Navigating the Waters of Cap Tables: A Comprehensive Guide for Investors

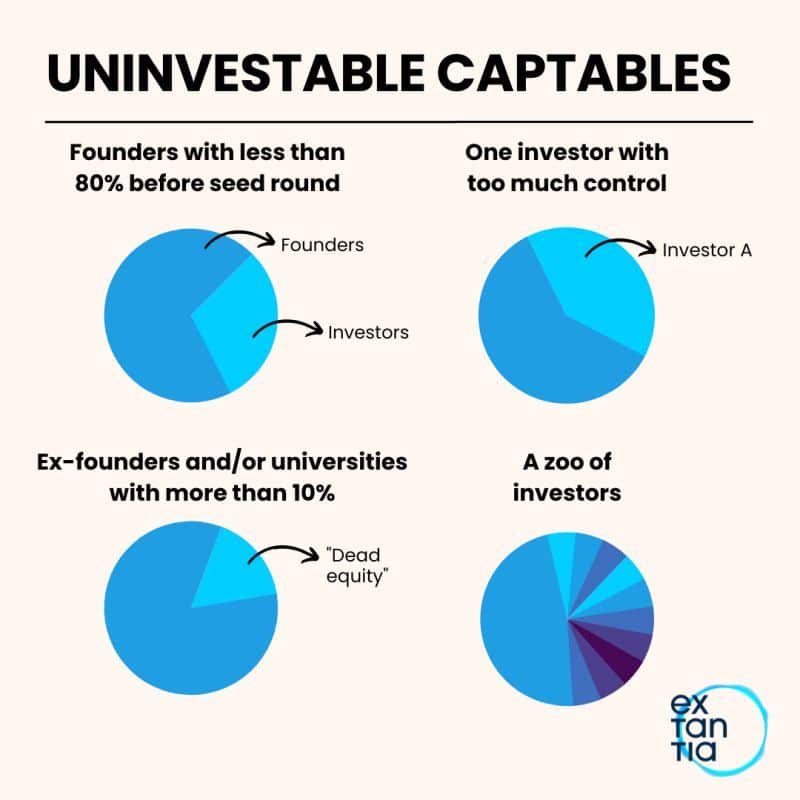

Investing in startups can be a rewarding but complex venture. One crucial aspect that often determines the success of an investment is the structure of the company’s capitalization table, commonly known as the cap table.

Avoiding the pitfalls of an unstable cap table is essential for investors looking to maximize their returns and minimize risks. In this article, we’ll explore the key elements investors should scrutinize when evaluating a company’s cap table.

1. Founder Equity:

Investors should inquire about the founders’ equity stake in the company. Assessing whether the founders have a significant “skin in the game” can indicate their commitment and belief in the venture’s success.

2. Employee Equity:

Understanding the vesting schedule for employee equity grants is crucial. Investors should ensure that the schedule aligns with the company’s growth trajectory and incentivizes long-term commitment from key team members.

3. Investor Equity:

Investors must delve into the details of investor equity, checking for preferences or anti-dilution clauses that could impact their own stake in the company. Clear understanding and negotiation of these terms are vital for safeguarding investors’ interests.

4. Convertible Securities:

Examining the potential dilution impact of convertible securities in future funding rounds is essential. Investors should be aware of the terms and conditions governing these securities to accurately assess their impact on their ownership percentage.

5. Option Pool:

An adequate option pool is necessary for attracting and retaining top talent. Investors should ensure that the option pool size aligns with the company’s hiring and growth plans.

6. Vesting Schedules:

Investors should inquire about vesting schedules, paying particular attention to acceleration clauses. These clauses can impact the timing of equity vesting events, potentially influencing the stability of the company’s key personnel.

7. Warrants:

Understanding the presence and terms of any warrants is crucial. Investors should assess the impact of warrant exercises on the company’s capital structure.

8. Advisor Equity:

The value that advisors bring to the company is paramount. Investors should evaluate the expertise and contribution of advisors to determine the appropriateness of their equity stakes.

9. Rights of First Refusal (ROFR):

ROFR clauses can affect share transferability. Investors should carefully examine these clauses to understand any restrictions on the transfer of shares and their potential impact on liquidity.

10. Legal Compliance:

Ensuring that the cap table complies with securities laws is non-negotiable. Investors should verify that the company has undergone a thorough legal review to mitigate regulatory risks.

Taken from Yair Reem’s original post

Conclusion

In the dynamic world of startup investing, cap tables play a pivotal role in shaping the outcome of an investment. While there is no one-size-fits-all cap table, asking the right questions can help investors uncover potential red flags and make informed decisions.

By thoroughly examining founder equity, employee equity, investor equity, and other key elements, investors can navigate the intricate landscape of cap tables and contribute to the success of innovative startups.

Invest wisely, ask the right questions, and stay informed for a prosperous investment journey.

English

English  Italiano

Italiano