Finding the Sweet Spot: Low Risk, High Reward Investments in Startups

In the world of investment, the adage “high risk equals high reward” is often touted as a guiding principle. However, there exists a lesser-known avenue where investors can reap substantial returns without exposing themselves to excessive risk – particularly in the realm of startup investments.

This sweet spot hinges on timing and strategic decision-making, allowing savvy investors to capitalize on opportunities that offer low risk and high reward.

A prime example of this phenomenon is exemplified by the early-stage investors of Loom, a startup that skyrocketed in value, yielding returns ranging from 25 to 64 times their initial investment. What sets these investments apart is not merely luck, but rather a keen ability to identify and support startups with the potential for significant growth and success.

So, how can investors spot these lucrative opportunities amidst the sea of startups vying for attention and funding? The key lies in understanding the distinguishing factors that separate high-risk ventures from those with lower risk and higher potential for reward.

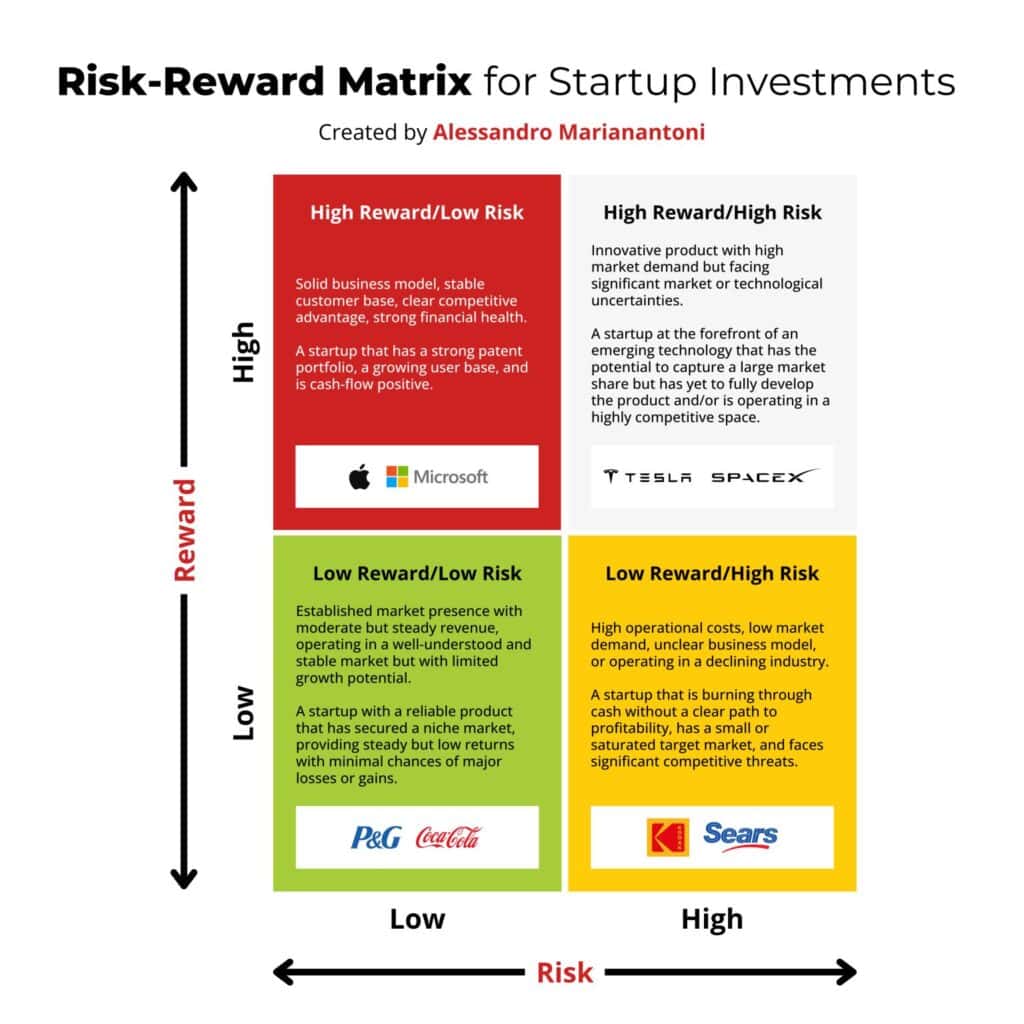

High-risk, high-reward startups typically exhibit the following characteristics:

- Innovative Product: These startups offer groundbreaking solutions or products that address unmet needs or disrupt existing markets. Innovation is often a driving force behind their growth potential.

- High Market Demand: There is substantial demand for the product or service being offered, indicating a sizable market opportunity and the potential for rapid scalability.

- Highly Competitive Space: While competition can be fierce, it also signifies the presence of a lucrative market. Startups operating in competitive spaces must demonstrate their ability to differentiate themselves and capture market share.

Conversely, low-risk, high-reward startups possess the following attributes:

- Clear Competitive Advantage: These startups have a distinct edge over competitors, whether it’s through proprietary technology, unique market positioning, or specialized expertise.

- Strong Patent Portfolio: Intellectual property rights, such as patents, can serve as valuable assets, providing legal protection and barriers to entry for competitors.

- Cash-flow Positive: Startups that demonstrate positive cash flow early on are less reliant on external funding and better positioned to weather market fluctuations and economic downturns.

While no investment is entirely devoid of risk, investors can mitigate potential pitfalls by focusing on startups with robust moats and financial stability. Rather than being swayed solely by the allure of a novel product or concept, prudent investors prioritize factors that contribute to long-term sustainability and profitability.

Ultimately, the choice between high-risk, high-reward investments and their lower-risk counterparts boils down to individual preferences and investment objectives. While some may be drawn to the excitement and potential windfalls associated with high-risk ventures, others may opt for the stability and predictability offered by low-risk opportunities.

In a landscape where uncertainty and volatility are inherent, the ability to identify and capitalize on opportunities that offer the optimal balance of risk and reward can spell the difference between success and failure in the world of startup investing. So, what type of investor are you – one who chases the allure of high-risk ventures, or one who seeks the stability of low-risk opportunities? The answer may very well determine your path to investment success.

English

English  Italiano

Italiano