’s Larry Page and Sergey Brin, who collectively held 31% of their brainchild, underscores the power of substantial founder equity in driving innovation and perseverance.

The Pitfalls of Excessive Dilution

In contrast, the prevailing wisdom that dictates founders should relinquish sizable portions of equity to secure funding warrants a closer examination. While external investment is often necessary for scaling operations and fueling growth, excessive dilution can erode founder motivation and impede the startup’s ability to weather the challenges of entrepreneurship. As the adage goes, “Too much of a good thing can be detrimental.”

Insights from Carta’s Data

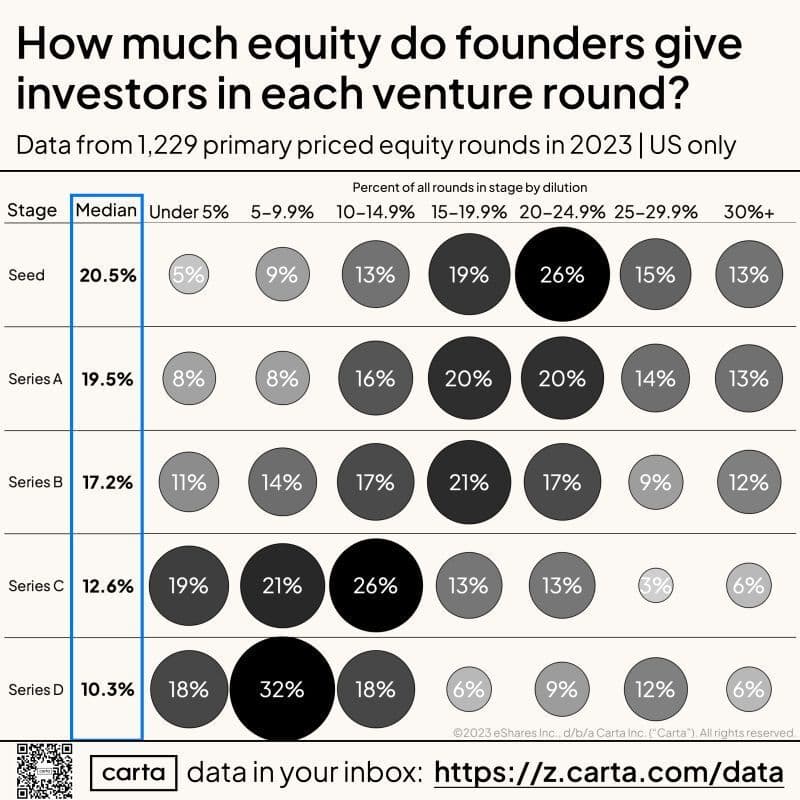

Enter Carta, a leading provider of equity management solutions, which offers valuable insights into the optimal balance between funding and founder equity. Based on Carta’s data, healthy benchmarks for dilution across successive funding rounds emerge, offering a roadmap for sustainable growth and founder retention.

For instance, in Series A funding rounds, where startups typically secure their first significant injection of capital from venture capitalists, founders may expect a dilution of around 19%. This figure increases modestly in subsequent rounds, with Series B, C, and D rounds resulting in dilutions of approximately 17%, 12%, and 10%, respectively.

Preserving Founder Equity for Long-Term Success

These benchmarks underscore the importance of striking a delicate balance between fundraising and founder equity preservation. By judiciously managing dilution, founders can safeguard their vested interest in the company’s success while ensuring that investors are sufficiently incentivized to support growth initiatives. Moreover, maintaining a meaningful equity stake incentivizes founders to remain steadfast in their commitment to the startup’s vision, driving innovation and resilience in the face of adversity.

Image taken from Carta

Conclusion

In conclusion, while the allure of rapid fundraising and sky-high valuations may be enticing, prudent founders and investors recognize that sustainable success hinges on preserving founder equity. By adhering to healthy dilution benchmarks and prioritizing long-term alignment of interests, startups can chart a course towards enduring prosperity, mirroring the remarkable trajectories of Facebook and Google while blazing their own trail in the annals of innovation.