If your close rate is stuck at 15%, the problem isn’t effort – it’s your sales process. A healthy close rate for B2B sales should be between 25% and 35%. Anything lower means your system has leaks that are costing you revenue. Here’s how to identify and fix the common issues:

- Wrong Leads: Unqualified leads waste time and resources. Tighten your Ideal Customer Profile (ICP) to focus on prospects who fit.

- Weak Qualification: Skipping proper pre-demo vetting results in wasted demos. Use frameworks like BANT or MEDDIC to ensure leads are ready.

- No Post-Demo System: Deals often stall after demos due to unclear next steps. Always schedule the next meeting before ending a demo.

- Pricing Confusion: If prospects focus on price, it’s because you haven’t shown value. Quantify their pain points and tie your pricing to outcomes.

Start by tracking where deals fail in your pipeline, review recent losses for patterns, and apply targeted fixes. Even small improvements can significantly boost your revenue without increasing your lead volume.

4 Reasons Your Close Rate Is Stuck

A 15% close rate isn’t just bad luck – it’s a sign of deeper issues in your sales pipeline. Let’s break down the four most common problems that might be holding you back and how to address them effectively.

Wrong Leads in Your Pipeline

If you’re seeing high no-show rates or prospects dropping off early, chances are you’re targeting the wrong audience. These are people who were never serious about buying in the first place.

Unqualified leads are behind 30% to 40% of deal losses. Without a clear Ideal Customer Profile (ICP), sales teams waste up to 70% of their outreach on prospects who were never going to convert. You’ll notice this issue when budget objections pop up late in the process or when you realize mid-demo that your contact has no decision-making authority.

"The tighter your ICP, the higher your reply rates, close rates, and overall pipeline quality." – Cleverly

To fix this, get specific. Instead of a vague ICP like "B2B companies in need of leads", tighten your focus to something like: "B2B SaaS companies, 50-200 employees, $5M-$50M ARR, headquartered in North America, using HubSpot or Salesforce." The more precise your filters, the fewer unqualified leads clogging your pipeline.

Now, let’s move on to the next issue.

Weak Qualification Before Demos

67% of lost sales result from poor pre-demo qualification. Skipping this step wastes valuable demo slots on leads who lack budget, authority, or even a real problem to solve.

Demos are high-impact and resource-intensive, so wasting them creates bottlenecks. Serious buyers end up waiting longer for a slot, which slows your entire sales cycle. Worse yet, many late-stage losses – pricing objections, stalled deals, or delayed decisions – can often be traced back to shallow discovery early on.

"If we cut a window into our black box, we may learn that our reps are doing really crisp demos and presentations, but tend to skim over discovery and qualification. This makes their forecast no more than a guess." – Chris Orlob, Content Author, Gong

The solution? Set clear entrance criteria for demos. Use frameworks like BANT (Budget, Authority, Need, Timeline) or MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) to ensure every lead has been properly vetted before they get to this stage.

No Post-Demo System

Even great demos can lead to dead deals if there’s no structured follow-up. Without a clear post-demo plan, opportunities go cold, and potential revenue slips through the cracks.

Deals tend to stall between the demo and proposal stages. You might have a great initial conversation, but then… nothing. A few follow-up emails later, and the deal is stuck in limbo – neither closed nor officially dead. This lack of momentum often comes down to not having a defined next step.

To fix this, establish a clear post-demo protocol. Before wrapping up the demo, schedule the next meeting and outline what happens next – whether it’s a technical deep dive, stakeholder presentation, or pricing discussion. Send a recap email within 24 hours, including the agreed-upon timeline. Consistent follow-up can turn a 15% close rate into 30%.

Pricing and Positioning Confusion

When prospects don’t see your value, they focus on price – and that’s a problem. This disconnect between value and cost accounts for 20% to 30% of lost deals. The issue isn’t necessarily that your product is too expensive; it’s that you haven’t clearly shown how it solves their pain points.

You’ll know this is an issue if deals stall after sending a proposal, prospects push back on pricing without discussing outcomes, or your reps seem hesitant during pricing conversations. If your team starts “selling features to strangers” instead of leading with business impact, you’ve got a problem.

"Confusion creates paralysis; paralysis kills win rates." – Hathawk

The fix? Lead with outcomes. During discovery, ask, “What is the monthly cost of this problem?” If the prospect can’t quantify their pain, your pricing will always feel arbitrary. Simplify your pricing into three tiers – Starter, Core, and Enterprise – and present the default package first, using a premium option as an anchor. This approach gives prospects a clear frame of reference and makes your pricing feel more grounded.

How to Diagnose Which Problem Is Yours

Before jumping into solutions, it’s crucial to figure out where your sales process is breaking down. You can’t fix what you don’t measure. Start by pinpointing the exact stage in your pipeline where deals are falling apart. Many founders overlook this step, but it’s the key to diagnosing the problem.

Track Where Deals Die in Your Pipeline

Break your pipeline into four main stages: lead-to-qualified, qualified-to-demo, demo-to-proposal, and proposal-to-close. Then, measure the conversion rate at each stage. For example, if 100 leads result in 60 qualified prospects, your lead-to-qualified conversion rate is 60%.

Each stage’s conversion rate tells a story. If you notice a low conversion rate from leads to qualified prospects (below 60%), it likely means your targeting is off, and you’re attracting the wrong audience. If qualified leads aren’t turning into demos (below 50%), your qualification process might be too loose, or scheduling could be creating friction. When demos fail to convert into proposals (below 45%), it’s often a sign that your discovery process isn’t deep enough, or your pitch isn’t clearly connecting your product’s value to the outcomes prospects care about. Finally, if proposals are stalling (below 35%), you might be dealing with pricing confusion or engaging the wrong decision-makers.

"If you’re blind to how your sales team is doing their calls and demos, you aren’t in control of making your number. It’s a roll of the dice." – Chris Orlob, Co-Founder and CEO, Pclub.io

Here’s a real-world example: In 2025, a Series B founder partnered with NextAccel to tackle a pipeline-to-close rate that had plummeted to 8%. By identifying a bottleneck in the negotiation phase – caused by a lack of clear conversion architecture – they revamped their pipeline. Within three months, their conversion rate jumped to 31%, adding over $2M in annualized revenue without increasing lead volume or marketing spend.

To deepen your analysis, pair these metrics with a review of past losses to uncover recurring patterns.

Review Your Last 10 Lost Deals

While conversion rates show where the leaks are, reviewing lost deals uncovers why they’re happening. Pull up your last 10 lost opportunities and document why each one fell through. Don’t rely on memory – dig into your CRM notes, emails, and call recordings. Then, group the losses into categories like wrong fit, no urgency, pricing objections, lost to a competitor, no decision, or stalled indefinitely.

Look for patterns. If six out of ten deals fell through because of a wrong fit, your ideal customer profile (ICP) might need refining. If deals frequently fail due to no urgency or indecision, it’s a sign that your discovery process isn’t addressing the prospect’s pain points deeply enough. Repeated pricing objections suggest you’re not anchoring the value of your solution before discussing cost. And if deals stall after the demo with no clear next step, you likely need a stronger post-demo follow-up process.

"If you can’t map failure patterns, you’re treating symptoms instead of fixing systemic conversion breaks." – Sanchita Chowdhury, NextAccel

Quick Fixes for Each Problem

Once you’ve pinpointed where your pipeline is breaking, these targeted solutions can help you address the root issues quickly. The best part? These fixes can be implemented within days, not months, making them highly actionable.

Fix Your ICP and Targeting

Stop wasting time and resources on prospects that don’t fit your business. Start by defining hard qualifiers based on specific firmographics: company size (50–200 employees), revenue range ($5M–$50M ARR), industry, and location. For example, a vague ICP like "B2B companies that need leads" won’t cut it. Instead, aim for something precise, such as "B2B SaaS companies with 50–200 employees, $5M–$50M ARR, selling to enterprise clients in North America."

To refine your ICP, analyze your closed-won deals from the past year. Look for patterns among customers with the highest lifetime value, fastest close rates, and lowest churn. Identify key buying triggers like recent funding, executive team changes, rapid headcount growth, or shifts in technology stacks. These triggers can help you fine-tune your targeting.

Without a clear ICP, sales teams waste 60–70% of their outreach on unqualified prospects. Enforce your qualifiers at the entry point – if a lead doesn’t meet your criteria, they shouldn’t enter your pipeline. Regularly revisit and update your ICP to keep pace with market shifts.

Add Pre-Demo Qualification

Don’t dive into full demos without confirming the basics first. Instead, use a 10-minute qualification call or an automated questionnaire to verify five key points: the decision-maker’s authority, budget range, decision timeline, the cost of the problem, and the internal decision process.

Frameworks like BANT (Budget, Authority, Need, Timeline) or MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) can help you standardize this process. By enforcing strict qualification criteria, you can boost your win rate by 6–10 percentage points. If a prospect can’t quantify their pain in economic terms, their urgency to buy is likely low. Don’t hesitate to disqualify – it frees up time to focus on high-potential leads and improves your forecasting accuracy. This approach keeps your pipeline efficient and focused.

Build a Post-Demo Follow-Up System

If follow-ups are where deals go to die, it’s time to fix that. Create a structured follow-up system that activates immediately after every demo. Start with a personalized summary sent within 24 hours, recapping the pain points discussed, the proposed solution, and the next steps. Follow up with a personal call or LinkedIn message within the next 48 hours to keep the momentum going.

Add value to your follow-ups by including case studies, ROI tools, and testimonials that reinforce your solution’s benefits. The stats don’t lie: 79% of leads fail to convert into customers, and 55% of businesses lose revenue due to undefined sales processes. Acting quickly matters too – sales reps are 21 times more likely to qualify a lead if they respond within 5 minutes versus later. Set clear exit criteria, such as confirming a budget or scheduling a technical review, before moving the deal forward.

Clarify Your Pricing and Positioning

Unclear pricing and positioning can derail deals at the final stage. Standardize your pricing into clear tiers with well-defined features, and craft messaging that ties your product’s value directly to its financial impact. Before discussing price, focus on quantifying the cost of the prospect’s problem to anchor the conversation.

If pricing objections come up repeatedly in lost deal reviews, it’s often a sign that price is being introduced before value has been established. Instead, use the discovery phase to identify and quantify the prospect’s pain, then position your solution as a cost-effective way to address it. A concise pricing sheet that outlines tiers, features, timelines, and support can eliminate confusion. When prospects clearly understand what they’re buying and how it benefits their bottom line, pricing discussions shift from objections to logistics.

sbb-itb-32a2de3

What a Healthy Close Rate Looks Like

B2B Sales Close Rate Benchmarks and Pipeline Conversion Metrics

Now that you’re aware of where your pipeline might be leaking, let’s break down what a strong close rate structure should look like.

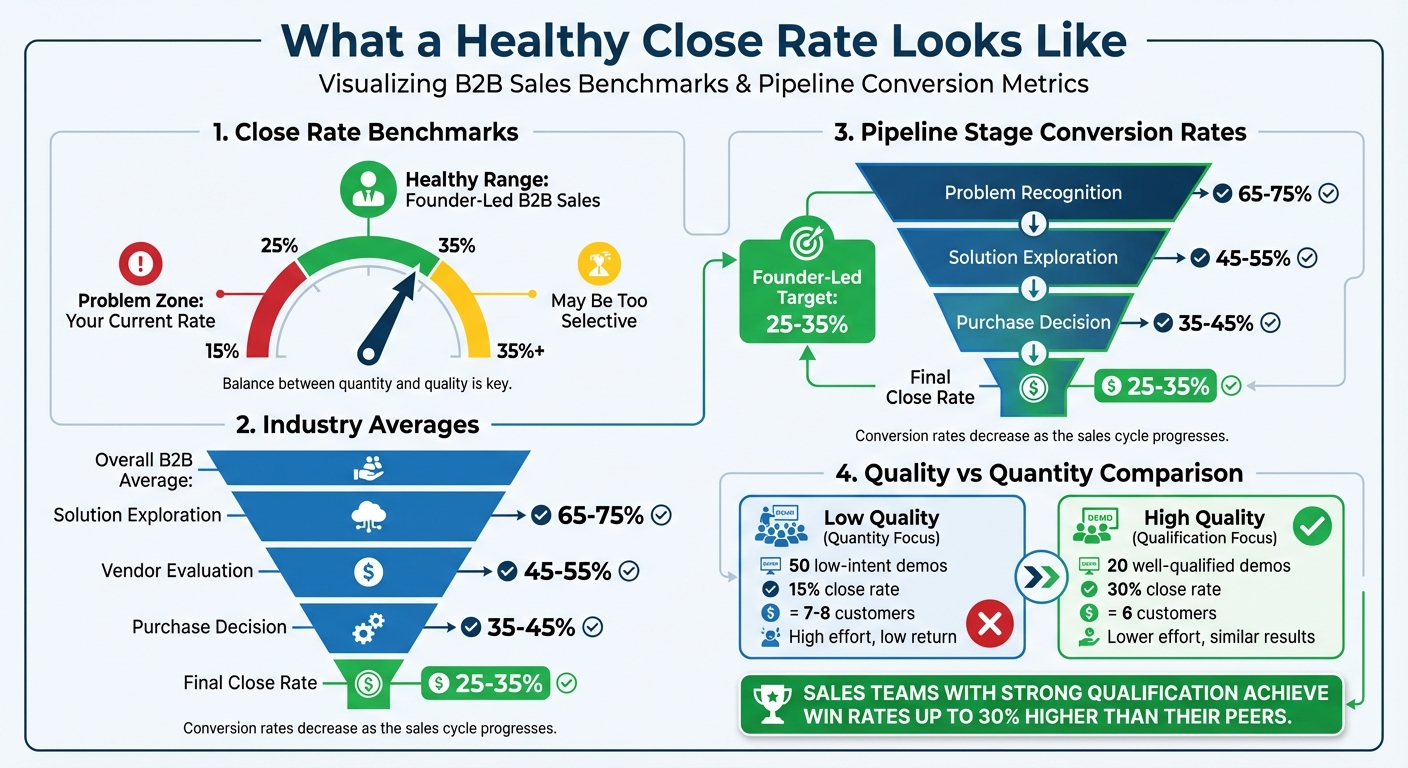

Benchmarks for Founder-Led B2B Sales

If your opportunity-to-close rate is sitting at 15%, you’re not alone – but it’s not where you need to be. For founder-led B2B sales, a healthy close rate typically lands between 25% and 35%. Falling below 20% often points to a deeper issue that needs immediate attention.

Let’s clarify: this is about opportunity-to-close rates, not lead-to-customer conversion. While general lead conversion rates hover around 2–5%, a qualified opportunity should push your close rate into the 25–35% range. Anything lower suggests problems with how you’re qualifying leads or managing your pipeline.

If you’re looking to pinpoint issues and make improvements, consider subscribing to our free AI Acceleration Newsletter here for actionable insights.

Industry averages provide more context: most B2B close rates hover around 21%, with some sector-specific variations – Software averages 22%, Finance 19%, and Business/Industrial 27%. However, if you’re running founder-led sales and generating $100K–$1M in ARR, you should be outperforming these benchmarks. Your in-depth product knowledge and ability to adapt should give you an edge. If your close rate is below 25%, it’s likely due to unqualified demos or a lack of clarity in your value proposition.

"Time kills deals. The longer a sales cycle drags on, the less likely it is to close." – Mark Roberge, Chief Revenue Officer, HubSpot

To improve, track your conversion rates at every stage of the pipeline. High-performing pipelines often see:

- 65–75% conversion from Problem Recognition to Solution Exploration

- 45–55% from Solution Exploration to Vendor Evaluation

- 35–45% from Vendor Evaluation to Purchase Decision

If your numbers fall short in any of these stages, that’s where you need to focus your efforts. These benchmarks reflect a well-optimized sales process.

Quality Over Quantity

The key to increasing your close rate isn’t about packing your calendar with more demos – it’s about improving the quality of those demos. A pipeline with 50 low-intent prospects will perform worse than one with 20 well-qualified opportunities. For example:

- Running 50 low-intent demos at a 15% close rate might get you 7 or 8 customers.

- Running 20 well-qualified demos at a 30% close rate can deliver nearly the same number of customers, but with far less wasted effort.

If you’re running 10+ demos a week but closing only 1–2 deals, it’s a sign you’re spending too much time on prospects who lack the budget, authority, or urgency to buy. By tightening your qualification criteria, you can boost your close rate while freeing up time for higher-value opportunities. Remember, the goal isn’t to cram your schedule with demos – it’s to maximize the revenue you generate for every hour spent selling.

Interestingly, a close rate above 35% isn’t always a good thing. It could indicate you’re being overly selective and turning away prospects who might have converted with better discovery or nurturing. The sweet spot lies in balancing volume with selectivity: having enough qualified opportunities to meet your revenue goals while proving your sales system is effective.

Sales teams that excel at qualification often achieve win rates up to 30% higher than their peers. They enforce strict criteria at every stage of the pipeline, disqualifying prospects who don’t meet the bar. This disciplined approach ensures that every demo counts, setting the stage for scalable revenue growth.

The Compounding Cost of Ignoring This

A 15% close rate isn’t just a minor hiccup – it’s a full-blown revenue drain. And the longer it goes unchecked, the worse it gets.

Revenue Lost from Pipeline Leaks

Let’s break it down: if your close rate is stuck at 15% instead of 25%, a $10M ARR business could lose a staggering $4M annually. That’s money slipping through the cracks due to inefficient pipeline conversions – money spent on marketing and demos that never pays off.

"If you’re converting 15% of pipeline instead of 25%, you’re leaving 40% of potential revenue on the table. For a $10M ARR business, that’s $4M in lost revenue annually." – Sanchita Chowdhury, NextAccel

Here’s a real-world example: in 2025, a Series B founder turned things around by boosting their pipeline-to-close rate from 8% to 31% in just three months. The result? Over $2M in additional revenue – without spending a dime more on marketing.

The financial toll of a broken conversion system is massive, but it doesn’t stop there. It’s time to address the leaks – subscribe to our free AI Acceleration Newsletter for actionable strategies.

Long-Term Impact on Growth

The damage isn’t just about today’s revenue. A poor close rate can cripple your long-term growth. Flawed pipelines do more than waste demo opportunities – they choke your ability to scale. Without a reliable system to convert leads, throwing more money into lead generation becomes a losing game.

Think about this: 55% of companies lose revenue because they don’t have a defined sales process. Without clear, repeatable systems, every deal feels like reinventing the wheel. Scaling a broken process by adding more sales reps? That’s a recipe for frustration, not growth. And when your revenue is unpredictable, good luck attracting investors or commanding a premium valuation.

Take this case from 2017: a SaaS CEO saw his demo-to-close rates slipping, threatening his company’s valuation. By identifying that his sales team had veered from core messaging and focusing on targeted coaching, he fixed the leaks. The payoff? A valuation boost of $50M – turning an $80M round into a $130M one.

"Revenue, and resulting profits therefrom, is often the primary metric that businesses use to measure their success. I would argue there is an even better metric to measure, which is ‘lost revenues.’" – George Deeb, Forbes

The bottom line? Ignoring these issues only compounds the problem. Over time, you’re looking at mounting lost revenue, wasted resources, and missed opportunities to scale.

Conclusion: Diagnose, Fix, and Scale

Hitting a 15% close rate isn’t the finish line – it’s a clear signal that something in your system isn’t working. A sales process is only as effective as the data driving it. The real difference between being stuck and achieving growth lies in whether you’re addressing surface-level symptoms or tackling the underlying system issues. Adding more demos or leads won’t magically fix things. Instead, you need to pinpoint where deals fall apart, apply targeted solutions, and track the impact of those changes.

Key Takeaways

Start by diving into the data. Track conversion rates at every stage of your pipeline – not just the final outcome. Take a close look at your last 10 lost deals. They’ll reveal exactly where things are breaking down – whether it’s unqualified leads, poor follow-ups, unclear pricing, or weak post-demo engagement. For more proven strategies, check out our free AI Acceleration Newsletter.

"Pipeline chaos isn’t a people problem. It’s a process problem masquerading as a performance issue." – Sanchita Chowdhury, NextAccel

To fix these leaks, refine your Ideal Customer Profile (ICP), enforce stricter qualification criteria, establish a reliable follow-up process, and simplify your pricing structure. Remember, even small improvements can add up. For example, a 10-point boost in your close rate at $5M ARR is like hiring an experienced sales rep – without the added payroll.

With this framework in hand, it’s time to map out your next steps to strengthen your system.

Next Steps: Build Systems That Scale

Measure everything. Use a rolling 30-day window to track whether your adjustments are making an impact. Create clear checkpoints for each stage of your pipeline – no deal should move forward without a documented budget, a decision-maker on board, and defined next steps. Leverage your CRM to automate confidence reporting and use historical data to forecast with precision.

The goal isn’t perfection; it’s predictability. For founder-led B2B sales, a healthy close rate typically falls between 25% and 40%. Addressing these system leaks now can save you from losing revenue and growth opportunities down the line. Diagnose the problems, fix the processes, and scale your system to maximize every opportunity. Want to take it further? Join our next Founders Meeting to learn how to implement these systems and transform your conversion rates. Spots are limited, so don’t wait to secure your place.

FAQs

How can I improve my Ideal Customer Profile (ICP) to boost my close rate?

Improving your Ideal Customer Profile (ICP) starts with digging into hard data instead of relying on assumptions. Begin by identifying your top 5–10 customers who bring in the most revenue and stick around the longest. Take a close look at their firmographics (like company size, industry, and location), technographics (the tools they use and any integration needs), and the pain points your solution solved for them. Also, pay attention to buying triggers – things like recent funding, new product launches, or regulatory shifts that made them ready to buy. Use this information to create a clear, data-driven ICP and weed out leads that don’t fit the mold early on, so you can focus your demo efforts on the prospects most likely to convert.

Next, analyze where deals are falling apart in your pipeline. For example, if budget issues frequently disqualify prospects during demos, adjust your ICP to exclude companies below a certain revenue threshold. You can also add qualifying questions about budget earlier in the process to save time. Keep in mind that your ICP should focus on the company’s traits, while individual roles within those companies are better addressed through buyer personas.

Finally, put your updated ICP to work by integrating it into your sales tools, such as lead-scoring systems, outbound campaigns, and qualification scripts. Continuously validate your ICP by comparing it against win-loss data. This approach will help you stop chasing unqualified leads and could boost your close rate from 15% to a stronger 25–40%, which is typical for founder-led B2B sales.

What makes a post-demo follow-up system effective for closing more deals?

An effective follow-up system after a demo can be the difference between a promising conversation and a closed deal. The key? It needs to be timely, organized, and actionable.

Start by sending a personalized recap within 24 hours of the demo. Highlight the most important points discussed, especially those that address the prospect’s challenges. This quick response keeps the discussion fresh in their mind and shows you respect their time and concerns.

Next, establish a clear next step with a specific deadline. Whether it’s scheduling a technical review, discussing pricing, or presenting a pilot proposal, make sure the plan is concrete. Assign follow-up tasks in your CRM and set automated reminders to ensure nothing slips through the cracks.

To strengthen your case, provide tailored resources like case studies, ROI calculators, or other materials that directly align with the prospect’s needs. These tools can help reinforce the value of your solution and keep their interest engaged.

By sticking to a consistent, data-driven follow-up strategy, you’ll create a reliable process that not only keeps deals on track but also boosts your overall close rate.

How can I handle pricing objections by showing the value of my product or service?

To handle pricing objections effectively, it’s crucial to focus on showing the return on investment (ROI) your product or service brings to the table. Share specific, data-backed examples to illustrate how your solution addresses their challenges or delivers measurable results. This could include relevant case studies, cost-benefit analyses, or performance metrics that clearly connect your pricing to the value they’ll gain. Present the price as an investment in their success, rather than just another expense. Avoid offering discounts that could devalue your offering; instead, highlight what sets your solution apart and why it’s essential for achieving their goals.