Navigating SAFE Fundraising: Current Trends and Insights in the Startup Landscape

In the ever-evolving world of startup financing, founders must grasp the intricacies of various fundraising methods. One such method, the Simple Agreement for Future Equity (SAFE), has gained significant traction, especially during a startup’s early stages.

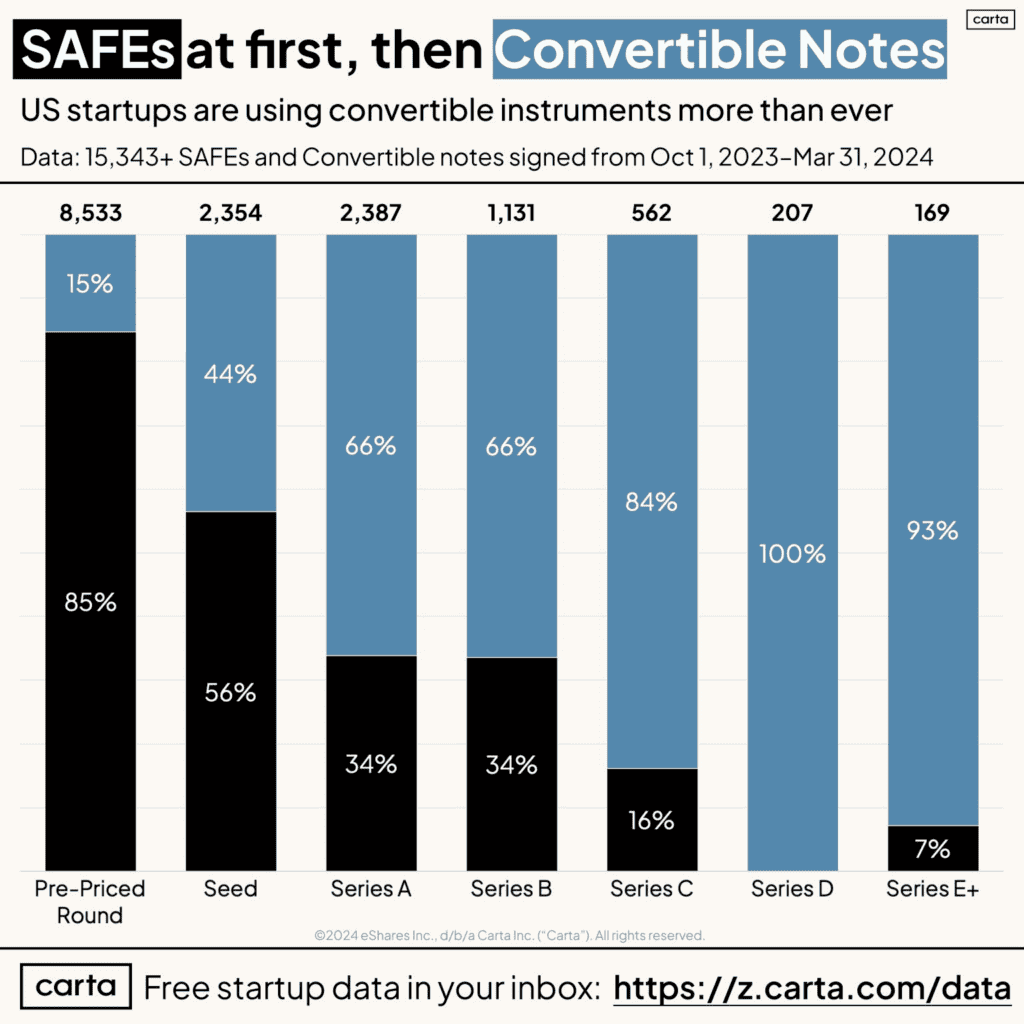

This article explores the latest trends in SAFE fundraising, highlighting its increasing popularity and the shift towards convertible notes as startups advance.

The Rising Popularity of SAFEs in Early-Stage Fundraising

Founders are increasingly opting for SAFEs as their fundraising tool of choice. Recent data from the past six months obtained from CARTA shows a clear preference for SAFEs over convertible notes in early-stage financing. The data, depicted with a black bar for SAFEs and a blue bar for convertible notes, emphasizes the growing dominance of SAFEs in pre-priced round investments across various sectors, including traditionally capital-intensive industries like Biotech.

Key Insights:

- Growing Use of SAFEs: In the US startup ecosystem, SAFEs are becoming the preferred instrument for early-stage fundraising, even in sectors that previously favored more structured funding rounds.

- Shift to Convertible Notes: As startups advance to later funding stages, such as Series A, there is a noticeable transition towards convertible notes. This change underscores a strategic shift in fundraising approaches as companies mature.

- Increase in Convertible Instruments: The overall adoption of convertible instruments, whether SAFEs or notes, has seen a significant rise, reflecting a broader trend in the startup financing landscape.

Why the Move Towards Convertible Instruments?

The growing preference for convertible instruments like SAFEs and convertible notes can be attributed to several factors that align with the current economic climate and the specific needs of rapidly evolving startups:

- Speed and Efficiency: Completing bridge financing through convertible instruments is generally quicker and less cumbersome, appealing to both founders and investors who prioritize efficiency.

- Cost-Effectiveness: These instruments often bypass the substantial legal costs associated with priced rounds, making them financially appealing for early-stage startups.

- Risk Mitigation: Especially during periods of market volatility or downturns, using a convertible instrument can avoid challenging discussions about valuation, potentially mitigating the consequences of a down round.

The Wider Context: Economic Downturn and Its Impact

Against the backdrop of an unstable economy and a cautious investment environment, startups are strategizing to maintain their momentum without compromising on valuation or equity. The current economic downturn has enhanced the appeal of SAFEs and convertible notes as flexible, less dilutive, and more founder-friendly financing options. These instruments enable startups to extend their financial runway, refine their product-market fit, and pursue growth with a flexible financial strategy.

Conclusion

As the startup ecosystem continues to evolve, the methods companies secure funding are also changing. The surge in popularity of SAFEs, especially during the initial fundraising stages, indicates a broader trend towards flexible and founder-centric financing solutions.

Based on numerous conversations with startup founders in our programs at M Accelerator, we corroborate the trend identified by CARTA.

By understanding these evolving trends and adjusting their fundraising strategies accordingly, founders can navigate the challenges of the startup journey with increased confidence and strategic insight.

Adopting such instruments in a landscape characterized by rapid changes and uncertainty could be the key to building resilient and sustainable growth.

English

English  Italiano

Italiano