Venture capital (VC) is a unique and high-risk asset class, known for its potential to generate substantial returns. However, the landscape is fraught with challenges, and not all investments lead to success. Recognizing the nuances of this industry, Limited Partners (LPs) play a crucial role in evaluating VC funds.

In this article, we delve into the key considerations that LPs use to assess VC funds, with insights drawn from industry expert James Heath.

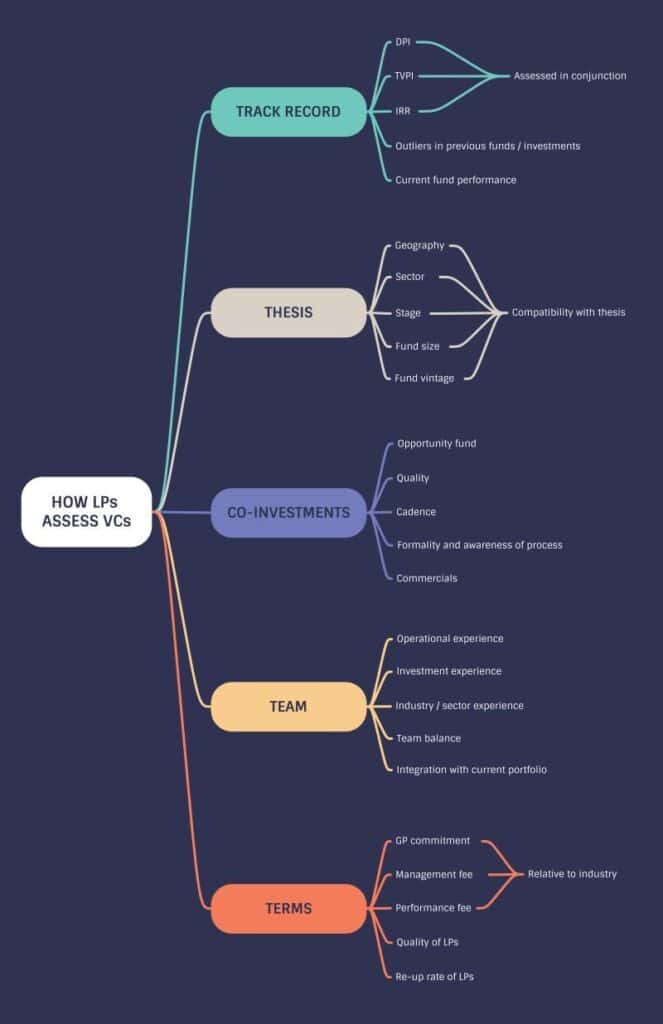

Track Record: Unveiling the Past for Future Gains

One of the foremost aspects that LPs scrutinize is the track record of a VC fund. This involves evaluating the fund’s history of successful investments, considering exit strategies and the returns generated. Metrics such as Internal Rate of Return (IRR), Total Value to Paid-In (TVPI), and Distributed to Paid-In (DPI) are key indicators of a fund’s performance. LPs seek a track record that demonstrates not only success but also consistency in delivering returns.

Thesis Alignment: Navigating Market Trends and Opportunities

LPs want to ensure that the VC fund aligns with their investment thesis. This involves assessing whether the fund’s strategy is in sync with current market trends and opportunities. The fund’s focus on specific stages, sectors, and sizes of investments is crucial. LPs look for a clear and coherent investment strategy that complements their own objectives and expectations.

Co-Investments: The Quality of Deal Flow Matters

The quality of a VC fund’s deal flow is a key determinant of its potential success. LPs inquire about the fund’s co-investments and the overall process for sourcing and evaluating deals. A formalized and systematic deal flow process is often preferred by LPs, indicating that the fund has a structured approach to identifying and securing investment opportunities. The ability to access high-quality deals is a significant factor in the LPs’ decision-making process.

Team: The Driving Force Behind Success

The individuals leading a VC fund, known as General Partners (GPs), are central to the assessment process. LPs delve into the backgrounds and relevant experiences of the GPs, seeking a team that not only possesses financial acumen but also has a track record of successful collaboration with founders. Building strong relationships with entrepreneurs is seen as an indicator of a VC team’s effectiveness.

Terms: Building Long-Term Partnerships

The financial terms of a VC fund, including rates and fees, are crucial considerations for LPs. However, they extend beyond mere financial arrangements. LPs assess how these terms reflect the General Partners’ commitment to the fund. The alignment of interests between LPs and GPs is vital for fostering long-term partnerships. LPs are keen on investments where the fee structure incentivizes the fund managers to prioritize the success of the portfolio companies.

Have a look at his original LinkedIn post here: https://lnkd.in/g6wZvdeF

Conclusion

While each of these aspects holds significance in the evaluation process, if one were to be singled out as the most crucial, it would be the track record. A successful history of investments demonstrates not only a fund’s ability to identify opportunities but also its capacity to navigate challenges and deliver returns consistently.

In the dynamic world of venture capital, where uncertainty is inherent, LPs play a pivotal role in mitigating risks and steering investments towards success. By rigorously assessing these five key aspects – track record, thesis alignment, co-investments, team, and terms – LPs aim to make informed decisions that can potentially unlock the extraordinary returns that VC investments promise.