Private membership clubs for business founders offer unparalleled access to high-level networking, exclusive spaces, and opportunities for deal-making. These clubs, with annual fees ranging from $2,000 to $200,000, cater to entrepreneurs generating $1M–$50M+ in revenue and provide a platform for connections that can drive business growth.

Key takeaways:

- Elite Networking: Clubs like Core Club and Zero Bond connect members with investors, executives, and strategic partners.

- Cost vs. Value: Membership fees can range from $2,000 to $200,000, with ROI depending on your ability to leverage connections.

- Who Benefits: Ideal for scaling founders ($10M+ ARR) or exit-ready entrepreneurs ($50M+ ARR). Early-stage founders (<$1M ARR) may find more value in affordable alternatives like local hubs or online communities.

- Club Examples:

- Core Club (NYC): $100K/year; ideal for founders with $50M+ revenue.

- Soho House (Global): $2K–$5K/year; best for creative founders with $1M–$10M revenue.

- Zero Bond (NYC): $3.6K/year; tech-focused, for $10M+ revenue founders.

- Aman Club (NYC): $200K initiation; for post-exit founders with $100M+ net worth.

Choosing a Club: Match your business stage, industry, and location to the right club. Early-stage founders should focus on building networks through affordable options before considering elite memberships.

Future Trends: Clubs are shifting toward hybrid models, integrating digital tools and blockchain for membership access, while sustainability is becoming a key focus.

The right club can accelerate growth, but only if you’re ready to invest the time and money wisely.

What Are Private Membership Clubs for Business Founders?

Definition and Evolution

Private membership clubs for business founders are exclusive spaces designed for entrepreneurs, CEOs, investors, and emerging leaders who have reached notable milestones in their careers. These clubs have evolved from traditional gentlemen’s clubs into dynamic environments where business and leisure coexist seamlessly.

This shift mirrors the modern lifestyle of successful founders, who no longer separate work from personal life. Instead, these clubs integrate both aspects. In fact, the global market for private membership clubs is projected to nearly double, reaching $59.1 billion by 2033, with an annual growth rate of 7.2% from its current $31 billion valuation.

This evolution highlights how these clubs stand apart from broader entrepreneur networks, offering a unique blend of exclusivity and value.

How They Differ from Entrepreneur Networks

Entrepreneur networks often focus on accessibility and general skill-building, typically offering free or low-cost entry points. Private membership clubs, on the other hand, are much more exclusive.

Take the Founders Club, for example. This invite-only community boasts over 350 members across 25 cities, collectively generating over $10 billion in revenue. Membership in such clubs requires a substantial financial commitment, including initiation fees and high annual dues, with strict criteria for eligibility.

Unlike traditional networks, which emphasize broad collaboration and basic learning opportunities, these clubs foster deeper, more strategic connections. Members engage in confidential discussions with peers who can facilitate significant business deals, moving beyond surface-level interactions like webinars.

| Feature | Private Membership Clubs | Traditional Entrepreneur Networks |

|---|---|---|

| Entry Requirements | Invite-only, rigorous vetting | Open or minimal requirements |

| Annual Cost | High investment, often six figures | Modest fees or free |

| Primary Focus | Deal-making, investor access, partnerships | Peer learning, broad networking |

| Physical Presence | Premium, exclusive spaces | Virtual or basic meeting spaces |

| Member Profile | Established leaders, high achievers | Broad range of entrepreneurs |

These distinctions create a unique edge for members, which is explored further in the next section.

The Business Case for Joining

Private membership clubs offer unparalleled value through exclusive access and carefully curated connections. Members become trusted resources for one another, opening doors that are often closed to outsiders. This environment fosters trust, which is key to accelerating high-stakes deal-making.

A 2023 study by the Kauffman Foundation revealed that 72% of entrepreneurs experience mental health challenges tied to their business responsibilities, with isolation being a major factor. These clubs combat that isolation by creating tight-knit communities where members share a genuine understanding of leadership pressures.

Additionally, being part of an elite club can enhance your personal and professional brand. The credibility gained from associating with a high-level network can lead to better funding opportunities, strategic partnerships, and faster growth for your business.

Who Actually Benefits?

These clubs are ideal for founders and accomplished entrepreneurs who have outgrown traditional networks. They provide a strategic, exclusive environment where meaningful connections and deal-making thrive.

10 Premier Private Membership Clubs for Business Founders

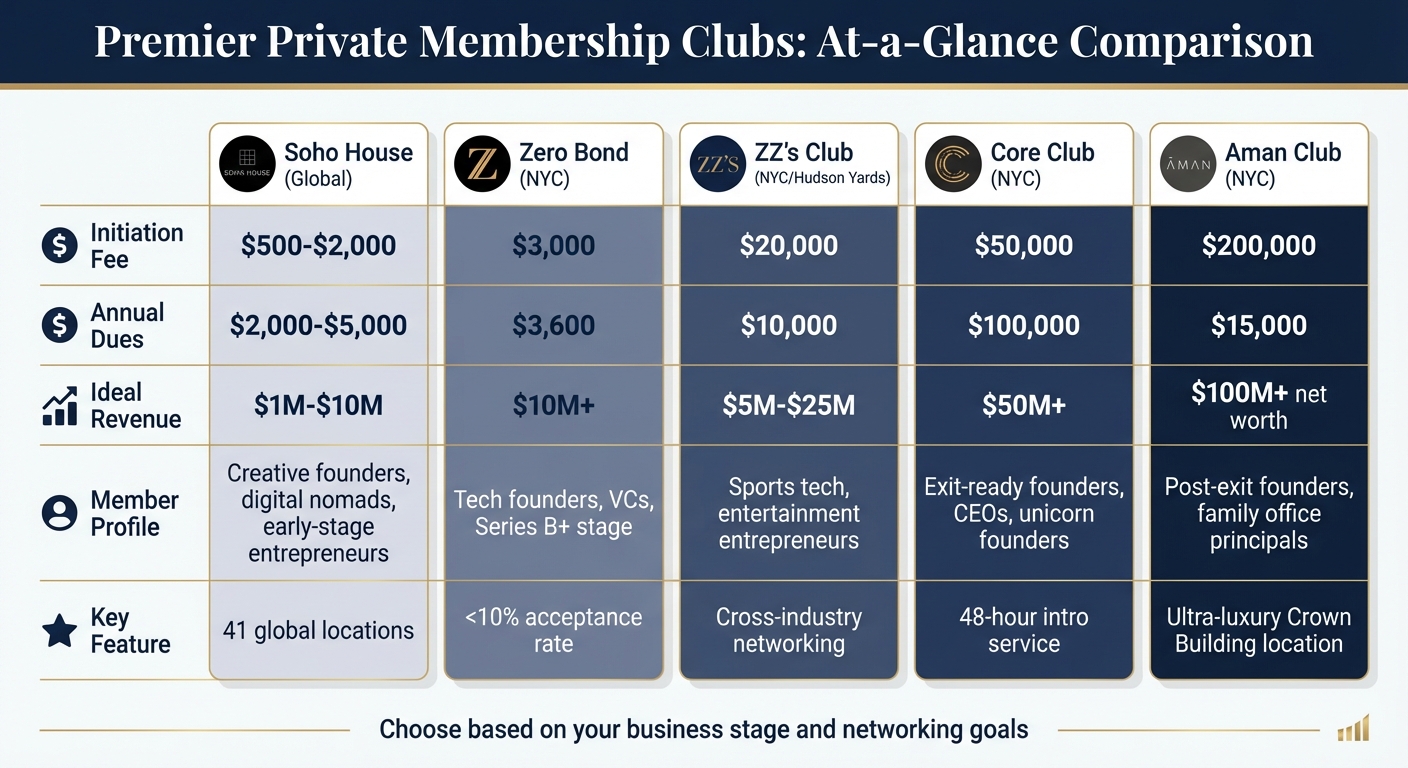

Private Membership Clubs Comparison: Costs, Requirements and Ideal Member Profiles for Business Founders

Private membership clubs for business founders offer a range of annual fees, from $2,000 to $200,000, catering to specific professional profiles and goals. To maintain exclusivity, most clubs require a thorough application process, often involving sponsorships, background checks, and strong referrals from existing members.

These clubs now go beyond traditional networking, integrating advanced wellness amenities and fostering intellectual growth through exclusive lectures and peer-to-peer learning. Below, we dive into five standout clubs that highlight the variety of offerings available to ambitious founders.

Core Club (NYC)

Core Club is where Manhattan’s elite entrepreneurs and executives gather for private, high-stakes networking.

What Sets It Apart: Located on Fifth Avenue, Core Club spans 60,000 square feet, offering a luxurious blend of privacy and functionality. It’s tailored for CEOs, managing directors, and unicorn founders with a net worth of $50M or more.

Key Details:

- Initiation Fee: $50,000

- Annual Dues: $100,000

- Signature Features: Multiple floors house fine dining areas, a spa with treatment suites, private meeting rooms, a curated wine cellar, and a fitness center with personal training and recovery services. Strict no-photography rules ensure confidentiality.

- Business Edge: The concierge team excels at arranging introductions, often within 48 hours, connecting members with investors or strategic partners.

How to Join: Applicants need sponsorship from two current members. Membership applications are reviewed quarterly, with a typical waitlist of 12–18 months.

Ideal For: Exit-ready founders with $50M+ in revenue and executives seeking top-tier financial connections.

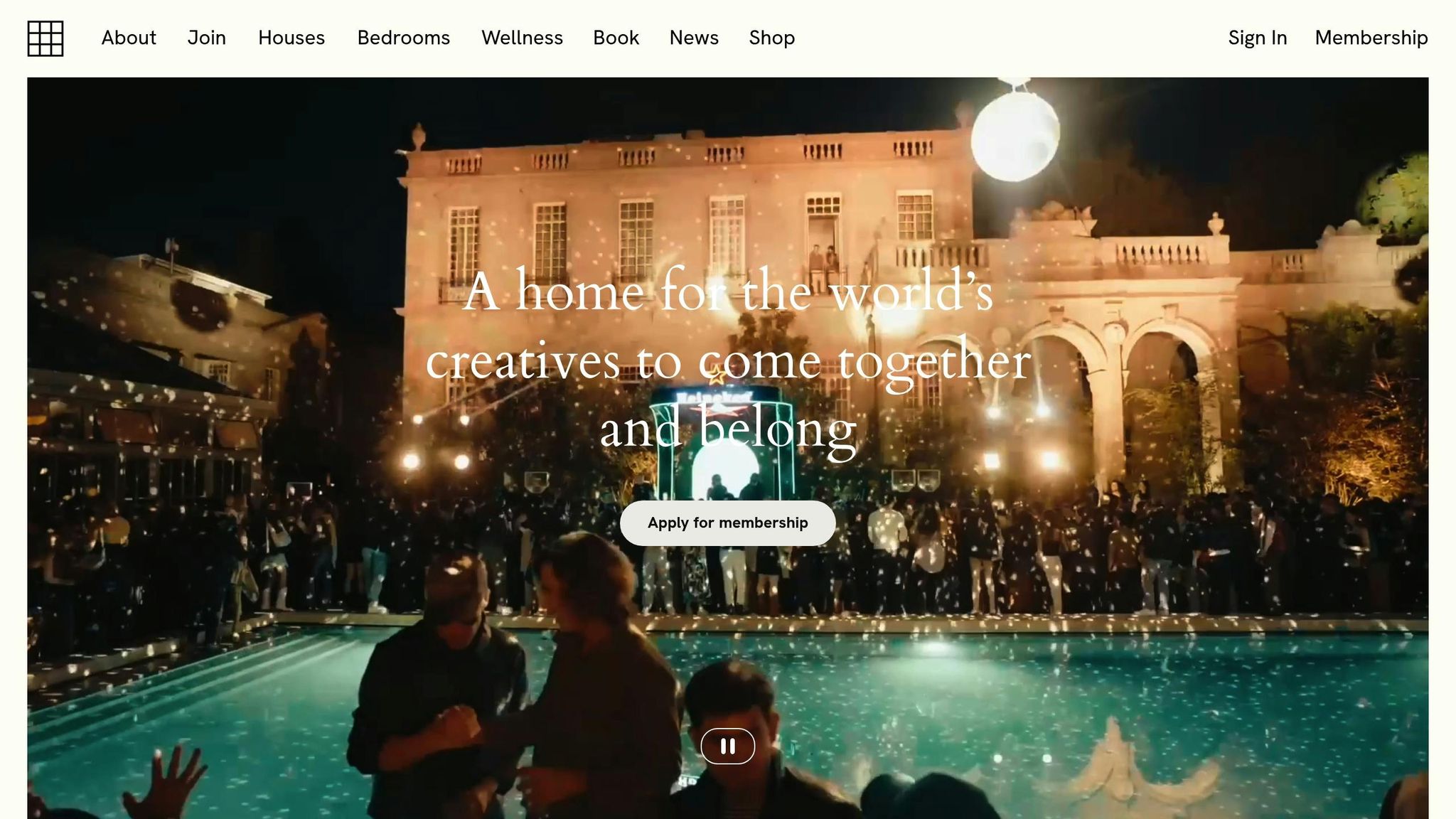

Soho House (Global)

Soho House caters to creative and media entrepreneurs, offering a global network of stylish locations at more accessible membership rates.

What Sets It Apart: Operating across 41 properties worldwide, Soho House blends work, leisure, and networking in a relaxed yet professional atmosphere. It’s ideal for creative directors, media entrepreneurs, and tech founders with revenues of $1M–$10M.

Key Details:

- Initiation Fee: $500–$2,000 (varies by location)

- Annual Dues: $2,000–$5,000

- Signature Features: Co-working spaces, rooftop pools, screening rooms, and exclusive dining areas. The Soho House app makes it easy to RSVP for events like film screenings, author talks, and industry panels.

- Business Edge: With its international footprint, members can effortlessly build global networks in a casual, social setting.

How to Join: A referral from an existing member is required, along with a review of professional credentials. Applications are typically processed in 4–6 weeks, though high-demand locations may have waitlists.

Ideal For: Creative founders, digital nomads, and early-stage entrepreneurs looking to expand their global reach.

Zero Bond (NYC)

Zero Bond is a modern, exclusive club designed for tech elites and high-profile entrepreneurs.

What Sets It Apart: Located in NoHo, Zero Bond combines sleek design with a highly selective admission process, admitting only 200–300 new members annually. Its members include tech founders, venture capitalists, and celebrity entrepreneurs.

Key Details:

- Initiation Fee: $3,000

- Annual Dues: $3,600

- Signature Features: The club spans multiple floors in a renovated industrial building, featuring a contemporary American restaurant, a hidden speakeasy bar, and curated art installations. Integrated tech streamlines reservations and member access.

- Business Edge: The exclusivity of the club ensures that every member is a high-value contributor, fostering focused discussions on fundraising, product development, and market trends.

How to Join: Membership is invitation-only, requiring sponsorship from a member active for at least a year. Applicants undergo a rigorous review of their business credentials and social presence, with an acceptance rate of less than 10%.

Ideal For: Tech founders preparing for Series B funding, entrepreneurs seeking venture capital, and those with $10M+ in revenue aiming for strategic exits.

Aman Club (NYC)

Aman Club offers an ultra-luxury experience for founders and executives who value exclusivity and high-end amenities.

What Sets It Apart: Situated in the historic Crown Building with views of Central Park, Aman Club is designed for post-exit founders, family office principals, and international business leaders with a net worth of $100M+.

Key Details:

- Initiation Fee: $200,000

- Annual Dues: $15,000

- Signature Features: The club boasts Japanese-inspired interiors, a private dining room with a dedicated chef, a cigar lounge, and a spa offering traditional Asian wellness treatments. Exclusive concierge services include private jet charters and yacht arrangements.

- Business Edge: Membership enhances credibility while enabling high-impact networking and international partnership opportunities.

How to Join: Applicants must secure a personal introduction from an existing member and undergo interviews and financial verification. The process typically takes 6–12 months.

Ideal For: Founders post-exit, CEOs of $100M+ companies, and family office principals exploring global investments.

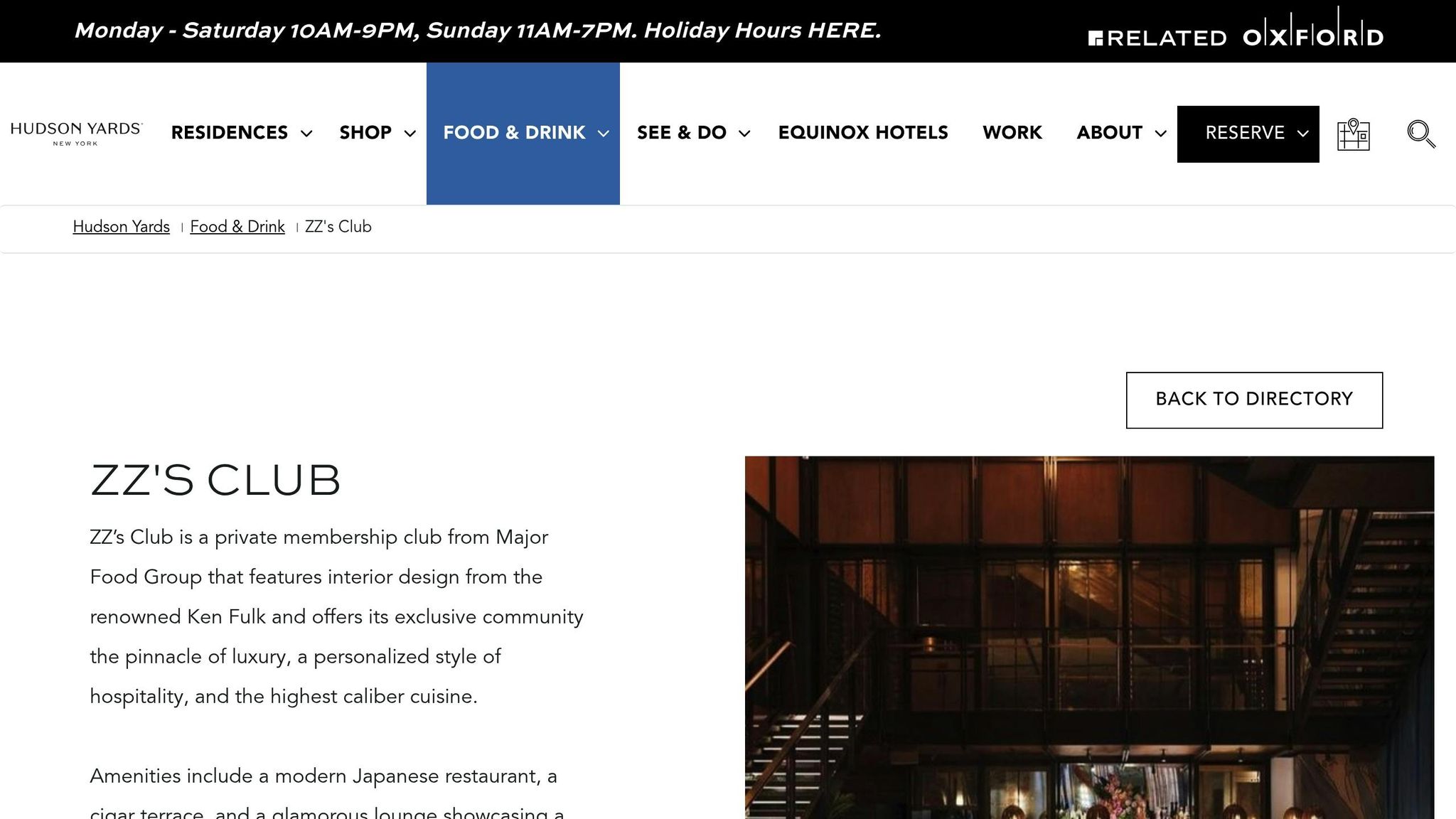

ZZ’s Club (NYC/Hudson Yards)

ZZ’s Club blends sports, entertainment, and tech networking in a lively, dynamic setting.

What Sets It Apart: Located in Hudson Yards and backed by Major Food Group, ZZ’s Club creates a vibrant atmosphere for cross-industry networking. Members include professional athletes turned entrepreneurs, sports tech founders, and entertainment executives with revenues of $5M–$25M.

Key Details:

- Initiation Fee: $20,000

- Annual Dues: $10,000

- Signature Features: Curated events, exclusive dining experiences, and versatile social spaces encourage both casual interactions and serious business discussions.

- Business Edge: The club fosters collaborations across the sports, tech, and entertainment sectors, making it a hub for innovative deal-making.

How to Join: Membership is by referral and involves a competitive screening process to ensure alignment with the club’s ethos.

Ideal For: Entrepreneurs at the intersection of sports, tech, and entertainment who value an energetic networking environment.

These private membership clubs showcase how tailored experiences and exclusive settings can facilitate meaningful connections and high-level business opportunities for founders. Whether you’re a creative entrepreneur or a seasoned executive, these clubs provide a gateway to elite networking and strategic growth.

The Hidden ROI: What Founders Actually Gain

The real return on investment (ROI) from private membership clubs for business founders goes far beyond exclusive networking events or luxury perks. The true value lies in faster deal-making, direct access to investors, and business opportunities that traditional networking often struggles to deliver.

Let’s look at the numbers: A software founder secured a $2.3 million partnership during a casual dinner with a fellow club member – skipping months of cold emails and drawn-out negotiations. Meanwhile, an e-commerce entrepreneur managed to cut customer acquisition costs by 40% after a single strategy session within a founders club. These clubs also leverage AI-driven systems to track and accelerate partnerships, making the process even more efficient. (For tips on automating partnerships, check out our free AI Acceleration Newsletter.)

The impact doesn’t stop there. One software executive credited a 35% revenue boost to insights gained during club discussions, while a retail entrepreneur saved $40,000 annually by tapping into vendor deals negotiated by other members. The trust within these communities eliminates much of the friction that comes with traditional business development, leading to results that are hard to replicate elsewhere.

These clubs also create opportunities that extend beyond financial returns. For example, they can dramatically speed up hiring. A SaaS company in NYC with $12 million in revenue found and hired a VP of Engineering in just 14 days through a club connection – a process that would typically take over three months using conventional recruiting methods. Similarly, an SF-based marketplace company generating $8 million in revenue used club introductions to connect with exit advisors who facilitated a $100 million-plus acquisition.

Membership also elevates a founder’s credibility. Being part of an elite private club sends a strong signal to investors, partners, and customers. Even casually mentioning an upcoming visit to a well-known club can convey competence and exclusivity, bypassing the usual pitching hurdles. This kind of social proof often opens doors that might otherwise remain closed.

For founders with global ambitions, memberships like Soho House offer instant access to local markets worldwide. The $2,000–$5,000 annual fee pales in comparison to the costs of traditional international expansion, making it a smart investment for scaling businesses.

These clubs are about more than just connections – they’re about creating opportunities that directly impact a founder’s bottom line and long-term success.

How to Choose the Right Private Membership Club

Finding the right private membership club is all about understanding your business needs, industry focus, and the potential return on your investment. The stakes are high – choosing poorly could mean wasting anywhere from $20,000 to $100,000 on connections that go nowhere. But the right choice can propel your business forward, making every dollar count.

Before diving in, start with clear goals. What do you want from this membership? For example, you might aim to "secure five new client leads within six months" or "reduce time spent on investor outreach by 20%." These kinds of SMART goals give you measurable ways to track success. Without these benchmarks, it’s hard to know if the club is delivering real value or just offering social perks. Keep detailed records of connections, leads, deals, and all associated costs to evaluate the club’s impact effectively.

Next, crunch the numbers. Calculate your cost-per-connection by dividing the total membership fee by the number of meaningful connections that lead to business opportunities. For instance, if you’re paying $50,000 annually and land 10 solid connections that result in deals, that’s $5,000 per connection. If those connections bring in six-figure revenue, the investment might make sense. However, if you’re only seeing a couple of weak leads with no real results, it’s time to rethink.

Be mindful of red flags. Clubs that focus more on Instagram-worthy aesthetics than measurable outcomes are often a waste of time and money. A strong club will demonstrate how its network benefits members with clear, data-backed results. Low retention rates or disengaged members are also warning signs that a club may not deliver the value it promises.

Match Your Stage

Your business stage plays a big role in determining which club will give you the best return on investment.

- Early growth founders (with $1M–$5M ARR) might find clubs like Soho House or NeueHouse to be a good fit. With annual fees ranging from $2,000 to $5,000, these clubs offer access to valuable networks without putting too much strain on early-stage budgets.

- Scaling founders (with $10M+ ARR) should look into higher-tier clubs like Core Club ($100,000 annually) or Zero Bond (a $20,000 initiation fee plus $10,000 annually). These clubs attract established executives and investors, creating opportunities for larger partnerships. At this level, the higher fees can be worth it if a single introduction leads to significant deals.

- Exit-ready founders (with $50M+ ARR) may benefit most from ultra-luxury clubs like Aman Club, which has a $200,000 initiation fee. These exclusive venues provide access to top-tier capital and strategic acquirers, making the steep price tag worthwhile for businesses seeking acquisitions or late-stage funding.

Once you’ve matched your stage, it’s time to refine your choice by considering industry focus and geography.

Industry and Geography Alignment

After identifying clubs that align with your revenue stage, narrow your options by focusing on your industry and location.

- Tech founders might find the most relevant connections at places like The Battery in San Francisco or Zero Bond in New York, where tech executives and venture capitalists often network.

- Media and creative founders could benefit more from clubs like Soho House or The Ned NoMad, which attract professionals from entertainment and content industries.

- Finance-focused founders looking for institutional partnerships should consider clubs like Core Club, which frequently hosts senior figures from major financial institutions.

Your geographic strategy also matters. If your business is focused on dominating a single city – like a New York fintech startup or an LA-based entertainment company – invest in the top local club where your industry thrives. On the other hand, if you’re planning international expansion, a club like Soho House, with its 40+ locations worldwide, can be a smart choice. With annual fees between $2,000 and $5,000, it provides access to key markets in cities like London, Barcelona, and Hong Kong.

Calculate ROI and Spot Red Flags

To evaluate a club’s ROI, use the formula: (Value Gained / Total Costs) × 100%. Value Gained includes additional revenue, time saved, and cost reductions. Keep an eye on referral rates and deal velocity as indicators of the club’s effectiveness.

"If equity is growing, members think like owners. If it isn’t growing to keep up with inflation, members are thinking like customers and therefore, you will be investing in a club that needs help." – Ray Cronin

This advice is especially relevant when assessing a club’s financial health. Ask for transparency from the club’s CFO or general manager about key metrics. A well-managed club should have an operating dues revenue ratio of at least 40% (ideally 50%) and a debt-to-equity ratio under 50% (with the industry norm closer to 20%). If the club refuses to share this information or the numbers raise concerns, it might not be a sound long-term investment.

Finally, evaluate the club’s governance and member engagement. Clubs bogged down by excessive bureaucracy often struggle to adapt to members’ needs. Look for organizations that emphasize clear communication, consistency, and a strong culture. These "3 C’s" are essential for ensuring member satisfaction and delivering meaningful business opportunities – not just fancy amenities.

sbb-itb-32a2de3

Alternatives for Earlier-Stage Founders

If your startup is pulling in less than $1 million annually, spending $20,000 to $100,000 on private membership clubs is likely out of reach. When you’re juggling product-market fit and tight cash flow, splurging on elite networking isn’t practical. But that doesn’t mean you should skip networking altogether. Instead, you need affordable, effective options that deliver value without breaking the bank.

Looking for AI-driven growth tips? Check out our free AI Acceleration Newsletter.

Affordable Membership Models

For early-stage founders, there are plenty of budget-friendly alternatives to high-priced private clubs. Regional innovation hubs, industry-specific accelerators, and online communities can provide the mentorship, structure, and networking opportunities you need to grow your business. These programs often share proven strategies drawn from past startup experiences, offer guidance on pitching and fundraising, and connect you with experts who can help refine your product and business model.

Many of these groups also tackle common startup challenges, offering support in areas like legal compliance, marketing, and product development. Whether you’re part of a global network or a niche-focused group (think no-code development or SaaS), you’ll find resources, connections, and even funding opportunities – often at little to no cost. These programs lower the barriers to entry, making them a smart choice for founders who are just starting out.

For those ready to dive into AI-powered business systems, M Studio’s Elite Founders program offers a practical alternative. With weekly implementation sessions, you’ll build automation tools that can start working for your business right away – all for a fraction of the cost of joining an elite private club.

By leveraging these affordable options, you’ll not only build a solid network but also prepare yourself for a future where joining elite clubs becomes a possibility.

Transition Strategies

Elite clubs don’t just look at your current revenue – they’re interested in your growth potential and long-term vision. They seek members who actively contribute to the community and collaborate to elevate the group as a whole. Building a strong support network and assembling a reliable board of advisors early on can accelerate your growth and make you a more appealing candidate for these clubs later.

To position yourself for future opportunities, focus on building meaningful relationships within entrepreneurial communities. Engage actively, share your expertise, and build trust with your peers. These efforts will pay off when you’re ready to join more exclusive networks. For instance, Alex Taussig of Lightspeed spent over a year cultivating a relationship with Max Rhodes, co-founder of Faire, by meeting regularly to discuss challenges and data. This long-term connection eventually led Lightspeed to preempt Faire’s Series B funding and invest in the company six times [Source: The Generalist, June 2024].

"A lot of the work to win a deal happens outside the deal context. For example, you cannot replicate cycles with a human being over a long period of time when it comes to earning the trust needed to be a board member or partner for the next decade. That is really hard to replicate. It’s the hardest thing to replicate. Every investment of mine that I’m really proud of is the result of getting to know the founders over at least a year." – Alex Taussig, Lightspeed

When the time comes to apply for private membership clubs, focus on showcasing your growth trajectory and long-term sustainability rather than just your revenue numbers. Highlight your contributions to the community, whether through mentoring, sharing expertise, or other forms of active participation. Strong recommendations from trusted advisors and informational interviews with current members can also help you find a club that matches your business needs and personal style.

The Future of Private Membership Clubs

Private membership clubs are undergoing a transformation, and founders need to rethink their networking strategies to make the most of this shift. The market for these clubs is expected to grow significantly, nearly doubling from $31 billion to $59.1 billion by 2033, with an annual growth rate of 7.2%. This expansion is driven by three key trends: hybrid physical-digital models, the integration of Web3 technology, and a focus on sustainability. These trends are reshaping membership models, combining in-person experiences with cutting-edge digital tools. Let’s dive into what this means for founders.

Hybrid and Digital Membership Models

Since the pandemic, private clubs have evolved into dynamic ecosystems that merge hospitality, real estate, wellness, and community-building into comprehensive lifestyle platforms. For founders, this means access to state-of-the-art workspaces, advanced tech tools, and specialized business services – all without the rigidity of owning or leasing permanent office space.

Digital tools are playing a big role in enhancing what’s being called the "Total Experience" (TX). Clubs now use online reservation systems, mobile apps, and geofencing to offer personalized communications and turn apps into platforms for community engagement. Take 12 Hay Hill in London, for example. It offers luxury serviced offices with 24/7 access, fully staffed reception services, high-speed internet, audiovisual capabilities, and meeting rooms. Members can also enjoy its roof terrace, bar, restaurant, and co-working lounges. Similarly, The City Club of San Francisco provides private office suites, concierge services, in-house dining, and 24/7 security.

"Anywhere operations" are another game-changer, allowing members to access club services both on-site and remotely through digital platforms. This flexibility is especially valuable for founders managing international travel, remote teams, and unpredictable schedules. It’s not just about convenience – it directly impacts how quickly deals can be closed and how easily founders can connect with investors.

Web3 and Token-Gated Communities

Blockchain technology is taking the private membership experience to the next level with NFT-based, token-gated access. These systems provide verifiable digital ownership, heightened security, and innovative ways to engage members. Instead of carrying a traditional membership card, founders can hold digital tokens that unlock access to exclusive spaces, events, and networks.

Consider this: 43% of consumers have joined Web3 loyalty programs for exclusive perks, and brands using NFT-based loyalty systems report a 28% increase in repeat interactions compared to traditional point-based programs. For founders, this means clubs can offer tiered access, tradeable memberships, and even blockchain-powered voting for transparent decision-making. These features open up new opportunities for forming partnerships and closing deals.

Sustainability and Niche Clubs

For climate-conscious founders, sustainability is becoming a core feature of private clubs. Many now incorporate eco-friendly practices, from blockchain solutions to carbon-neutral operations, as part of their value proposition. As more founders focus on climate tech and prioritize ESG metrics, these clubs naturally become hubs for networking with like-minded investors and partners.

"By blending hospitality, wellness, workspaces, dining, and cultural programming under one roof, private members clubs provide a seamless mix of leisure and productivity. Members are drawn to the prestige of belonging, the networking opportunities, and the promise of a cosmopolitan yet intimate environment that feels both aspirational and personal." – Riyan Itani, Director and Founder of Global Branded Residences

Looking ahead, private membership clubs are moving beyond exclusivity to offer immersive experiences that connect the physical and digital worlds. For founders considering memberships in the years to come, focus on clubs that prioritize technology, provide flexible workspaces, and align with your personal and business values. These are the memberships that will help you stay ahead in a rapidly changing world.

Conclusion

Private membership clubs cater to a distinct group of founders – typically growth-stage entrepreneurs generating $1M–$5M+ in revenue. These clubs offer perks like direct access to investors, quicker deal-making opportunities, and elevated brand credibility, which can justify annual fees ranging from $5,000 to $100,000. However, for founders earning less than $1M ARR, the return on investment may not align with the cost.

Before diving in, take a moment to evaluate your business stage and goals. Do you need access to intellectual communities, specialized facilities like co-working spaces or podcast studios, or a network of members aligned with your industry? For example, tech entrepreneurs might find value in The Battery, while finance professionals may benefit more from Core Club. If you’re eager to refine your growth strategies with AI-driven insights, consider subscribing to our AI Acceleration Newsletter for weekly tips on smarter networking and strategy-building.

Once you’ve joined a club, tracking your progress is key. Look at both tangible outcomes – like closed deals, cost efficiencies, and partnerships – and intangible benefits, such as strategic advice or leadership support. If you’re not seeing meaningful results within 12–18 months, it’s worth reevaluating whether the club aligns with your needs.

Keep in mind that the private club landscape is constantly shifting. From Web3 token-gated memberships to communities focused on sustainability, the industry is evolving. Seek out clubs that value authentic connections, uphold high membership standards, and deliver programming that drives real business results. The right club can accelerate your growth, but the wrong one might just drain your time and resources.

FAQs

How do I choose the right private membership club for my business needs?

Choosing the right private membership club hinges on where you are in your business journey, your industry, and what you’re aiming to achieve. If you’re an early-stage founder ($1-5M revenue), clubs like Soho House or NeueHouse can be great for networking and building your presence. For scaling founders ($10M+ revenue), exclusive spots like Core Club or Zero Bond offer opportunities to connect with investors and explore potential deals. Meanwhile, exit-ready founders ($50M+ revenue) might lean toward ultra-luxury options like Aman, where high-level connections can open new doors.

When deciding, think about the club’s location, the type of members it attracts, and the overall vibe. Does it align with your goals? Assess the potential return on investment by considering how the club could help you form valuable partnerships, recruit talent, or forge meaningful business relationships. The key is to choose a club that fits your current growth stage and delivers real business benefits – not just a shiny badge of exclusivity.

What are the key differences between private membership clubs and traditional entrepreneur networks?

Private membership clubs and entrepreneur networks serve very different purposes and audiences, each offering its own set of advantages.

Private membership clubs are all about exclusivity and luxury. These clubs provide sophisticated physical spaces where high-level networking, deal-making, and access to investors take center stage. They’re tailored for growth-stage founders and executives who value curated settings for forging high-value connections. However, this exclusivity comes at a price, with annual fees ranging from $5,000 to over $100,000.

On the other hand, entrepreneur networks focus on community, learning, and mentorship. They’re usually more accessible – often virtual – and foster collaboration and knowledge-sharing rather than exclusivity. These networks are particularly suited for founders in the earlier stages of their journey, offering a supportive environment to develop skills and build meaningful relationships.

While private clubs lean into prestige and tangible business outcomes, entrepreneur networks thrive on inclusivity and shared growth.

What are the benefits of joining a private membership club for business founders?

Joining a private membership club can open doors to exclusive networks, quicker deal-making opportunities, and a boost in brand credibility. These clubs create a one-of-a-kind space where founders meet investors, secure partnerships swiftly, and forge connections that drive business growth. Some members even share stories of closing deals in as little as 48 hours, thanks to the carefully curated introductions and relaxed, informal settings these clubs offer.

Beyond immediate wins, membership can also pave the way for long-term goals like expanding into international markets, recruiting top talent, and forming strategic partnerships. While annual fees range from $5,000 to $100,000, the payoff often lies in the high-quality connections and opportunities that are otherwise hard to come by.