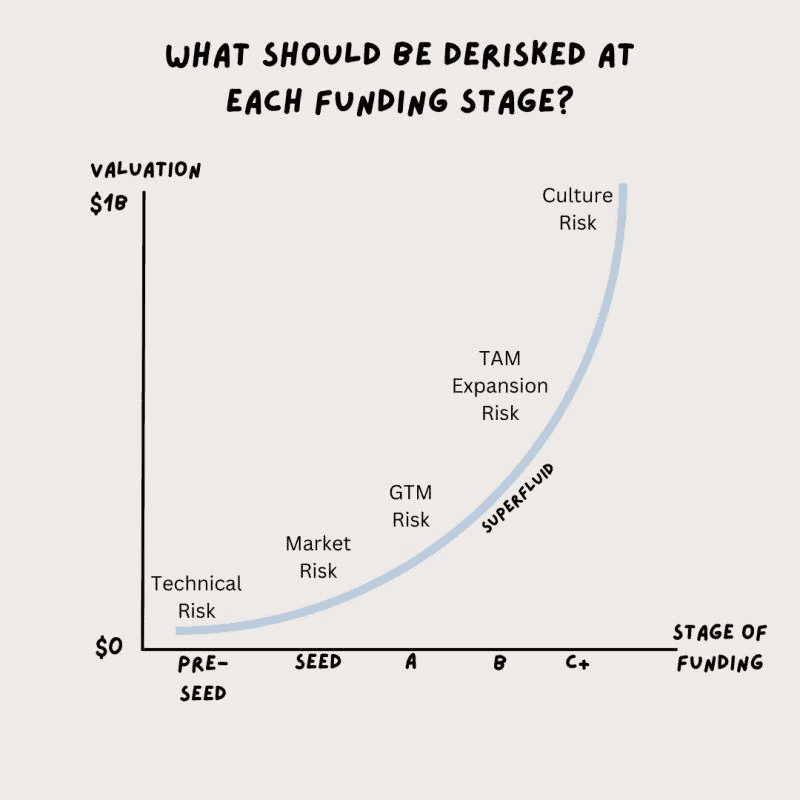

As investors, we are acutely aware that risk is an inherent part of the startup landscape. However, the success of your startup investments can be significantly enhanced by adjusting your support and guidance based on the unique risks associated with each stage of a startup’s development.

By understanding and addressing these specific risks, you can increase the likelihood of a successful outcome. In this article, we’ll explore the different risk factors at each startup stage and offer valuable insights on how to de-risk your investments effectively.

Pre-Seed: Validating Market Viability

At the pre-seed stage, the primary risk is market validation. Investors must assess whether the startup’s offering addresses a genuine problem in the market. Potential questions to ask include:

- Does the startup solve a real problem in the market?

- Is there a demonstrated need for their product or service?

Investors can help mitigate this risk by encouraging startups to conduct in-depth market research, engage with potential customers, and create a minimum viable product (MVP) to test their concept. Providing guidance on building a strong value proposition is crucial at this stage.

Seed: Evaluating Team Competency

In the seed stage, the risk primarily lies in the startup team’s ability to iterate and improve effectively. To de-risk your investment, consider the following:

- Do they have the skills and adaptability to iterate their product or service?

- Is the team capable of navigating challenges and pivoting when necessary?

Mentoring and support that focuses on team development, skills enhancement, and strategic guidance can be immensely valuable at this stage.

Series A: Achieving Product-Market Fit (PMF)

The Series A stage brings with it the risk associated with product-market fit (PMF). Investors should analyze whether customers are genuinely interested in the startup’s offering and willing to pay for it. Key questions include:

- Is there strong evidence of product-market fit?

- Are customers satisfied and engaged with the product or service?

At this stage, providing resources for market testing, customer feedback, and scalability can help reduce the PMF risk.

Series B: Scaling Successfully

In Series B, the primary risk revolves around scaling the business effectively. Investors should assess whether the startup is equipped to handle the complexities that come with rapid growth. Key considerations include:

- Can they manage the operational intricacies of scaling?

- Is the team prepared to handle increased demand and competition?

Investors can de-risk Series B investments by offering mentorship on scaling strategies, operational efficiency, and access to additional resources.

Series C and Beyond: Preparing for Attractive Exit

For startups in Series C and beyond, the risk primarily centers around executing a successful exit strategy. Investors must evaluate whether the company is on track and adequately prepared for a lucrative exit. Questions to ask include:

- Are they on target for a desirable exit?

- Is the startup well-positioned to navigate exit negotiations and agreements?

Investors can assist in de-risking these investments by offering guidance on exit planning, mergers and acquisitions, and introductions to potential acquirers.

Persistent Risks

Apart from the stage-specific risks, certain challenges are omnipresent in a startup’s journey:

Market Disruption: Startups face the constant threat of market disruption from emerging technologies, changing consumer preferences, or new competitors. Investors can help by encouraging startups to stay agile, continually innovate, and adapt to market shifts.

Competition: Competition is fierce in most industries. Investors should guide startups in identifying and differentiating themselves from competitors, emphasizing the importance of a unique value proposition.

Culture: Maintaining a healthy and productive company culture is vital. Investors can play a pivotal role in advising on culture-building and ensuring alignment with the startup’s long-term vision.

Investor’s Tip

To maximize the success of your startup investments, it’s crucial to provide startups with the right mix of network, resources, mentorship, and coaching. By offering tailored support that addresses the specific risks associated with each stage, you can significantly improve the chances of a successful outcome. Remember, investing in startups is not just about providing capital; it’s about actively participating in their journey to mitigate risks and create lasting success.

M Accelerator

At M Accelerator, we take great pride in providing founders with a comprehensive platform that has the power to transform their entrepreneurial aspirations into tangible successes. Our network is a rich tapestry of experienced mentors, visionary investors, strategic corporate partners, dedicated coaches, and an extensive video library, all carefully curated to empower founders on their journey. This platform is a testament to our unwavering commitment to support startups.

We’ve witnessed the incredible value of having access to these resources and connections, and that’s why we’re dedicated to sharing this wealth with the next generation of innovators. M Accelerator is not just a platform; it’s a dynamic ecosystem that fosters growth, learning, and achievement for founders as we stand with them in their pursuit of entrepreneurial greatness.