Decoding the Early-Stage and Growth-Stage Metrics That Matter for Startup Success

Embarking on the journey of investing in startups with the ultimate goal of witnessing them go public is an ambitious pursuit. The allure of an Initial Public Offering (IPO) is undeniably captivating, but the path to achieving this milestone is laden with challenges.

According to a 2018 study by CB Insights, a mere 1% of startups successfully make it to IPO, emphasizing the importance of strategic decision-making and a keen understanding of key metrics in the world of venture capital.

Recent Success Story

In the ever-evolving landscape of startup investments, success stories such as Klaviyo going public underscore the significance of specific metrics in predicting and fostering growth. Klaviyo’s remarkable financials at the time of going public—$788 million in revenue, 35% year-over-year growth, 74% gross margin, and an impressive 119% net dollar retention—serve as benchmarks for aspiring investors seeking the next big IPO.

Key Metrics for Startup Investments

To identify startups with the potential to follow in Klaviyo’s footsteps, investors should focus on key early indicators that set the stage for success. Here are some crucial metrics to consider:

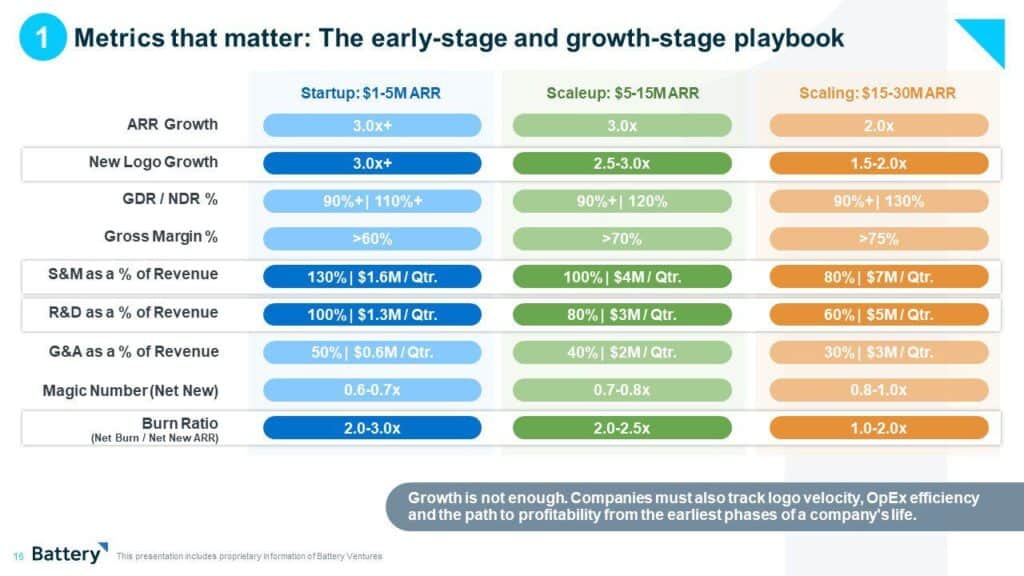

1. **ARR Growth:**

– 3x or more in startups with $1-5 million in Annual Recurring Revenue (ARR).

– 3x growth in scaleups with $5-15 million in ARR.

2. **Gross Margin Percentage:**

– Greater than 60% in startups with $1-5 million in ARR.

– Greater than 70% in scaleups with $5-15 million in ARR.

3. **Burn Ratio:**

– 2-3x in startups with $1-5 million in ARR.

– 2-2.5x in scaleups with $5-15 million in ARR.

These metrics act as early indicators, providing insights into a startup’s potential for sustainable growth and financial viability.

Additional Key Indicators

Investors should also consider other critical indicators not limited to the mentioned benchmarks. These may include customer acquisition cost (CAC), lifetime value (LTV), and churn rate, among others. A holistic evaluation of these metrics provides a comprehensive view of a startup’s health and trajectory.

Source of info and image: OpenCloud https://www.battery.com/blog/opencloud-2023/

Conclusion

While the journey from startup to IPO remains challenging, strategic investors armed with a deep understanding of key metrics can significantly increase their chances of identifying and supporting the next success story. Klaviyo’s IPO serves as a testament to the importance of sustained growth, robust financials, and customer retention.

As the startup ecosystem continues to evolve, staying attuned to these early-stage and growth-stage metrics will be instrumental in navigating the complex landscape of venture capital and reaping the rewards of successful IPOs.

English

English  Italiano

Italiano