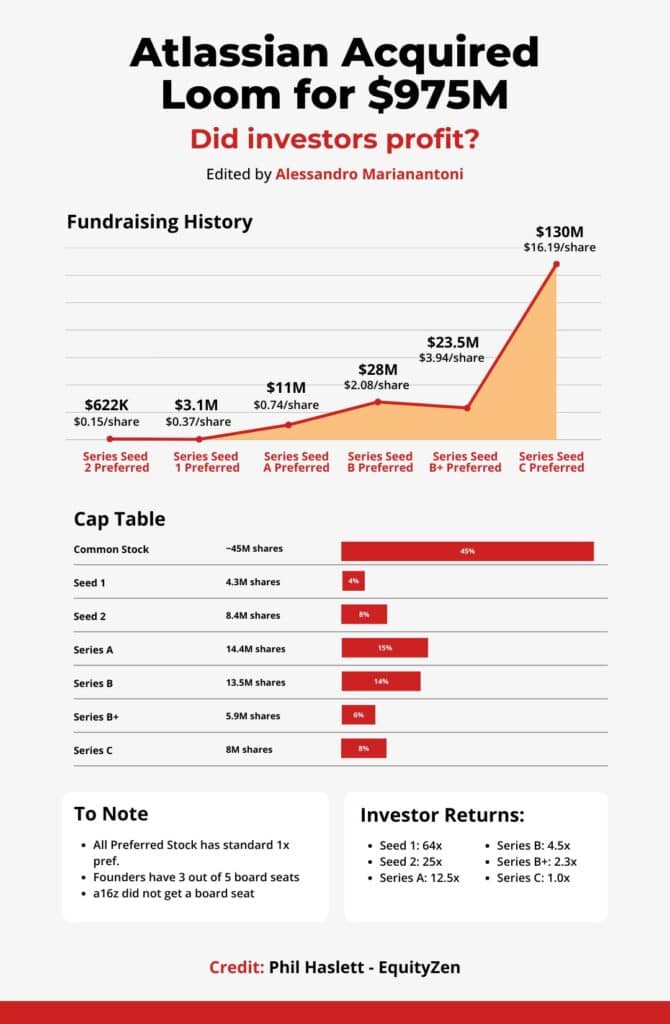

In the ever-evolving landscape of tech acquisitions, Atlassian’s recent move to acquire Loom for a staggering $975 million has sent ripples through the investment community. However, not all investors are toasting to the windfall. Depending on the stage at which they invested, returns vary significantly, showcasing the intricate dance of risk and reward in the world of startup investments.

The Acquisition

Atlassian’s acquisition of Loom represents a substantial bet on the future of workplace collaboration and communication tools. Loom, a video messaging service, has gained traction in a time where remote work has become the norm, making it an attractive asset for Atlassian. The $975 million price tag not only reflects the value Atlassian sees in Loom’s technology but also marks a significant payday for Loom’s early backers.

Investment Returns Across Rounds

- Series C (a16z): Those who jumped into the latest Series C round, represented by the venture capital firm Andreessen Horowitz (a16z), may be feeling a bit underwhelmed. With a 1.0x return, investors in this round have essentially broken even, emphasizing the inherent risk in backing later-stage funding rounds.

- Series B+: Investors who joined the Series B+ round are looking at a more favorable outcome, with a 2.3x return. While not a grand slam, this return illustrates the potential for profit in the mid-stages of a startup’s growth.

- Series B (Sequoia): Sequoia Capital, entering the game during the Series B round, is seeing a more substantial 4.5x return. This showcases the advantage of identifying promising startups before they reach the later stages of funding.

- Series A (Kleiner Perkins): Kleiner Perkins, having the foresight to invest during the Series A round, is enjoying a handsome 12.5x return. Early-stage commitment has paid off significantly in this case.

- Seed 1 (1517 Fund): For those who took the plunge in the Seed 1 round, the return is an impressive 25x. This demonstrates the remarkable potential for profit when spotting a startup’s potential in its infancy.

- Seed 2 (Angels): The jaw-dropping moment comes for investors in the Seed 2 round, often individual angels. With a staggering 64x return, this showcases the extraordinary returns possible for those who take the highest risk at the earliest stage.

High Risk, High Reward

Loom’s acquisition by Atlassian serves as a testament to the high-risk, high-reward nature of early-stage investing. Seed and Series A investors took a gamble on an unproven idea, and for those who made the right bet, the returns are astronomical. However, this game is not for the faint of heart, as later-stage investors might find themselves with more modest returns or, in some cases, merely breaking even.

Phil Haslett has the deal details here: https://lnkd.in/gri_XrV5

Conclusion

Atlassian’s acquisition of Loom provides a vivid illustration of the dynamic and unpredictable nature of startup investments. The varying returns across investment rounds underscore the importance of timing and risk assessment in the world of venture capital.

As the tech industry continues to evolve, the Loom acquisition will undoubtedly stand as a case study for aspiring investors, emphasizing the potential rewards awaiting those who are willing to take the plunge in the early stages of a promising startup.