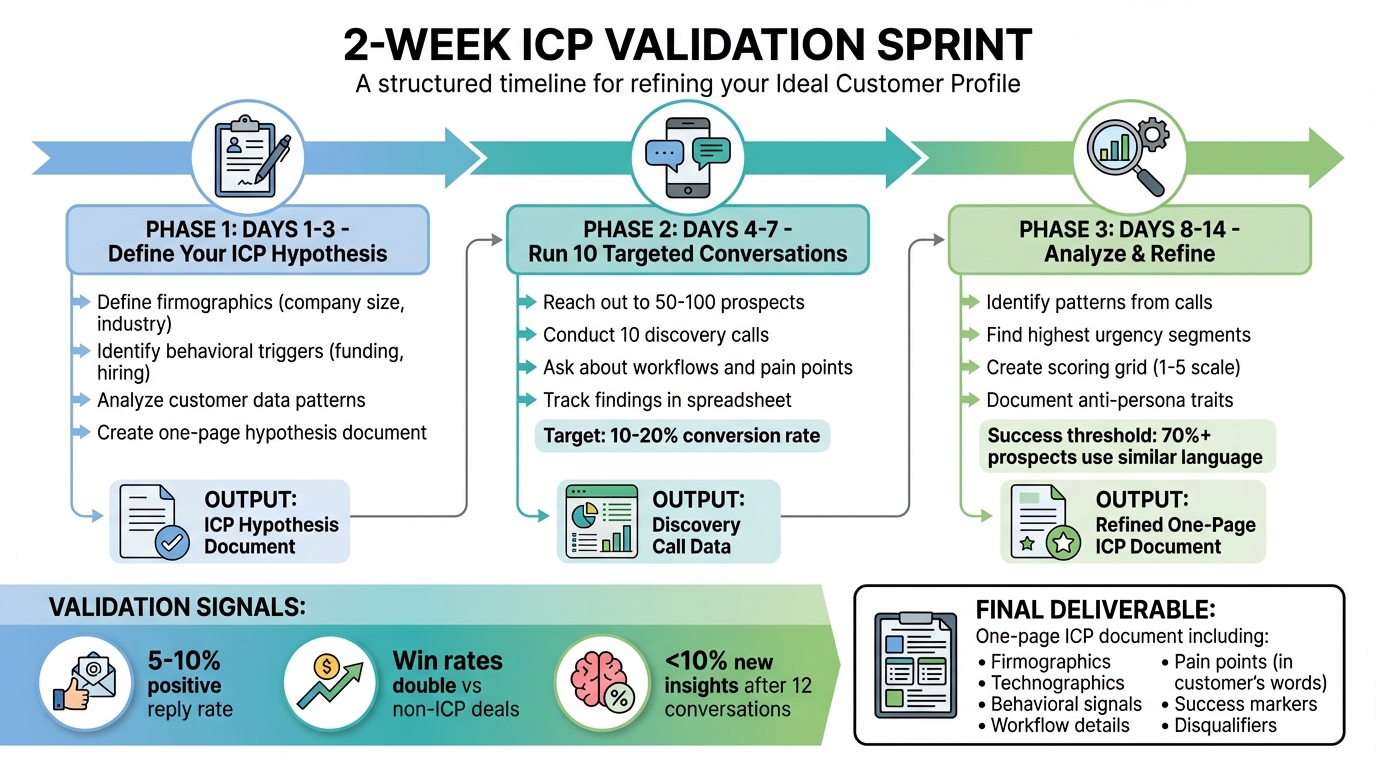

Your Ideal Customer Profile (ICP) is only effective if it leads to paying customers. Many founders skip validation, relying on assumptions or broad definitions like "SaaS companies with 10-50 employees." This wastes time and resources on leads that don’t convert. Here’s a two-week sprint to validate your ICP quickly:

- Days 1-3: Define your ICP hypothesis. Focus on firmographics (e.g., company size, industry) and behavioral triggers (e.g., recent funding, hiring trends). Use customer data to identify patterns in high-converting accounts.

- Days 4-7: Conduct 10 discovery calls with targeted prospects. Ask about workflows, pain points, and triggers for urgency. Track findings in a spreadsheet.

- Days 8-14: Analyze patterns from your calls. Identify segments with the highest urgency and fastest sales cycles. Refine your ICP into a one-page document with clear attributes, disqualifiers, and actionable insights.

2-Week ICP Validation Sprint Timeline

Days 1-3: Document Your ICP Hypothesis

Before you start reaching out to prospects, take the first three days to set a solid foundation. Use this time to create a clear, testable hypothesis about your Ideal Customer Profile (ICP): who they are, the problem your product solves for them, and why they need to act immediately. The goal isn’t perfection – it’s about crafting a hypothesis you can confirm or adjust over the next 11 days.

Define Your Target Customer

Begin with the basics: firmographics like company size, revenue, industry, and location. Then, layer in technographics, which include the tools and technologies your ideal customers use. The trick is to narrow your focus to a highly specific segment. For instance, instead of targeting "B2B SaaS companies", aim for something like:

"B2B SaaS companies with 50-200 employees, using HubSpot CRM, located in North America, and generating $10M+ in annual revenue."

"We started really narrow." – Tomer London, Co-founder and CPO of Gusto

This level of focus allows you to test quickly and gather meaningful feedback. The best ICPs include at least three specific attributes, ensuring the profile is actionable. But don’t just stick to firmographics – consider the customer’s workflow. For example, "teams managing outbound sales" is far more actionable than simply saying "SaaS companies." Understanding workflows gives you insight into the problem you’re solving, which is more valuable than a generic company description.

Identify the Problem and Timing

Zero in on the exact pain point your product addresses and determine why potential customers need to act now – not six months down the line. Look for triggers that push them into the market. These could include:

- A recent Series B funding round

- Hiring 10+ engineers in the last quarter

- A surge in support tickets overwhelming their team

These external factors often indicate urgency far better than generic firmographic data.

"The words customers use are not just ideas. They are the structure of all communication. If you don’t know them, you are talking past them." – Jennifer Havice, Author

When documenting the problem, use your customers’ exact language. For example, if they say, “We’re drowning in manual reporting,” don’t reframe it as “inefficient data workflows.” Their words should form the basis of your messaging.

Use Your Existing Data

Your CRM is a goldmine for insights. Analyze your top-performing customers – the ones that bring in the most revenue or stick around the longest. What do they have in common? Look at:

- Deals that closed quickly

- Customers with high product usage

- Accounts with minimal support issues

Then flip the script and review lost deals or churned accounts. What patterns emerge? These anti-patterns help you identify traits of prospects who are a poor fit, so you can disqualify them early.

Even a small sample of five closed deals can reveal valuable trends. Create a scoring grid based on attributes like company size, tech stack, and behavior, rating each on a scale of 1 to 5. This scoring system helps you objectively prioritize who to target during Days 4-7.

By the end of Day 3, you should have a concise, one-page document that outlines the following:

- Who you’re targeting

- What problem you solve

- Why they need it now

- Who you won’t sell to

This document is your hypothesis. With it in hand, you’ll be ready to test and refine your approach through focused conversations in Days 4-7.

Days 4-7: Run 10 Targeted Conversations

During this four-day stretch, it’s time to test your assumptions through 10 focused discovery calls. These conversations are designed to confirm who needs your product and why, helping you validate the hypotheses you’ve developed so far.

Find the Right Prospects

Leverage tools like LinkedIn Sales Navigator to narrow down prospects based on the criteria you established earlier – things like industry, company size, revenue, and technology stack. To secure 10 meaningful conversations, aim to reach out to 50–100 prospects. A 10–20% conversion rate is a reasonable expectation for this type of outreach.

Focus on three key groups:

- Lost deals: Learn what caused them to walk away.

- New customers: Pinpoint the triggers that led them to buy.

- Loyal customers: Capture their language and understand what keeps them engaged.

Use a mix of email, LinkedIn messages, and cold calls to find out which channel gets the best response. Try two different messaging approaches: one emphasizing ROI and the other addressing a specific pain point. This helps you figure out what resonates most with your audience.

Once you’ve lined up your calls, shift your attention to crafting the right questions.

What to Ask in Discovery Calls

Kick things off with workflow-related questions like:

"What tasks does your team handle daily to manage [specific process]?"

This ensures the prospect is actively dealing with the problem your product addresses.

Next, dig into triggers:

"What event made you start looking for a solution now?"

Look for answers like recent funding, leadership changes, or operational challenges like a spike in support tickets.

Don’t stop at surface-level responses. Use the “three whys” technique: if they say they need better reporting, ask why that matters, then why that matters, and so on. This approach uncovers the deeper issues and the real costs of doing nothing.

Another effective question:

"If your budget was cut tomorrow, which vendor would you drop first and why?"

This can reveal where their priorities lie. Pay attention to emotional cues – irritation, sighs, or even laughter often point to significant pain points.

Track Your Findings

Keep detailed notes in a spreadsheet that logs company details, pain points, triggers, urgency, and a fit score (1–5). Make sure to record the exact words prospects use – this will be invaluable for refining your messaging later.

After every 3-4 calls, schedule a 30-minute team meeting to review your findings. Look for patterns, such as recurring objections or consistent friction points. If 7 out of 10 prospects mention the same issue, you’re likely zeroing in on a major pain point.

Also, document any red flags – traits that consistently show up in poor-fit prospects. These will help you build an anti-persona to disqualify leads that aren’t worth pursuing in the future.

The insights you gather here will set the stage for refining your Ideal Customer Profile (ICP) in the next phase.

Days 8-14: Analyze Patterns and Refine Your ICP

After completing your 10 discovery calls, it’s time to dig into the data and refine your Ideal Customer Profile (ICP). Over the next week, focus on identifying patterns that reveal which prospects have the most urgency, the quickest sales cycles, and the highest likelihood of success. These insights will help you zero in on the segments you can win consistently.

Look for Patterns in Your Data

Review your notes carefully to uncover recurring pain points and buying triggers mentioned during your calls. Research shows that consistent themes often emerge after 12 to 20 interviews. Since you’ve already had 10 targeted conversations, you might already see key patterns forming. If certain pain points and triggers keep coming up, it’s a strong indicator that your ICP is coming into focus.

Pay special attention to buying triggers that suggest immediate spending. Look for signs like recent funding, new leadership hires, or looming regulatory deadlines. The best-fit prospects are often those already doing the work your product supports. For instance, if you offer an outbound sales tool, companies actively running outbound campaigns are more likely to convert quickly.

Don’t overlook emotional cues. Note moments when prospects expressed frustration or excitement – these emotional peaks often highlight urgency. Also, track the alternatives they mentioned. If they’re dissatisfied with a rigid software or an outdated spreadsheet system, it’s a good sign they’re ready for something better.

To make your insights actionable, refine your scoring grid. Rate each prospect based on firmographic, behavioral, and situational factors. Prospects scoring 15 or higher should be classified as your Primary ICP. This structured approach helps turn intuition into clear, data-driven decisions.

With these patterns in hand, you’re ready to narrow your focus to the segments that show the strongest buying signals.

Narrow Your ICP

Now that you’ve identified patterns, it’s time to concentrate on the segments with the highest urgency and fastest conversion potential. A common mistake at this stage is trying to keep too many segments in play. Instead, focus on one or two groups where you can win now – not the larger, aspirational accounts that might pay off down the road.

Organize your prospects into three tiers:

- Primary: These are your top-priority prospects with the highest fit and fastest sales velocity. Direct all sales efforts here.

- Secondary: These prospects show potential but are less consistent. Use automated nurturing to keep them engaged.

- Expansion: These are long-term opportunities with weaker signals. Revisit them quarterly.

Pay close attention to the segment that shows the loudest signs of urgency. If two segments seem equally promising, prioritize the one with faster feedback loops or fewer barriers, like regulatory hurdles. Quick learning cycles and adaptability often outweigh the appeal of a larger but slower-moving market.

Create an anti-persona by documenting the traits of prospects who consistently failed to convert. Look for red flags like low urgency, excessive support needs, or technical incompatibility. Knowing who not to target is just as important as knowing who to pursue – it keeps your pipeline focused and efficient.

"Determining your Ideal Customer is NOT about determining the ONLY type of customer you’ll ever do business with. No, it’s about determining the Ideal Customer for a particular situation." – Lincoln Murphy, Founder, Sixteen Ventures

Create Your One-Page ICP Document

Take your refined insights and consolidate them into a one-page document that your entire team can use. This document should be practical and actionable, not just a static slide deck. Here’s what to include:

- Firmographics: Key details like industry, revenue range, employee count, and location.

- Technographics: Information on current tools, necessary integrations, and technical maturity.

- Behavioral signals: Buying triggers such as recent funding, new hires, or regulatory deadlines.

- The "work" to be done: Specific workflows your product supports, like managing outbound sales campaigns with a team of 5+ reps.

- Pain points and alternatives: Use the exact language prospects shared during calls. For example, if someone said, “I just need something that won’t break in 3 months,” that’s a potential headline for your sales materials.

- Success markers: Indicators of long-term value, such as expansion potential or specific ROI metrics prospects track.

- Buying committee roles: List the titles of decision-makers, influencers, and users you’ll need to engage.

- Disqualifiers: Traits like low urgency, lack of ownership, or technical mismatches that make a prospect a poor fit.

This document isn’t just for sales – it’s a decision-making tool that should guide your entire team. Use it to prioritize deals, shape your product roadmap, and refine your sales process. Plan to update it every 3 to 6 months as your market and business evolve.

| ICP Component | What to Include | Why It Matters |

|---|---|---|

| Firmographics | Industry, revenue, employee count, geography | Establishes the baseline "DNA" of the account |

| Technographics | Current tools, integrations, tech maturity | Identifies compatibility and friction points |

| Behavioral | Funding, hiring, deadlines, demo urgency | Reveals active intent and spending triggers |

| Workflow | Primary workflow, current alternatives, pain points | Defines the specific work your product supports |

| Success Markers | Expansion potential, ROI metrics, advocacy likelihood | Predicts long-term value and retention |

| Negative ICP | Low urgency, technical incompatibility, lack of ownership | Prevents wasted time on poor-fit prospects |

sbb-itb-32a2de3

Validation Signals and Mistakes to Avoid

Signals That Confirm Your ICP

You know you’ve nailed your Ideal Customer Profile (ICP) when consistent patterns emerge in your interactions. A strong indicator is achieving a 5–10% positive reply rate and seeing win rates double compared to non-ICP deals. If prospects are responding within hours or by the next day, it’s a clear sign that your messaging and target audience are in sync.

Another powerful signal? When over 70% of prospects describe their challenges using nearly identical language. This repetition highlights a shared, pressing problem. Incorporating these exact phrases into your marketing can boost your click-through rates by 20–40%. Pay attention to what’s called "The Nod" – when prospects immediately recognize the value of your product and say things like, "We needed this yesterday," rather than a lukewarm, "That’s interesting."

"Your ICP is not anyone with a budget. It’s people who see your product and think, ‘This was made for me.’" – Meka Asonye, Partner, First Round

Another validation clue? When new interviews yield less than 10% new insights. This saturation point often occurs after about 12 conversations. By then, the patterns should be crystal clear. Additionally, if prospects are already engaging in workflows your product supports – like running outbound campaigns for an outbound sales tool – that’s a strong sign of alignment.

These signals indicate you’re on the right track, but ignoring common pitfalls can still derail your progress.

Common Validation Mistakes

Even when you see validation signals, certain missteps can stall your momentum. One of the biggest traps? Expanding your ICP too soon. It’s tempting to add more segments as soon as you see traction, but this can dilute your focus. Clay CEO Kareem Amin shared that their company struggled for five years with almost no revenue because they tried to cater to multiple audiences – recruiters, sales teams, engineers – all at once. Real growth came only after they narrowed their focus to outbound sales teams.

Don’t overlook negative feedback. If prospects frequently mention a missing integration or technical limitation, take it seriously and disqualify that segment. Developing an anti-persona document can help you stay disciplined.

Also, avoid relying on "soft" leads from friends or investor referrals. These leads often give false positives because people in your network are naturally more supportive. Outbound sales data, on the other hand, provides a more accurate picture of demand. Finally, don’t rush into demos. If a prospect doesn’t meet your criteria, it’s better to politely end the conversation early rather than waste time on a poor fit.

Conclusion

Why a Narrow ICP Wins

After completing your focused 2-week ICP validation, the next step is all about commitment. A well-defined and validated ICP gives you the edge to drive growth faster. Deals that align with a narrow ICP often see win rates double compared to non-ICP deals.

Take the example of Retool founder David Hsu. By carefully testing and refining their ICP, Retool secured 40 customers and hit $2 million in ARR before even launching publicly. Initially targeting "FileMaker developers", they shifted focus to "frontend and backend developers" at large corporations. This adjustment revealed that Fortune 250 companies were spending up to $400 million annually on internal tools. That level of focus requires discipline.

"Selling to everyone equals closing no one." – Thomas Waites, Founder, TW Sales

For the next 30 days, commit to your refined ICP. Reach out to 50–100 validated prospects, track meaningful metrics like meetings per 100 contacts (not vanity metrics like open rates), and document your results. This sprint will turn your ICP hypothesis into a repeatable, proven strategy. Want more insights like this? Subscribe to our AI Acceleration Newsletter for weekly tips to help you move faster.

Take Action Now

Now that you have a validated ICP, it’s time to act on it.

Don’t wait for perfection – speed is your ally here. Use your one-page, data-backed ICP document immediately. This framework allowed us to validate our target market in just 2 weeks instead of the typical 6 months. Want to learn how to do the same? Join our next Founders Meeting. It’s a small group with limited spots.

FAQs

How can I identify the right prospects for discovery calls during ICP validation?

To pinpoint the right prospects for your discovery calls, start by crafting a clear hypothesis about your ideal customer. Zero in on a few key traits – like industry, company size, revenue range, and the specific challenge your product addresses. Keep an eye out for urgency cues, such as recent funding, expansion plans, or regulatory shifts, which can help you prioritize prospects who are more likely to take action soon.

Focus on decision-makers who are directly responsible for the problem your product solves and have the authority to make purchasing decisions – think VPs or department heads. Compare these attributes with your current customers to identify patterns among those who converted quickly and stayed engaged. To streamline your efforts, use a simple scoring system (e.g., assign 0-2 points for each attribute) to rank prospects and narrow your list to the top 10-12 candidates for discovery calls. This data-driven approach keeps things efficient and increases your chances of refining your ideal customer profile within two weeks.

What are the key signs that my ICP is accurate?

The clearest signs that your Ideal Customer Profile (ICP) is hitting the mark include:

- Quick sales cycles: When your target accounts move from the first conversation to a signed deal in a matter of days, it’s a strong indicator that your ICP aligns perfectly with the right buyers.

- High conversion rates: If more than 30% of your discovery calls turn into opportunities, it’s a sign your targeting criteria are spot-on.

- Recurring problem language: When prospects consistently bring up the pain points you expected, it’s proof you’ve identified a genuine and pressing need.

- Engagement from key roles and industries: Positive responses from specific roles (like CTOs or VPs of Security) and industries (such as SaaS or FinTech) show your segmentation is on target.

- Low churn and active product use: Early customers who stick around past 90 days, expand their contracts, or frequently use your product confirm that your ICP delivers ongoing value.

When these patterns emerge – faster deals, strong engagement, and loyal customers – you can confidently refine and double down on your ICP, knowing it’s a solid foundation for predictable growth.

What are the common mistakes to avoid when validating your ICP?

Avoiding missteps during ICP validation is all about staying focused, testing efficiently, and basing decisions on solid data instead of gut feelings or assumptions.

It’s tempting to assume that the first prospects who show interest define your ICP. Many founders fall into this trap, often zeroing in on early responders or personal connections. However, these initial customers might not reflect the broader market. Think of your ICP as a working hypothesis that needs testing, not a fixed blueprint.

Keep things simple and targeted. Instead of spreading yourself thin with dozens of interviews, aim for 10–15 meaningful discovery conversations. The goal is to uncover clear buying triggers and patterns – like which prospects are closing deals quickly or demonstrating a strong sense of urgency.

Don’t ignore negative feedback. If prospects consistently challenge your value proposition or hesitate to take the next step, take it seriously. Use this feedback to refine your ICP. Pay close attention to tangible signals, such as accounts that close quickly or prospects showing clear urgency. By staying disciplined and relying on data, you’ll minimize costly errors and develop an ICP that accelerates sales and supports long-term growth.