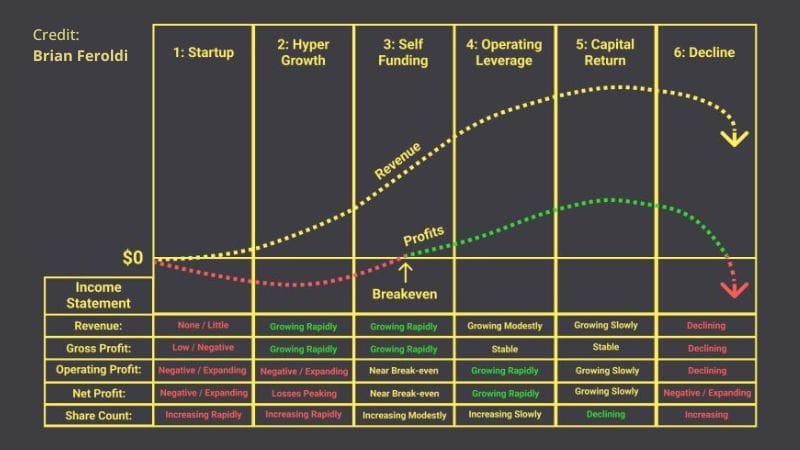

In the dynamic world of startups, the path to success is often uncertain, requiring strategic planning, resilience, and substantial support. Investor involvement is crucial at every stage of a startup’s lifecycle, playing a pivotal role in its growth and sustainability. This article explores how to scale a startup in every stage, emphasizing the symbiotic relationship between investors and founders.

1. Seed Stage Investments

At the embryonic stage of a startup, seed funding is essential to kickstart operations. Investors at this stage need to provide:

- Initial Capital: Supporting market research, product development, and team building is crucial for laying a strong foundation.

- Mentorship and Introductions: Offering guidance and connecting founders with potential partners, clients, and additional investors can significantly boost a startup’s prospects.

- Resource Assistance: Providing essential resources such as office space, legal advice, and networking opportunities can accelerate growth.

2. Hypergrowth Stage Investments

As a startup gains momentum, investors must pivot their support to address the challenges of hypergrowth:

- Recruitment Assistance: Helping in recruiting key personnel and talents is vital to managing and sustaining rapid growth.

- Strategic Refinement: Assisting in refining business models and strategies for scaling, including market expansion and product diversification, is crucial.

3. Self-Funding Stage

During the self-funding stage, investors play a critical role by:

- Strategic Advice: Focusing on providing strategic advice for profitability becomes imperative.

- Network Leveraging: Utilizing existing networks for partnerships can enhance a startup’s reach and influence.

- Operational Insights: Offering insights on operational efficiency and financial health is essential for sustained success.

4. Operational Leverage Stage

Investors’ support takes a pragmatic turn during the operational leverage stage by:

- Maximizing Output: Focusing on maximizing output with minimal cost becomes paramount.

- Risk Mitigation: Advising on mitigating operational and financial risks is crucial for long-term stability.

- Facilitating Financing: Facilitating access to debt financing helps increase operational capacity.

5. Capital Return Stage

As the startup approaches capital return, investors assist in:

- Exit Planning: Planning for IPOs, acquisitions, or mergers becomes a primary focus.

- Market Entry Strategies: Brainstorming ways to enter new markets ensures sustained growth.

- Financial Policies: Advising on dividend policies, share buybacks, or debt repayments optimizes returns.

6. Decline Stage

In the unfortunate event of a decline, investors guide founders in:

- Restructuring: Recommending restructuring strategies to revive the company’s health.

- Asset Liquidation: Advising on selling off portions of the business to reduce losses.

- Winding Down Operations: Assisting in winding down operations or finding buyers to salvage investor value.

Conclusion

In conclusion, the startup journey is a collaborative effort between investors and founders. Both parties must work hand-in-hand to navigate the complexities of each stage, ensuring sustainable growth and maximizing returns. The effectiveness of this partnership lies in the continuous adaptation of investor support strategies to meet the evolving needs of the startup throughout its lifecycle. Ultimately, success is not just about reaching the destination but also about the strength and resilience developed throughout the journey.