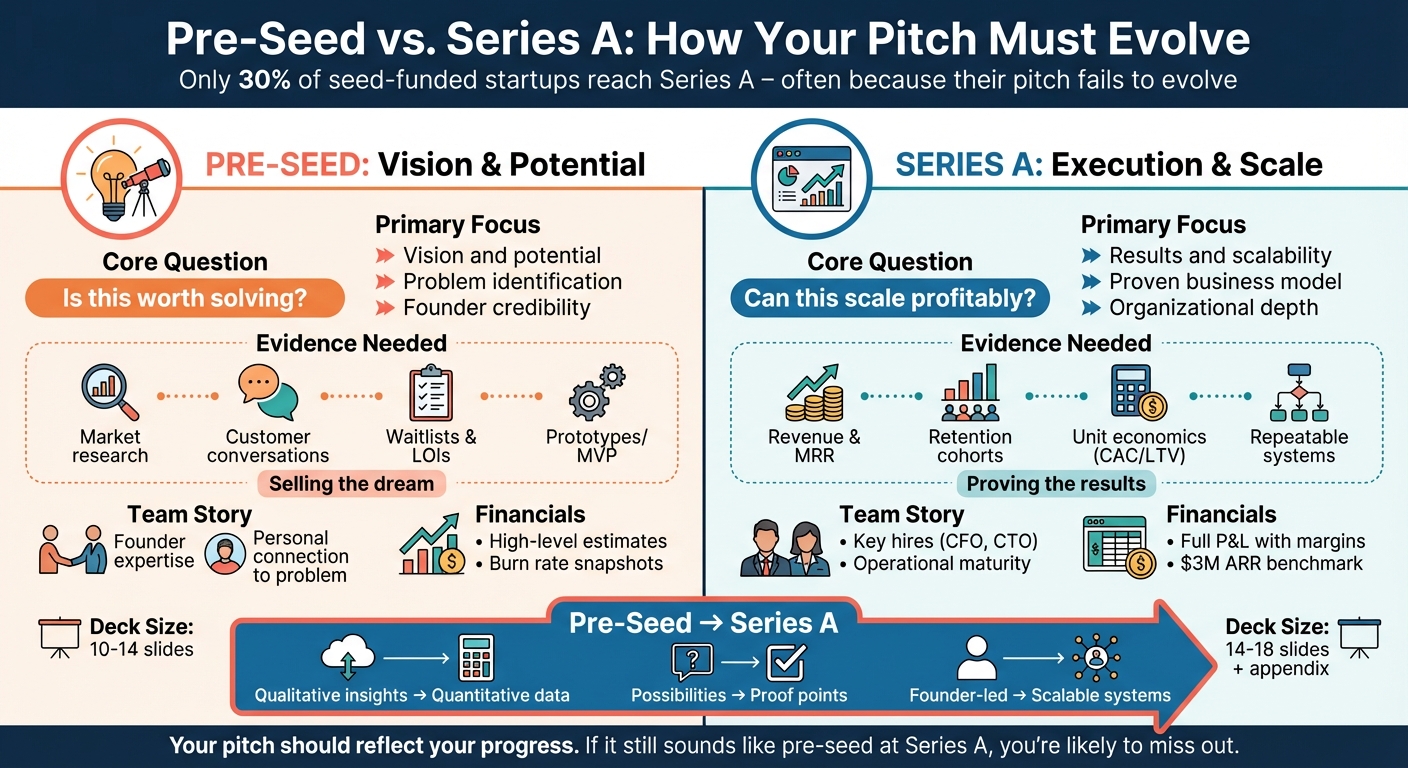

When pitching to investors, your story needs to change as your startup grows. At the pre-seed stage, it’s about selling a vision and proving there’s a real problem to solve. By Series A, the focus shifts to execution – showing data, traction, and scalable systems. Why does this matter? Only 30% of seed-funded startups reach Series A, often because their pitch fails to evolve.

Key Takeaways:

- Pre-Seed Pitch: Focus on the problem, market insights, and your team’s unique ability to solve it. Use prototypes or early customer feedback to build belief.

- Series A Pitch: Highlight measurable results like revenue, retention, and scalable growth. Investors now expect proof your business model works.

Quick Comparison:

| Stage | Focus | Evidence Needed | Investor Question |

|---|---|---|---|

| Pre-Seed | Vision and potential | Market research, early tests | Is this worth solving? |

| Series A | Results and scalability | Revenue, metrics, repeatable systems | Can this scale profitably? |

Your pitch should reflect your progress. Pre-seed decks sell dreams, while Series A decks prove results. If your pitch still sounds like pre-seed at Series A, you’re likely to miss out.

Pre-Seed vs Series A Pitch Requirements: Key Differences for Startup Founders

How Pre-Seed and Series A Narratives Differ

Pre-seed pitches are all about vision, while Series A pitches focus on execution. At the pre-seed stage, investors are drawn to potential – your sharp market insights and big ideas. By the time you’re pitching for Series A, they want proof: evidence that your business model works consistently across customers and channels. Pre-seed storytelling leans on possibilities, showcasing early experiments, prototypes, and unique perspectives. Series A, on the other hand, highlights readiness – repeatable sales processes, steady growth, and clear market demand. Join our free AI Acceleration Newsletter for weekly insights on AI systems.

This shift in focus is crucial to understand. At pre-seed, your passion and insight take center stage. By Series A, the spotlight shifts to your team and scalable systems, showing that your business can operate smoothly without constant founder involvement. As Amélie Laurent, Product Manager at Sisyphus, explains:

"At Seed, investors back belief… At Series A, belief isn’t the question anymore. Execution is." – Amélie Laurent, Product Manager, Sisyphus

Here’s how these differences play out in practice.

Pre-Seed: Vision Over Numbers

At the pre-seed stage, investors are betting on your unique insight – your ability to identify a problem others have overlooked. Your pitch should focus on demonstrating that this problem is real and that you have a deep understanding of it. Evidence here is usually qualitative: market research, early customer conversations, waitlists, letters of intent, or pilot programs.

Take CardioPath, a digital therapeutics platform, as an example. Their pre-seed narrative centered around the emotional and financial toll of cardiac care. They highlighted a $17 billion annual cost tied to cardiac readmissions in the U.S. healthcare system and shared patient stories to connect with investors. Instead of hard metrics, they relied on their vision to engage their audience. At this stage, a simple pitch deck with mockups or an MVP (minimum viable product) is often sufficient – investors don’t expect fully developed unit economics yet.

Series A: Numbers Over Vision

By Series A, the narrative shifts dramatically. Investors now expect proof that your solution works at scale. Your pitch should lead with traction – revenue figures, retention rates, unit economics, and evidence that your go-to-market strategy is repeatable. The focus moves away from the problem to the solution and its measurable success.

When CardioPath returned for its Series A round 18 months later, they completely revamped their pitch. Their presentation highlighted hard data: 2,400+ enrolled patients, a 34% reduction in 30-day readmissions, and active contracts with three major health systems. The visuals were data-driven, reflecting operational maturity and the scalable system they had built to address the problem.

Series A investors also expect a clear, detailed use-of-funds plan tied to specific growth milestones. They want reassurance that you can execute your strategy without major hiccups. Rob Smith, Partner at M13, puts it succinctly:

"Investors can be lazy. If they only read the titles of your slides, that should be enough to tell your startup story." – Rob Smith, Partner at M13

This means your pitch deck needs to be crystal clear. Key metrics and proofs should be immediately visible, even if an investor spends just a few minutes skimming. And expectations are higher now – $3 million in ARR is becoming the new benchmark for Series A readiness, replacing the older $1 million target.

Here’s a quick comparison of how expectations evolve between pre-seed and Series A:

| Feature | Pre-Seed Expectation | Series A Expectation |

|---|---|---|

| Primary Question | Is this insight real and is the team right? | Is this working scalably and can the team execute? |

| Evidence Type | Market research, LOIs, waitlists | Cohort data, retention, unit economics |

| Narrative Focus | Possibility and exploration | Readiness and validation |

| Team Story | Founder credibility and personal trust | Organizational depth and key operators |

| Financials | Early revenue snapshots | Full P&L with strategic narrative and margins |

At M Accelerator, we specialize in helping founders evolve their pitch narratives from visionary to actionable, leveraging AI-driven systems to refine their storytelling.

What to Include in Your Narrative at Each Stage

Your pitch needs to grow alongside your business. What works at the pre-seed stage won’t cut it when you’re aiming for Series A. Investors are looking for entirely different things at each phase. At pre-seed, it’s all about your vision – what could be. By Series A, you need to demonstrate what already is. Leveraging AI-powered storytelling can help refine your narrative at every step. For tips and insights, check out our free AI Acceleration Newsletter.

At the pre-seed stage, investors are focused on your understanding of the problem and why your team is uniquely positioned to solve it. For Series A, the spotlight shifts to your ability to scale – proven systems, strong customer retention, and metrics that show your business model works without you personally driving every deal.

As John Vrionis, Co-founder of Unusual Ventures, puts it:

"Your investor presentation is not the same as your customer presentation… the investor presentation must include a compelling narrative about your team, the big opportunity, the economics, and the milestones." – John Vrionis, Co-founder, Unusual Ventures

If you’re preparing for Series A, it’s time to build the systems that make your narrative stand out. Our Elite Founders program offers weekly sessions to help you implement automations and track the key elements investors care about.

Side-by-Side Comparison

Take CardioPath as an example. Their journey highlights how your narrative must shift from showcasing potential to proving results. Below is a breakdown of how the focus areas evolve between pre-seed and Series A:

| Narrative Element | Pre-Seed Focus | Series A Focus |

|---|---|---|

| Problem Statement | Anecdotal insights into market pain | Data-driven urgency with proof customers are willing to pay for solutions |

| Solution Demo | Mockups or MVP screens illustrating the vision | Live product screenshots with adoption data and integration workflows |

| Traction Metrics | Early signals: customer conversations, waitlists | Consistent growth: MRR, retention cohorts, NDR, CAC/LTV |

| Market Size | Broad TAM/SAM/SOM to validate opportunity | Focused beachhead strategy with clear first wins and expansion plans |

| Team Story | Founder expertise and credibility | Depth in operations with key hires driving specific outcomes |

| Financial Projections | High-level estimates on burn rate and runway | Full P&L with a detailed narrative on margins, operating leverage, and goals |

| Funding Ask | General milestones tied to a lump sum | Detailed allocation with clear outcomes and measurable value creation |

At M Accelerator, we guide founders through building the AI-driven systems and frameworks that deliver the traction metrics Series A investors expect.

How Your Pitch Deck Changes from Pre-Seed to Series A

Your pitch deck transforms as your business matures – shifting from selling a vision to proving scalability. Every element, from text to visuals, reflects this evolution. With investors spending just 3 minutes and 44 seconds reviewing a deck, precision is key. Series A decks, for instance, average 2.6 words per slide to efficiently convey proof while maintaining a compelling story. Let’s explore how your deck adapts from a vision-driven pre-seed stage to a traction-focused Series A presentation.

Pre-Seed Deck: Problem and Vision

A pre-seed deck, typically 10–14 slides, revolves around one crucial question: Is this problem worth solving, and is this team uniquely qualified to solve it? The focus here is on the problem’s significance and the founders’ deep connection to it. Your slides should highlight the market pain and your unique insight into solving it. Use warm, relatable visuals – like illustrations or icons – that build empathy for the issue. Mockups or early MVP screens are effective tools to showcase what your solution could become.

The "Team" slide is critical at this stage. It should spotlight the founders’ backgrounds and personal stories, illustrating why you’re the right team for this venture. Investors often skim decks, so your slide titles must tell a clear, compelling story on their own.

"Investors can be lazy. If they only read the titles of your slides, that should be enough to tell your startup story." – Rob Smith, Partner at M13

The pre-seed deck is about inspiring belief in your vision. But as you move toward Series A, the narrative must evolve to reflect tangible progress.

Series A Deck: Traction and Growth

By Series A, your deck grows to 14–18 slides, but the real shift is in focus – it’s all about proof. If your strongest slide is still vision-driven, your narrative hasn’t matured enough. Investors at this stage prioritize data over potential. They want evidence that your business is operational and ready to scale.

Visuals also take a more polished, professional turn. Replace warm illustrations with clean layouts, real product screenshots, and data visualizations. Highlight live usage, workflow integrations, and engagement metrics. The "Team" slide should now emphasize organizational depth, showcasing key hires like your CFO, CTO, and other critical roles that demonstrate your ability to scale.

An Executive Summary slide at the beginning is a must. This single slide offers a snapshot of your traction, market position, and investment ask, allowing investors to grasp the essentials in under 30 seconds. While your core narrative should remain concise – 12–15 slides – include a detailed appendix of 30+ slides to address deeper questions on financials, operations, and technical details.

"Seed rounds are about finding a business model. Series A is about executing that model at scale." – Borja Zamora, Founder of Zamora Design

Your Series A deck must prove that your business is not only functional but ready to grow. Founders aiming to refine their pitch decks with AI-driven strategies can explore M Studio / M Accelerator for expert guidance.

sbb-itb-32a2de3

How to Tell Your Story at Each Stage

The way you present your story evolves significantly between pre-seed and Series A. It’s not just about changing the content – it’s about reshaping the entire narrative. At the pre-seed stage, you’re selling belief in a vision that hasn’t materialized yet. By Series A, the focus shifts to proving that vision is already becoming reality. Mastering this transition can make the difference between investors leaning in or tuning out.

Want to learn how AI can refine your storytelling? Join our free AI Acceleration Newsletter here. Get weekly insights into AI frameworks designed to improve startup storytelling.

Pre-Seed: Founder Story and Early Validation

At the pre-seed stage, your story is all about your credibility and early signs of promise. Start by sharing the founding insight – a market truth others have overlooked – and explain why you are uniquely positioned to act on it. Confidence in your expertise is key, but don’t stop there. Tie it directly to your vision for the future.

Take Blue Wire, for example. This sports podcast platform raised pre-seed funding with a simple 9-slide deck. Their focus? A compelling narrative about how sports audiences were changing the way they consumed content. They didn’t rely on mountains of data; instead, they told a powerful story about a market shift and positioned themselves as central to it. Similarly, Manpacks raised $500,000 by using a 12-slide deck, dedicating almost half of it to a visual "flip book" that illustrated the problem and solution in a way that resonated emotionally.

Your pre-seed narrative should answer one critical question: Is this problem worth solving, and are you the right team to solve it? Use brief customer stories to create emotional connections, and back your insight with small but meaningful early tests – whether that’s customer conversations, prototypes, or mockups.

Series A: Metrics and Risk Reduction

By Series A, the storytelling game changes. Investors no longer need to be convinced about the problem or your ability to tackle it. Instead, they’re asking: Is this working, and can it scale? This is where your narrative shifts to focus on measurable results and risk management.

Every assumption you made at the pre-seed stage should now be backed by data. For instance, instead of saying, “We believe customers will pay $X,” you should be able to demonstrate, “Our average contract value is $12,500, with 94% of payments collected within 30 days.”

Your strongest proof point should appear by slide 3 – investors spend the majority of their time on the first few slides. Use data-driven customer success stories to show traction, retention, and growth. Be transparent about potential risks: What challenges could arise, and how does this funding help mitigate them?

For founders looking to align their storytelling with investor expectations, platforms like Elite Founders offer hands-on support to help refine your approach.

What Investors Look For and Worry About at Each Stage

Investors have different priorities and concerns depending on the funding stage. Knowing what matters to them – and addressing it proactively – can make all the difference. This builds on earlier discussions about shifting from a vision-driven narrative to one focused on execution. Want to sharpen your storytelling? Check out the free AI Acceleration Newsletter or explore platforms like M Studio / M Accelerator, which help founders craft AI-powered go-to-market strategies that grow alongside their business.

Pre-Seed: Evaluating Potential

At the pre-seed stage, investors focus on potential. They’re asking: Does this team have the insight and ability to solve a real problem? At this point, you’re not expected to have all the answers, but you need to show you’re asking the right questions.

Here’s what investors are looking for:

- A unique market insight: What truth have you uncovered that others have overlooked? Generic statements like “small businesses need better software” won’t cut it – specific, research-backed insights are key.

- Founder-market fit: Why are you the right person or team to tackle this problem? Your background, experience, and connection to the issue should stand out.

- Market size: Is the opportunity big enough to matter? Investors want to see that your idea has room to grow.

Attention to detail matters even at this early stage. A polished pitch deck signals that you’re serious, while addressing risks upfront shows you’ve thought things through. Investors need to believe you can adapt and navigate uncertainty, even when the path forward isn’t clear. This trust sets the foundation for the more rigorous expectations of Series A.

Series A: Evaluating Scale

By Series A, the game changes. The focus shifts from potential to performance. The core question becomes: Can this business scale profitably? Investors want proof that you’ve moved beyond experimentation and can deliver consistent, repeatable results.

Key areas of focus include:

- Scalable systems: Founder-led sales might work early on, but investors need to see a repeatable sales process that doesn’t rely on you personally.

- Unit economics: Metrics like customer acquisition cost (CAC), lifetime value (LTV), and retention rates are under the microscope. Growth velocity – how fast you’re growing – is often more important than hitting a specific revenue milestone.

- Evolved narrative: Your pitch should reflect progress. If it still sounds like your seed-stage story, it’s a red flag. As Amélie Laurent, Product Manager at Sisyphus, explains:

"Most startups don’t miss Series A because the business isn’t working. They miss it because their pitch deck still looks and sounds like Seed."

Strategic clarity is also critical. If you’ve abandoned your original focus or introduced untested ideas, it signals confusion, not growth. Your founding insight should remain steady, with new data and results reinforcing your case.

Interestingly, companies that use well-crafted, data-driven narratives raise an average of $12.3M – 52% more than those relying on generic templates. This underscores the importance of a clear, compelling story as you transition from potential to scalability.

| Evaluation Focus | Pre-Seed Stage | Series A Stage |

|---|---|---|

| Core Question | Is this insight real, and is this team right? | Is this working at scale, and can this team execute? |

| Primary Evidence | Market research & founder insight | Unit economics & repeatable sales motion |

| Main Concern | Lack of founder-market fit | Founder-dependent sales that won’t scale |

| Success Metric | Market opportunity & team credibility | Growth velocity & operational maturity |

| Red Flag | Avoiding discussion of risks | Narrative that still sounds like Seed |

Conclusion

Your pitch needs to evolve as your startup progresses, transitioning from showcasing potential to proving measurable progress. At the pre-seed stage, the focus is on selling a vision – highlighting market insights, a compelling idea, and your team’s ability to execute. If you’re curious about how AI can enhance your fundraising narrative, check out our AI Acceleration Newsletter for weekly tips on leveraging AI in your journey.

By the time you reach Series A, the narrative must shift. It’s less about potential and more about performance. Investors will expect to see metrics, scalable growth systems, and data that demonstrate your ability to scale. Kirk Patel, Co-Founder of M’idea Hub, sums it up perfectly:

"Seed decks explain potential. Series A decks explain progress."

This change in focus is critical. Only 30% of seed-funded startups secure Series A funding, often because their narrative fails to mature. A polished story that prioritizes traction over vision can make all the difference, potentially leading to higher funding rounds. Remember, updating numbers isn’t enough – you need to reframe your story to highlight progress and scalability.

AI tools can play a significant role in this process, cutting design time by up to 70% and optimizing your pitch for the brief 3 minutes and 44 seconds investors typically spend reviewing your deck. However, strategic clarity and readiness to execute remain non-negotiable.

To help bridge the gap from potential to proof, consider programs designed to support founders at every stage. For example, M Studio / M Accelerator offers tailored programs, while Elite Founders provides weekly AI and go-to-market sessions to help you build automations that strengthen your pitch. For companies ready to scale, Venture Studio Partnerships delivers advanced AI integration that transforms your narrative into one focused on proof. With experience supporting 500+ founders who’ve collectively raised over $75M, these programs don’t just offer advice – they work alongside you to build solutions.

FAQs

How do investor expectations differ between the pre-seed and Series A stages?

Investor expectations change dramatically as a startup moves from the pre-seed stage to Series A, reflecting the company’s development and readiness to scale. At the pre-seed stage, the spotlight is on the founders’ vision, the problem they aim to solve, and how the idea could shake up the market. While early validation – like a prototype or initial customer feedback – adds value, the primary focus is on the strength of the idea and the team’s ability to bring it to life.

By the time a startup reaches Series A, the game changes. Investors now expect proof of traction and a clear plan for scaling. They’ll be looking for evidence of product-market fit, user growth, revenue streams, and a well-thought-out go-to-market strategy. At this stage, data matters – financial metrics and a scalable business model are key to winning over investors. Showing tangible progress and the ability to grow at scale becomes essential for securing Series A funding.

How can startups shift their pitch from vision-driven to data-focused as they grow?

To shift from a vision-driven pitch to one grounded in data, startups need to adjust their narrative to spotlight measurable achievements and market validation. While early-stage pitches often revolve around ambitious visions, progressing toward a Series A round means investors will expect concrete proof of progress – think revenue growth, user engagement, or other critical KPIs.

Highlight metrics that showcase your momentum, such as customer acquisition costs, lifetime value, and retention rates. Tailor your pitch to your stage of growth by demonstrating a solid product-market fit, a business model that can scale, and realistic financial projections. Keep your pitch deck current with actual data, and practice presenting these insights in a way that instills confidence in your ability to scale successfully.

What are the most common mistakes startups make when preparing their Series A pitch?

One big misstep startups often make during their Series A pitch is sticking to a vision-heavy narrative without transitioning to a focus on proof. Early-stage pitches typically revolve around the problem, solution, and potential. But by the time you’re pitching for Series A, investors want to see evidence of progress. This means showcasing metrics like revenue growth, user acquisition, retention rates, or key product milestones. If your pitch leans too heavily on storytelling without delivering measurable results, it might seem unprepared for this stage of funding.

Another common error? Recycling your seed-stage pitch deck without updating it to reflect your company’s growth. Series A investors are looking for more than just potential – they want to see scalability, market validation, and a clear path to profitability. A pitch deck that skips detailed financial forecasts, market traction, or proof of product-market fit will likely fall short of expectations. To stand out, your pitch needs to emphasize your growth, operational readiness, and ability to scale effectively.