The investment world is diverse, offering various avenues for investors to explore. Among these, venture capital (VC) and private equity (PE) are prominent options, each with its own characteristics and advantages.

This article provides a breakdown of these investment options from the point of view of an investor, highlighting their key differences and considerations.

Risk and Return Profile

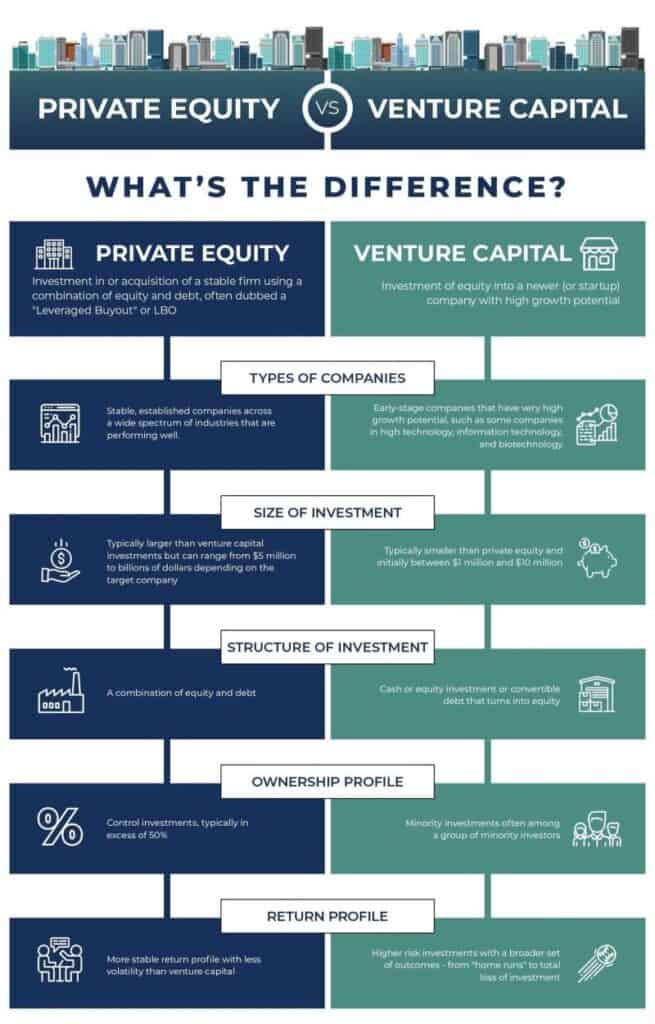

One of the fundamental distinctions between VC and PE investments lies in their risk and return profiles.

VC investments are associated with higher risk due to their involvement with early-stage startups. However, they offer the potential for significant returns if the startup experiences substantial growth and successful liquidity events like an IPO or acquisition.

On the other hand, PE investments typically carry lower risk compared to VC. This is because PE firms target companies with established track records and often generate returns through cash flow, dividends, and capital appreciation. While the returns may not be as explosive as those in the VC space, they are generally more predictable.

Investment Horizon

The investment horizon is another key consideration for investors when choosing between VC and PE.

VC investments tend to have a longer horizon. A startup can take several years to achieve significant growth and reach liquidity events like an IPO or acquisition. Investors in this space must be patient and prepared for a longer-term commitment.

In contrast, PE investments often have a shorter investment horizon. PE firms focus on improving the performance of their portfolio companies within a few years to prepare them for an exit with a profit. This shorter timeframe can appeal to investors looking for quicker investment returns.

Control and Influence

Control and influence over portfolio companies are important factors for investors to consider.

VC investors typically hold minority stakes in startups and may have limited control or influence over the company’s operations. While they can provide strategic guidance and mentorship, the ultimate decision-making often rests with the company’s founders and management.

PE investors, on the other hand, usually acquire a controlling or substantial stake in portfolio companies. This allows them to implement strategic changes, exert greater influence over decision-making, and drive the company’s direction. The level of control and influence in PE investments can be significantly higher than in VC.

Investor Role

The role of an investor in VC and PE varies significantly.

In VC, investors are expected to provide not only capital but also strategic guidance and access to valuable networks. VC investors often take a seat on the boards of their portfolio companies, providing active mentorship to help them navigate the challenges of early-stage growth.

In PE, the focus shifts towards improving operational efficiencies, financial management, and corporate governance. PE investors may become involved in restructuring, cost-cutting, mergers, or acquisitions, actively shaping the portfolio company’s direction and performance.

Investment Size

Investment size is a crucial aspect when choosing between VC and PE, and it varies depending on the stage of investment.

- For Angel (pre-VC): Investment typically ranges from $10,000 to $250,000.

- For Seed (VC): Investment can be between $250,000 and $5 million.

- For Growth (VC/PE): Investment falls in the range of $5 million to $50 million.

- For Crossover (PE): Investment typically ranges from $50 million to $100 million.

- For Late-stage/buyout (PE): Investments in this category can range from millions to billions of dollars.

Image sourced from Hadley Capital

Conclusion

In summary, venture capital and private equity represent two distinct paths for investors, each with its own risk-return dynamics, investment horizons, control levels, and investor roles. The choice between VC and PE ultimately depends on an investor’s risk tolerance, investment objectives, and the stage of companies they are interested in.

As with any investment, thorough research and a clear understanding of the specific sector and market are essential to making informed decisions. Regardless of the chosen path, the potential for significant financial rewards awaits those who navigate the world of venture capital and private equity wisely.