Uncovering Startup Secrets: The Importance of Due Diligence in Investment

In the ever-evolving world of venture capital, where the excitement of innovation and the allure of promising startups can be intoxicating, it’s easy for investors to get caught up in the whirlwind of opportunities and overlook the importance of thorough due diligence.

This article emphasizes the critical role of due diligence in assessing startups, highlighting that a pitch can tell you a lot about a startup, but due diligence can reveal its secrets.

The Allure and the Reality

Investing in startups has always carried an aura of glamour and high-risk, high-reward potential. Entrepreneurs pitch their groundbreaking ideas, charismatic founders charm investors, and the prospect of being part of the next big thing is enticing. However, seasoned investors know that success in venture capital is not solely determined by intuition and gut feeling.

The Pitch Is Just the Beginning

A captivating pitch can certainly draw investors in, but it should only be the beginning of a more comprehensive evaluation process. The reality is that even the most polished presentations can conceal crucial details, potential pitfalls, or hidden problems within a startup. Thus, a diligent examination is imperative to ensure a well-informed investment decision.

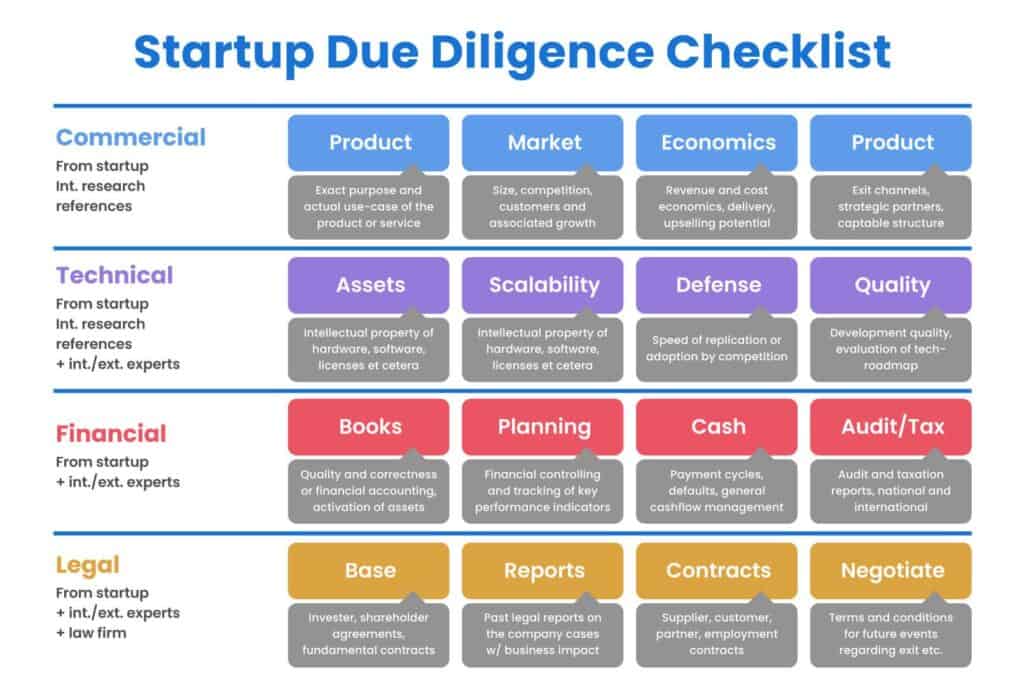

Key Aspects of Due Diligence

- The Product:

– Does the product actually exist? It’s essential to verify that the startup has a tangible product, and not just a concept or prototype. Reviewing their materials and source code can provide insights into the progress and quality of their offering.

– Intellectual Property (IP) rights: Investors should check if the startup holds any patents or copyrights that protect its intellectual assets. Understanding the IP landscape is crucial for assessing the startup’s competitive advantage.

- The Financials:

– Unnecessary expenses: Scrutinizing a startup’s financials can help identify inefficient spending and the overall health of their financial management.

– Realistic projections: Are the revenue projections and growth expectations grounded in reality? Overly optimistic financial forecasts can be a red flag.

– Burn rate: Assessing the startup’s burn rate, i.e., how quickly it is spending its capital, is crucial in evaluating its sustainability and funding needs.

- The Legalities:

– Legal disputes: Investigate whether the startup is involved in any ongoing legal disputes. Legal issues can impact its ability to operate and its reputation.

– Contractual obligations: Reviewing the startup’s contractual agreements, including contracts with suppliers, customers, and partners, can reveal potential risks or obligations that might not be immediately apparent.

– Compliance and regulations: Ensure that the startup complies with all relevant laws and regulations in its industry. Non-compliance can lead to costly consequences.

- The Cap Table:

– Previous funding rounds: Examine the terms of past investment rounds to understand the startup’s capital structure and the rights of other investors.

– Anti-dilution provisions: Investigate if there are any anti-dilution clauses in place, as these can impact the value of your investment over time.

– Vesting schedules: Understand the vesting schedules of the team to ensure that key members remain committed to the startup’s success.

- The Team:

– Scaling plans: How does the startup plan to scale its team and operations? Evaluate their strategy for growth and expansion.

– Advisory board: The expertise and connections of the advisory board can greatly impact a startup’s success. Assess their qualifications and relevance.

– Hiring plans: Understand the startup’s hiring plans and its ability to attract and retain top talent.

Image sourced from Dealroom

Conclusion

In the world of venture capital, due diligence is a non-negotiable step that separates informed investments from impulsive decisions. While FOMO (Fear of Missing Out) may drive some investors to rush into deals, taking the time to analyze every aspect of a startup can uncover hidden risks and opportunities that are not apparent on the surface.

Investors must remain objective and prioritize their own best interests. Unearthing a startup’s secrets through due diligence is an essential safeguard against potential losses and an integral part of making sound investment decisions. In the long run, this diligence will save investors not only money but also invaluable time and effort.

So, remember, a pitch can be captivating, but it’s due diligence that ultimately reveals the true nature of a startup and ensures that your investment aligns with your goals and expectations.

Join our meetings to work on these topics.

English

English  Italiano

Italiano