The Efficient Frontier for Optimized Portfolios: Why Investing in the Best Startup Might Not Be Your Best Bet

Investing is a delicate balancing act between risk and return, and the concept of the efficient frontier plays a pivotal role in helping investors navigate this terrain. The efficient frontier aims to maximize returns within a specified risk threshold while advocating for diversification to reduce overall portfolio risk.

In this article, we will explore the efficient frontier and discuss why investing in the best startup may not always be the optimal choice.

Understanding the Efficient Frontier

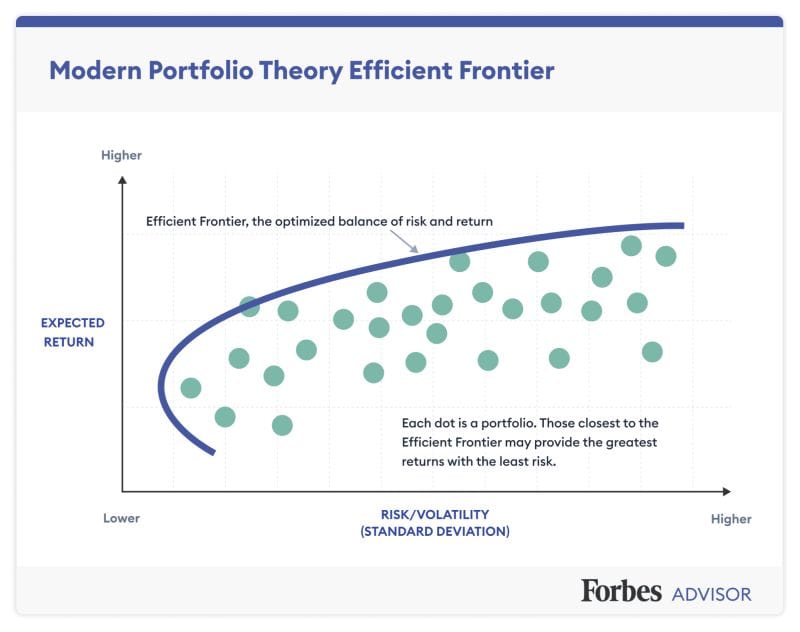

The efficient frontier is a financial concept that involves plotting expected returns against the level of risk associated with a portfolio. The goal is to identify the optimal combination of assets that provides the highest return for a given level of risk or, conversely, the lowest risk for a desired level of return. This principle is crucial in constructing portfolios that strike the right balance between risk and reward.

Calculation of the Efficient Frontier

To calculate the efficient frontier, one must follow these steps:

- Multiply the percentage of each asset in a model portfolio by its expected risk or return.

- Add up the percentage-adjusted risk levels to determine total portfolio risk and the percentage-adjusted expected returns to find the portfolio’s expected return.

- Plot an efficient frontier by comparing expected returns for a range of asset allocations.

Portfolios lying on or above the efficient frontier line represent optimal portfolios that offer the highest return for a specified level of risk. This approach helps investors avoid overexposure to a specific sector, contributing to a more balanced and diversified portfolio.

Why the Best Startup Might Not Be the Best Investment

Despite being touted as the best in the market, even the most promising startups may not align with the efficient frontier. Overemphasis on a single asset, no matter how lucrative, can introduce significant risk into a portfolio. The efficient frontier encourages investors to consider a mix of assets, thereby spreading risk and increasing the potential for stable returns.

Limitations of the Efficient Frontier

While the efficient frontier provides valuable insights, it’s essential to acknowledge its limitations:

- Dependence on Historical Data: The efficient frontier relies on historical data, and past performance may not accurately predict future outcomes.

- Lack of Adaptability to Market Changes: Market conditions are dynamic, and the efficient frontier may not account for sudden changes that could impact asset values.

- Inflexibility in Addressing Evolving Investor Goals: Investor goals and risk tolerance evolve over time, but the efficient frontier may not be flexible enough to accommodate these changes.

Alternative Strategies for Optimized Portfolios

Given the limitations of the efficient frontier, investors should consider complementary strategies to build optimized portfolios:

- Dynamic Asset Allocation: Regularly reassess and adjust portfolio allocations based on changing market conditions and individual financial goals.

- Factor-Based Investing: Consider factors such as value, size, and momentum to enhance portfolio diversification and potentially improve risk-adjusted returns.

- Risk Parity Strategies: Allocate capital based on risk contribution rather than market value to achieve a more balanced risk profile.

Info and image sourced from Forbes Advisor

Conclusion

While the efficient frontier provides a valuable framework for portfolio optimization, it’s crucial to recognize its limitations and explore additional strategies to tailor investments to individual needs. Investing in the best startup may be tempting, but a well-diversified portfolio that aligns with the efficient frontier could offer a more sustainable and risk-conscious approach to wealth creation. As the financial landscape evolves, investors must remain vigilant, continuously reassessing their strategies to adapt to changing market dynamics and evolving personal goals.

English

English  Italiano

Italiano