In the dynamic world of venture capital and startup investments, the concept of liquidation preference plays a pivotal role in determining the fate of returns during company exits. A case in point is the recent acquisition of Loom for $975 million, where the absence of liquidation preference could have resulted in a significant loss for a16z, turning their breakeven scenario into a 33% loss.

This article delves into the importance of liquidation preference, its role in payout order, and how it acts as a protective shield for investors in the unpredictable landscape of startup exits.

Understanding Liquidation Preference

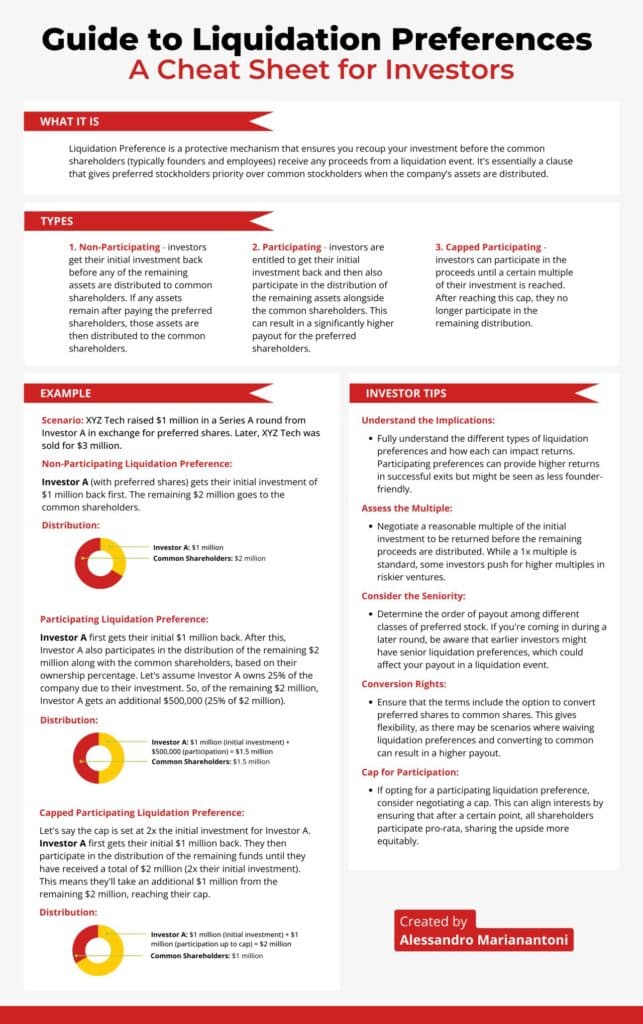

At its core, liquidation preference addresses a crucial question: Who gets their money back first? This element is fundamental in shaping the hierarchy of payouts when a startup undergoes an exit event, such as an acquisition or an initial public offering (IPO). The absence of a clear liquidation preference structure can expose investors to considerable risk and impact their returns significantly.

Protecting Investments in a Downward Exit Scenario

One of the primary advantages of liquidation preference is its ability to shield investors when a company exits at a lower valuation than initially anticipated. In such cases, preferred shareholders, who hold preferred stock with a liquidation preference, receive their investment back before common shareholders. This express pass over common shareholders ensures that investors, like a16z in the Loom acquisition, can recoup a portion of their investment even if the exit valuation falls short of expectations.

Real-Life Scenario: a16z and Loom Acquisition

To illustrate the significance of liquidation preference, let’s consider the example of a16z’s investment in Loom. Despite initially investing at a valuation of $1.5 billion, the acquisition of Loom for $975 million could have resulted in a loss for a16z without the protective measure of liquidation preference. In this case, the preferred shares with a 1x liquidation preference allowed a16z to recoup their investment at the expense of common shareholders, essentially saving them from a substantial loss.

Nuances of Liquidation Preference

While the presented example highlights the fundamental role of liquidation preference, it’s important to note that there are various nuances to this concept. Different types of liquidation preferences, such as participating and non-participating preferences, can impact the distribution of proceeds among investors. Understanding these nuances is crucial for investors looking to navigate the complex landscape of startup investments effectively.

Conclusion

In the ever-evolving world of venture capital, understanding and strategically implementing liquidation preference can make the difference between a successful exit and a significant loss. As demonstrated by the a16z and Loom acquisition case, liquidation preference not only determines payout order but serves as a vital safeguard for investors, allowing them to mitigate risks and protect their investments in the face of unexpected valuation downturns.

This guide provides a foundational understanding of liquidation preference, empowering investors to make informed decisions and navigate the intricate terrain of startup exits.