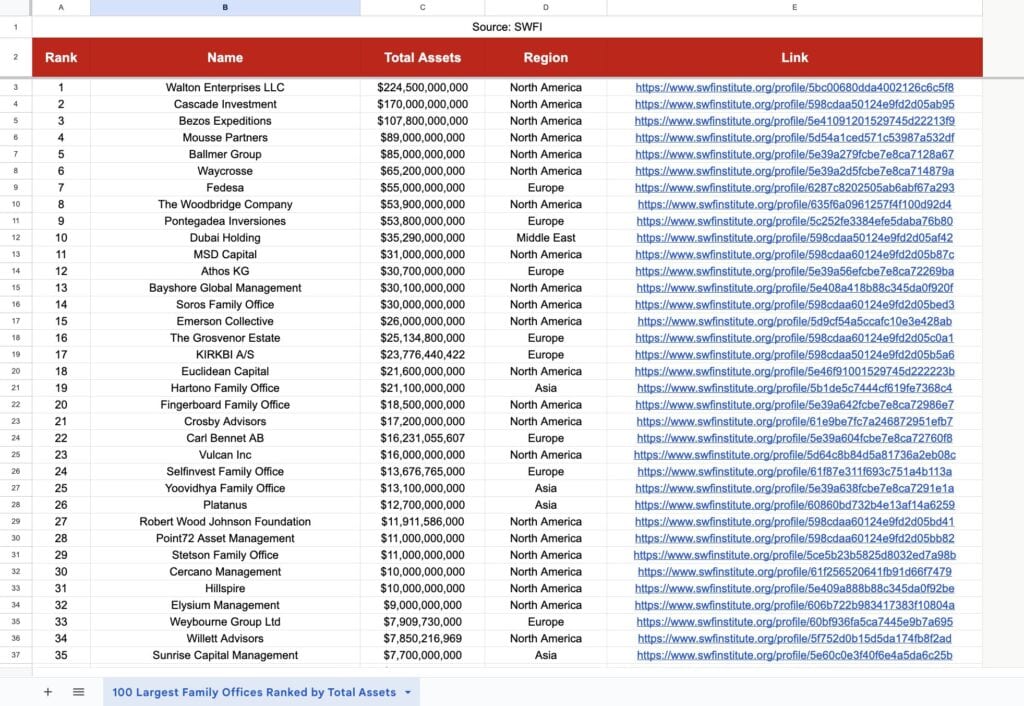

Subscribe to our Newsletter to Download the list: 100 Largest Family Offices Ranked by Total Assets.

In the dynamic world of finance and investment, family offices have emerged as key players, managing vast amounts of capital and influencing global economic landscapes. The recently released rankings by the Sovereign Wealth Fund Institute (SWFI) shed light on the 100 largest family offices, providing insights into their investment strategies, preferred sectors, and the immense capital they wield.

Diversified Investment Trends

According to data from Mordor Intelligence, family offices are diversifying their investment portfolios across various sectors. Health technology stands out as a frontrunner, attracting 86% of these financial powerhouses. This reflects a keen interest in advancements that promote well-being and innovation within the healthcare industry.

Digital and green technologies are also capturing the attention of over 70% of family offices, showcasing a commitment to sustainable and technologically-driven solutions. As the world increasingly focuses on environmental concerns, these offices recognize the potential for both profit and positive impact in green investments.

Private Equity Dominance

Private equity remains a dominant force in the investment preferences of family offices, with 52% of them favoring this asset class. This inclination toward private equity suggests a strategic focus on long-term, high-return investments. By engaging in private equity deals, family offices can actively participate in the growth of promising businesses, while also exercising a degree of control over their investment strategies.

Strategic Criteria for Partnership

For businesses seeking collaboration with family offices, aligning interests and values is paramount. These financial entities are not just sources of capital; they are strategic partners looking for opportunities that align with their long-term perspectives. Confidentiality and transparency are crucial elements in these partnerships, ensuring a harmonious and trust-based relationship.

Furthermore, family offices are increasingly prioritizing investments with a social impact. This commitment to making a positive difference in the world has become a significant criterion for collaboration. Businesses with a clear social mission may find family offices to be ideal partners for achieving shared philanthropic goals.

Top Players in the Family Office Arena

The SWFI rankings unveil the top players in the family office arena, showcasing their staggering AUM and influence. Notable names include:

- Ballmer Group (#5): With an impressive $85 billion in AUM, the Ballmer Group is a major player in the family office landscape. Founded by Steve Ballmer, the former CEO of Microsoft, the Ballmer Group is likely to continue shaping the investment landscape with its substantial capital.

- Mousse Partners (#4): Managing $89 billion in AUM, Mousse Partners holds a prominent position among the top family offices. Known for its diverse portfolio, Mousse Partners is a key player in driving investments across various sectors.

- Bezos Expeditions (#3): Standing tall with $107 billion in AUM, Bezos Expeditions, founded by Jeff Bezos, demonstrates the significant impact of tech moguls in the family office space. With a focus on strategic and impactful investments, Bezos Expeditions is a force to be reckoned with.

Geographic Distribution and Global Presence

The concentration of family office operations varies significantly across regions, with New York and New York City emerging as leading hubs for wealth management services in the United States. These financial centers attract ultra wealthy families seeking sophisticated investment management and access to diverse capital markets. Beyond North America, Hong Kong has become a critical gateway for family wealth operations in Asia, offering strategic access to emerging markets and real estate opportunities across the region.

The Single Family Office vs. Multi Family Office Model

Understanding the distinction between a single family office and a multi family office structure is crucial for wealthy family decision-making. A single family office serves one family exclusively, providing personalized wealth management, estate planning, and financial planning tailored to their unique needs and investment strategy. In contrast, a multi family office pools resources and expertise to serve multiple clients, often delivering cost efficiencies while maintaining high-quality investment management services. Major financial institutions like Morgan Stanley and Northern Trust have expanded their family office services to cater to this growing segment of individual investors.

Notable Family Offices Beyond the Top Three

While Bezos Expeditions, Mousse Partners, and the Ballmer Group dominate headlines, other significant players shape the family office landscape. Walton Enterprises, the family business investment firm of the Walmart founding family, manages substantial assets across diverse sectors. Similarly, billionaires from Dell Technologies have established sophisticated operations in Palo Alto and other technology corridors, focusing on venture capital investments in portfolio companies that drive innovation. Bill Gates’ investment firm, Cascade Investment, represents another powerful example of how technology wealth translates into strategic capital deployment across real estate, private equity firms, and private company investments.

Strategic Asset Allocation and Wealth Preservation

Effective asset management within family offices requires balancing growth objectives with wealth preservation across generations. Beyond private equity and venture capital, real estate investments provide stability and inflation protection for private wealth portfolios. Family offices increasingly employ comprehensive estate planning strategies to ensure seamless wealth transfer while optimizing tax efficiency. The role of the client relationship extends beyond traditional wealth management, encompassing financial planning, investment strategy development, and coordination with external advisors to achieve long-term family wealth objectives.

Conclusion:

As the financial landscape continues to evolve, family offices play a pivotal role in shaping the future of capital allocation and investment trends. These sophisticated investment management entities serve as more than sources of funding—they are strategic partners for businesses, portfolio companies, and individual investors who share their values and vision for sustainable growth.

With the family office model expanding globally from New York to Hong Kong, and from single family office structures to multi family office platforms, the diversity of approaches reflects the unique needs of each wealthy family. Whether focused on real estate, private equity, or innovative venture capital opportunities, these institutions combine substantial assets with deep expertise in wealth management and financial planning.

The SWFI rankings illuminate the largest family offices and their investment strategies, offering valuable insights for entrepreneurs, private companies, and investors seeking collaboration with these influential entities. As billionaires and ultra wealthy families continue to professionalize their wealth management operations through dedicated family business structures, partnering with established advisors and firms that understand the nuances of private wealth becomes increasingly critical for long-term success.