In the dynamic world of startups, understanding startup growth expectations is crucial for attracting investment. Renowned venture capital firms like a16z, Lightspeed, Accel, Menlo, Greylock, and Founders Fund have set clear benchmarks for growth rates, which are critical for startups aiming for success.

Get the Exact Growth Rates Investors Expect in 2025

✓ Stage-by-stage growth expectations (Pre-seed to Series C+)

✓ 2025 benchmark data from 1,500+ companies

✓ Burn multiple thresholds that get investor attention

✓ Industry-specific growth rates (AI, Cybersecurity, Fintech)

✓ Red flags that kill funding rounds

Table of Contents

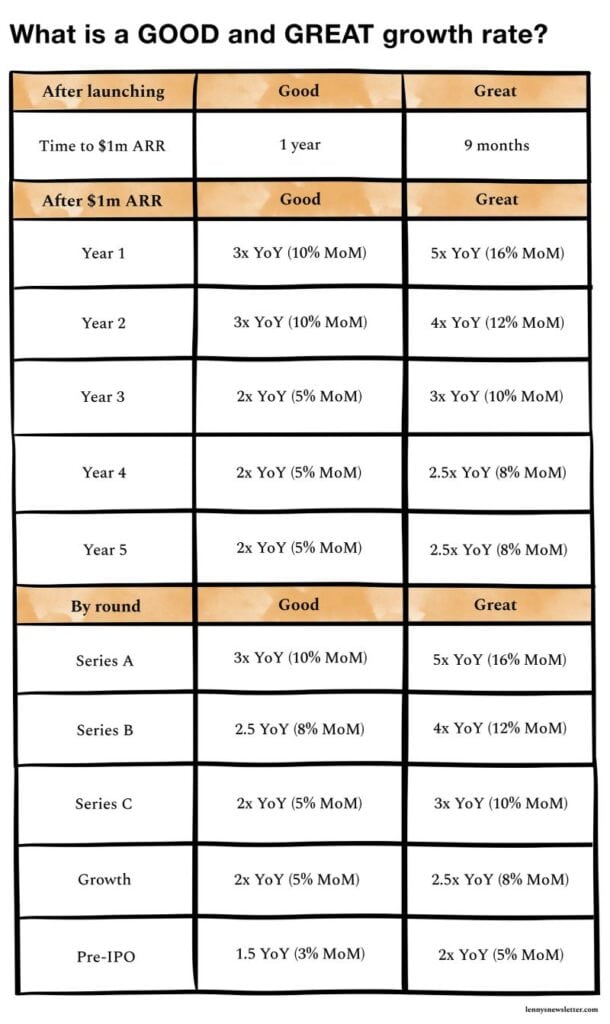

The Early Stage: Racing to $1M ARR

The initial phase for any startup is pivotal. Here, the primary goal is achieving a $1M Annual Recurring Revenue (ARR). This target is not just a number; it represents a significant milestone indicating product-market fit and the potential for scalability. Investors typically expect startups to hit this mark within a year of launch.

During this phase, a Month-over-Month (MoM) growth rate of 15%-25% is considered the gold standard. This aggressive growth rate demonstrates a startup’s ability to quickly capture market share and validate its business model.

Post $1M ARR: Sustaining and Scaling

Once a startup crosses the $1M ARR threshold, the growth expectations shift. The focus moves from high-speed growth to sustainable scaling. The MoM growth rate is expected to be between 5% and 10%. While this may seem like a deceleration, it is a strategic shift towards strengthening the business foundation for long-term success.

Year-over-Year (YoY) growth expectations also change post $1M ARR. A 2X to 3X YoY growth is considered healthy and indicative of a startup’s ability to scale efficiently while managing the complexities of a growing business.

From Seed to Series A: Growth Metrics That Attract Capital

For early stage startups, especially those navigating the seed stage, maintaining strong and consistent growth is critical to securing follow-on funding. Series A investors look for clear evidence of traction, often through revenue growth, customer acquisition, and market validation. A monthly growth rate above 15% during this period is a signal that the startup is not only surviving but thriving. The transition from seed funding to Series A requires a proven growth strategy, solid product development milestones, and validation of a repeatable business model.

Innovative startups that show signs of exponential growth and product-market fit tend to attract more attention from venture capital firms. Whether you’re in healthcare, fintech, or a tech startup, growth stage indicators like working capital efficiency, a defined target market, and increasing customer retention rates play a key role in investor evaluations. Programs like startup accelerators and JP Morgan-backed startup banking initiatives often help early stage companies prepare for these critical metrics.

Pre-IPO: Managing Expectations and Growth

As startups approach the IPO stage, growth rates naturally begin to slow down. This slowdown is not a sign of stagnation but a reflection of the business reaching maturity and operating at a larger scale. During this stage, a 3% – 5% MoM growth or a 1.5X – 5X YoY growth is typical.

Balancing Rapid Growth with Long-Term Vision

While rapid growth can be exciting, successful startups understand the importance of balancing speed with sustainable growth. Venture capital funding can accelerate expansion, but it also comes with pressure to hit aggressive targets. Founders should develop growth strategies that consider long-term revenue generation, scalability of the business model, and efficient use of capital. This is especially true for startups entering Series A and beyond, where growth is expected to align with stronger unit economics and operational scalability.

Sustainable growth doesn’t mean slowing down—it means growing smarter. Early stage entrepreneurs should focus on aligning growth tactics with core metrics like customer lifetime value, acquisition costs, and market research insights. Startups that prioritize these fundamentals are more likely to become promising startups with long-term potential—earning not only investor trust but the foundation for building a truly successful company.

Reality Check: Do These Numbers Align with Expectations?

The benchmarks set by leading venture capitalists are ambitious yet achievable. They serve as a guideline for startups to measure their growth trajectory. However, it’s important to remember that these figures are not one-size-fits-all. The nature of the industry, market conditions, and unique challenges of each startup play a significant role in determining realistic growth rates.

In conclusion, while top investors’ growth rate expectations can serve as a strategic blueprint, startups must also weigh their unique circumstances and market dynamics. Meeting these ambitious targets is admirable, yet balancing rapid expansion with sustainable practices is crucial for long-term success.

If you’d like to read more insights like this and discover additional opportunities tailored for business founders, sign up for our free newsletter to stay informed and connected.