Startups are notorious for their high failure rates, with statistics showing that 9 out of 10 new ventures fail or go out of business at some point. The odds are undeniably stacked against investors.

However, the potential rewards of investing in a successful startup can be astronomical, often yielding returns in the thousands of percent.

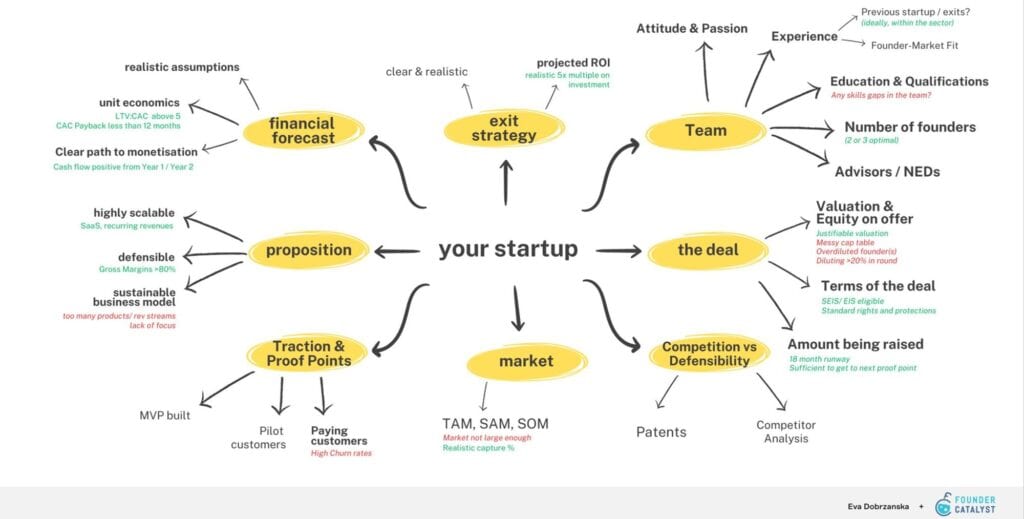

The key to realizing these impressive gains is identifying startups with real potential. To aid in this process, Eva Dobrzanska shared a comprehensive mind map for evaluating startups, covering crucial aspects to consider before investing.

Understanding the Deal

The first critical element to scrutinize is whether the startup’s terms align with its growth plan. It is imperative to assess whether the terms and conditions offered to investors are consistent with the company’s long-term objectives. This alignment will help determine if the startup is serious about its business strategy and potential for growth.

Unique Advantage in Experience or Expertise

A startup’s team is often its most valuable asset. Evaluate whether the team possesses a unique advantage in terms of experience or expertise that sets them apart from the competition. The collective skills and knowledge of the founding team can significantly impact the startup’s success.

Look for the following attributes:

- Relevant industry expertise.

- Strong leadership and management skills.

- A track record of successful ventures.

- A clear and cohesive team dynamic.

Realistic Understanding of the Market

Understanding the market is a fundamental aspect of evaluating a startup. Do they have a realistic and nuanced understanding of their target market? A startup that is grounded in reality and can accurately gauge market dynamics is more likely to adapt and thrive.

Conduct market research to gauge the startup’s potential. Look for evidence that the market is large enough to support the business and that there is a clear demand for the product or service. Consider factors like:

- Market size and growth potential.

- Market trends and competitive landscape.

- Customer feedback and testimonials.

Exit Strategy

One of the key considerations for investors is whether the startup has a clear exit strategy with potential scenarios. An exit strategy outlines how investors can realize a return on their investment, whether through acquisition, IPO, or other avenues. A well-defined exit strategy adds confidence to the investment. This can impact your investment timeline and potential returns.

Value Proposition

Scrutinize the startup’s value proposition. Is it scalable, defensible, and sustainable? A strong value proposition should address the startup’s ability to grow, protect its market position, and maintain longevity in the face of competition.

Financial Forecast

Assess the startup’s financial forecast, focusing on its assumptions and the path to profitability. A startup with realistic assumptions and a clear path to profit is more likely to deliver a return on investment.

Examine the startup’s financial health and projections. Key financial metrics to evaluate include:

- Revenue and profit margins.

- Burn rate (monthly expenses vs. income).

- Cash flow and funding requirements.

- Revenue growth potential.

Traction and Validation

Check if the startup has achieved traction and validation in the market. This can be demonstrated by the presence of a Minimum Viable Product (MVP) and paying customers. Traction and validation signify that the startup has real-world demand and potential for growth.

Evaluate the startup’s user base and traction. This includes looking at customer acquisition channels, user retention, and growth metrics. Consider:

- User acquisition cost and lifetime value.

- Churn rate (customer attrition).

- Growth trends and milestones achieved.

Intellectual Property and Competitive Advantages

Assess the startup’s intellectual property (IP) and competitive advantages. Determine whether it has any patents, trademarks, or proprietary technology that gives it a competitive edge. Analyze:

- Intellectual property portfolio.

- Barriers to entry for competitors.

- Sustainable competitive advantages.

Due Diligence

Perform due diligence to uncover any potential legal or regulatory issues, outstanding liabilities, or other risks. This includes reviewing:

- Legal contracts and agreements.

- Pending or potential litigation.

- Compliance with industry regulations.

Risk Assessment

Assess the risks associated with the startup. Every investment comes with risks, and it’s important to identify and understand them. Consider factors like market risks, execution risks, and external factors that could impact the business.

Competitive Edge

Finally, evaluate the startup’s level of competitiveness. Does it possess intellectual property (IP), unique technology, or proprietary processes that set it apart from competitors? A strong competitive edge can be a significant advantage in a crowded marketplace.

In conclusion, while the odds may be stacked against investors in the world of startups, strategic evaluation can significantly mitigate the risks. By carefully assessing each of these factors, investors can increase their chances of identifying promising startups with the potential for substantial returns.

This mind map published by Eva Dobrzanska provides a valuable framework for this evaluation, offering a structured approach to assess the numerous facets of startup investment.

Ultimately, investing in startups can be a high-risk, high-reward endeavor. Still, by following these guidelines, investors can position themselves for success in this dynamic and ever-evolving landscape. The key is to not only consider each of these factors individually but also to recognize their interplay in shaping the overall viability and potential for success of a startup.

Diligence and a keen eye for these facets can empower investors to make more informed and potentially lucrative decisions in the unpredictable startup investment world.