When pitching to investors, strong revenue numbers alone won’t cut it. They want to see if your success is built on a scalable system – not just founder-driven efforts. The key difference lies between a sales process (manual, founder-reliant steps) and a revenue engine (repeatable, measurable systems). If you can’t explain what happens after a demo in a clear, systematic way, you risk losing investor confidence.

Here’s what matters most to investors:

- Sales Process: Relies on individual effort, lacks scalability, and focuses on seller actions.

- Revenue Engine: Built on automation, buyer-focused milestones, and unified data for predictable growth.

- Key Metrics: Investors analyze CAC payback consistency, deal velocity, ICP alignment, conversion rate stability, and founder dependency.

To build an investor-ready revenue engine:

- Map your current process with buyer-focused stages.

- Measure conversion rates and deal progression.

- Automate and document top-performing strategies.

Investors prioritize systems that can scale without heavy founder involvement. If your revenue depends on you, they’ll see it as a risk, not an asset.

Sales Process vs. Revenue Engine: What’s the Difference?

Sales Process vs Revenue Engine: Key Differences for Investor Readiness

Founders often confuse a sales process with a revenue engine, but understanding the distinction is critical. Why? Investors are drawn to scalable systems, not businesses that rely on the extraordinary efforts of a few individuals.

Sales Process: Manual Steps That Don’t Scale

A sales process refers to the manual steps your team takes to close deals. Think follow-up emails, discovery calls, tailored proposals, and contract negotiations. It’s a common approach for early-stage companies, especially when founders are heavily involved.

The catch? It’s not scalable. As Gracie Rotman from Vocap Partners explains:

"The founders’ time is not infinitely scalable, nor is their rolodex of contacts."

Sure, this method can generate a few million dollars in revenue, but it doesn’t guarantee a repeatable, scalable system.

Traditional sales processes focus on seller actions – like sending a proposal or scheduling a demo. But these metrics don’t reflect real buyer progress. If your pipeline stages are based on what your team did rather than what the prospect confirmed, you’re building on shaky ground.

Revenue Engine: Systems That Run Without You

A revenue engine, on the other hand, is a well-oiled system that aligns teams with shared data and processes. It’s built to deliver consistent revenue across the entire customer lifecycle – from initial contact to renewal.

The game changer here is automation and measurability. A revenue engine tracks buyer actions instead of seller activities. For example, stages are defined by tangible buyer milestones – like requesting a contract, initiating IT review, or designating your company as their vendor of choice. Every step is backed by evidence, whether it’s an email, document, or recorded agreement. Optimism alone doesn’t move deals forward.

Revenue Operations (RevOps) is the backbone of this system. As Jeff Ignacio from GTMnow puts it:

"Revenue Operations act as the framework that keeps the entire engine running smoothly by unifying operations and strategy for each of the different teams."

This approach ensures seamless handoffs, unified tools, and a reliable dataset for forecasting. Companies using this model see impressive results – 32% higher revenue and 38% better win rates.

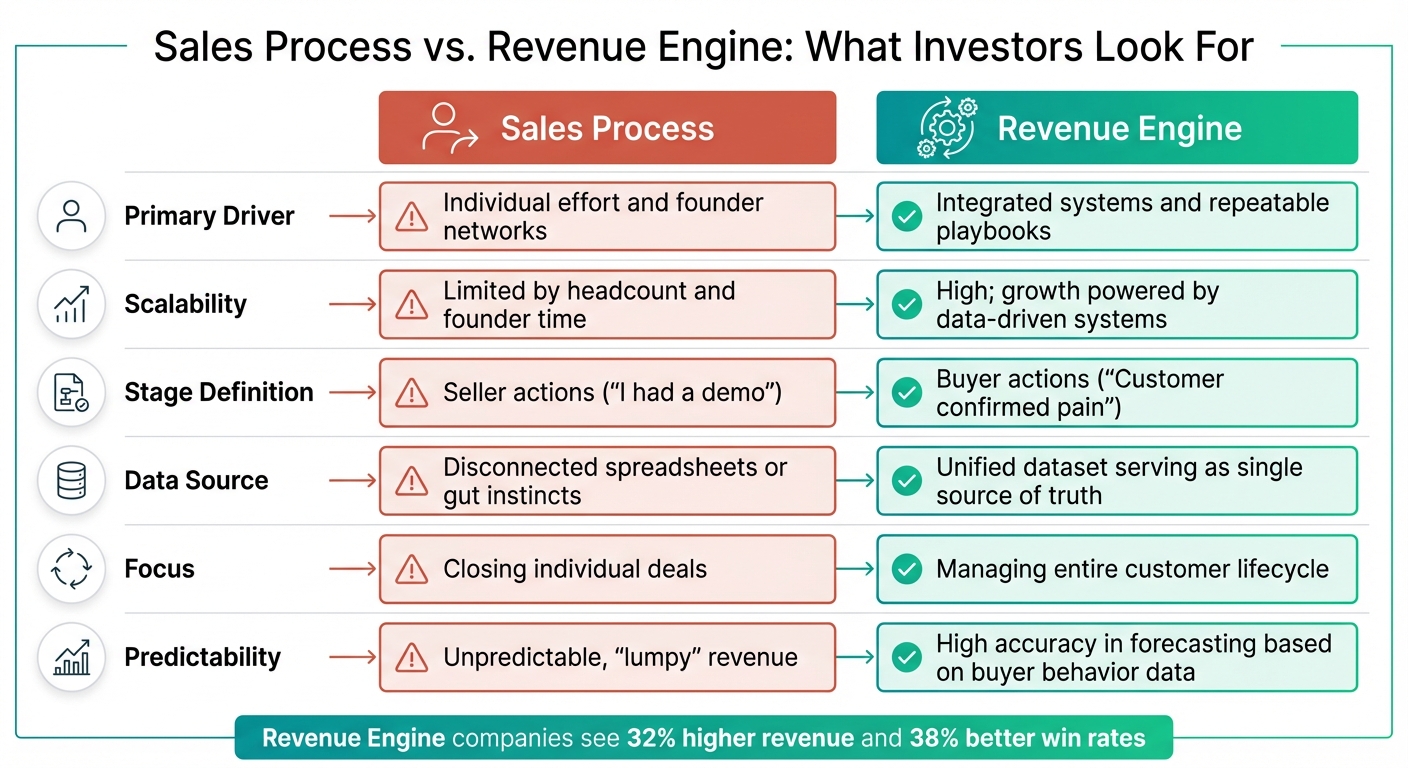

Side-by-Side Comparison

| Feature | Sales Process | Revenue Engine |

|---|---|---|

| Primary Driver | Individual effort and founder networks | Integrated systems and repeatable playbooks |

| Scalability | Limited by headcount and founder time | High; growth powered by data-driven systems |

| Stage Definition | Seller actions ("I had a demo") | Buyer actions ("Customer confirmed pain") |

| Data Source | Disconnected spreadsheets or gut instincts | Unified dataset serving as a single source of truth |

| Focus | Closing individual deals | Managing the entire customer lifecycle |

| Predictability | Unpredictable, "lumpy" revenue | High accuracy in forecasting based on buyer behavior data |

Grasping these differences is essential. Investors don’t just look at how much revenue you’ve earned – they want to know if your system can scale. A business generating $1 million with a repeatable revenue engine is often more attractive than a $5 million business relying on founder-driven deals. The real question is: can your next hire replicate your success without you in the room?

5 Metrics Investors Check During Diligence

When investors dive into your revenue model, they aren’t just scanning the top-line numbers. They’re looking for signs that your business can grow and operate smoothly without heavy involvement from the founders. Here are five key metrics that show whether your system can truly stand on its own.

1. CAC Payback Consistency

It’s not enough to know your average customer acquisition cost (CAC). Investors want to see how quickly specific customer groups pay back their acquisition costs. A company-wide average can mask problem areas where certain customer segments never become profitable. Brian Zimmerman of OpenView puts it this way:

"If your new business exceeds your sales and marketing expenses, you’re nearing a scalable model."

Inconsistent payback periods across customer cohorts suggest scalability issues. Companies with gross margins above 70% are better positioned to reinvest in growth, speeding up payback times.

Before meeting with investors, ensure your data definitions are consistent across teams. Break down CAC payback by customer segment instead of relying on an overall average. If some customer groups consistently fail to pay back acquisition costs, your business isn’t ready to scale.

2. Deal Velocity Trends Across Quarters

Investors analyze how long it takes deals to move through each stage of your sales pipeline. They want to see if your sales cycle remains steady – or even improves – as the company grows and the founder steps back. Mark Regan and Joe Morrissey from Andreessen Horowitz explain:

"Sales at scale is almost all RevOps."

A scalable revenue engine shows stable or shorter sales cycles even as deal volume increases. If your cycle times grow longer as you scale, it’s a red flag.

To keep things on track, set clear criteria for when deals enter and exit each pipeline stage. For example, the Discovery stage might take no more than 14 days, while Evaluation could be capped at 45 days. Adjust these targets based on your specific business. Conduct weekly reviews to identify and resolve stalled deals that might inflate your velocity metrics. Investors will also look for strong alignment with your ideal customer profile (ICP) in each deal.

3. ICP Evidence in Closed Deals

Investors need to see that your wins aren’t just random. Each closed deal should include a documented problem statement from the buyer, ideally pulled from recorded calls or emails. This proves that your deals align with your ICP.

Patterns like similar industries, company sizes, and recurring pain points indicate that you’ve developed a repeatable sales process. On the other hand, if your wins appear scattered across unrelated segments, it suggests you’re still searching for product-market fit. Track win rates by source, segment, and deal size. If you notice large differences between customer types, it might mean your ICP isn’t fully validated yet.

4. Conversion Rate Stability

Stable conversion rates between sales stages show that your process is reliable, not dependent on individual effort. Investors typically expect around 75% of your sales team to meet or exceed their quotas. If only the founder or a single standout salesperson consistently closes deals, it signals overreliance on individual performance.

To demonstrate a strong system, aim for forecast accuracy within ±10% over a 30-day period. Implement a quick, 30-minute pipeline hygiene check before reviews to clean up opportunities that don’t meet your criteria. Measure conversion rates by sales rep, lead source, and customer segment. Large swings in these metrics could indicate that your process relies on chance rather than a repeatable strategy. Aligning your sales and marketing teams can also lead to higher win rates and increased revenue.

5. Founder Dependency Score

If your revenue engine leans too heavily on the founder, it’s a major red flag for investors. They want to see that your business can scale without the founder being involved in every deal. If founder intervention is still required to close sales, it suggests you’re running a job, not a scalable business.

Track your progress as you shift from founder-led sales to a team-driven model. Founders should step back from daily deal reviews only after the sales team has hit predictable quotas for at least three consecutive cycles. Persistent founder involvement in closing deals signals high risk and lack of scalability.

To address this, document your entire revenue process from start to finish. Pinpoint every manual step and decision that depends on the founder’s judgment or intuition. Then, work to replace these bottlenecks with automated tools, standardized playbooks, and clear decision-making criteria. Investors are drawn to systems that can grow independently – not businesses that hinge on a single person’s efforts.

3 Mistakes That Kill Your Revenue Engine

Many founders think they’ve built a revenue engine, but in reality, they’ve only added tools without creating a system to manage deal flow effectively. These three common mistakes explain why investors often pass on companies that struggle to scale.

Mistake 1: Confusing Tools with Systems

Just using software like HubSpot doesn’t mean you’ve built a revenue engine. A CRM is simply a database for tracking deal statuses – it’s a tool, not the engine that drives revenue. As Mark Regan and Joe Morrissey from Andreessen Horowitz explain:

"The best founders think they’re building two products from the inception of their companies: the first is the actual product they’re selling to customers, and the second is a well-oiled, differentiated GTM machine."

An effective revenue engine goes beyond tools. It requires clear, evidence-based exit criteria – like a prospect requesting next steps via email, scheduling a technical review, or signing a mutual action plan. If deals move forward based on gut feelings rather than measurable progress, it signals a lack of structure. Investors notice this and may view it as a red flag. To attract investment and scale successfully, you need consistent, repeatable performance metrics.

Mistake 2: Staying in Founder-Led Sales Too Long

Founder-led sales are fine in the early stages, but once you hit $500,000 ARR, scaling to 5× growth demands more than one person can handle. Founders often take pride in being involved in every deal, but this approach doesn’t scale when you’re also managing product development, customer support, and fundraising.

Jason Lemkin, CEO and Founder of SaaStr, explains:

"You can’t hire a VP of sales before you have an engine, before you have a process. Really that almost always means two sales reps hitting quota."

If your sales process relies heavily on the founder’s personal network or involvement, it’s a sign that the system isn’t scalable. To fix this, document your successful strategies, hire two sales reps to test and validate a repeatable process, and then bring in a VP of Sales to scale operations. This shift ensures your pipeline doesn’t depend solely on founder-led efforts and can grow sustainably.

Mistake 3: Not Measuring Post-Demo Activity

For many B2B SaaS companies, the demo is a critical step in closing deals. Yet, 63% still rely on manual follow-ups without tracking what happens afterward. Without monitoring post-demo activity – like conversions from trial to proposal or contract review – you’re leaving potential revenue untapped.

Adem Manderovic, Founder of CRO School, sums it up perfectly:

"Sales should validate the market – who they’re with today, when contracts are up, what they like and don’t like."

Tracking post-demo engagement is crucial. Are prospects revisiting your pricing page, downloading case studies, or involving other stakeholders? If not, it’s hard to tell whether they’re genuinely interested or just being polite. Start by measuring the average time deals spend in each stage after the demo. For example, if deals frequently stall at the proposal stage, it might indicate issues with pricing or contract terms. If prospects disappear after the demo, your qualification process may need improvement.

Top-performing B2B companies convert 88% of qualified leads into booked meetings by optimizing every handoff in the process. If your conversion rate lags behind, investors might assume these inefficiencies will only grow as you scale.

Addressing these mistakes is essential to building the kind of revenue engine that attracts investors. If you’re ready to move beyond manual processes and create a scalable, automated system, Join our AI Acceleration Newsletter for expert insights on AI-driven go-to-market strategies.

sbb-itb-32a2de3

How to Build a Revenue Engine Investors Want to Fund

Founders often discover gaps in their revenue processes during investor due diligence. To create a revenue engine that attracts funding, you can transform manual chaos into measurable systems in just a few weeks by following three focused steps.

Are you using an AI framework to streamline revenue generation? Subscribe to our AI Acceleration Newsletter for weekly tips on building automated go-to-market systems that catch investors’ attention.

Step 1: Map Your Current Revenue Process

Start by analyzing your last 20 closed deals to understand what actually happened. Dive into your CRM data to review every touchpoint, the time spent between stages, and the content shared along the way. This analysis will highlight the true journey your prospects take and reveal manual handoffs that might fail as you scale.

Next, reframe your deal stages with the buyer’s perspective in mind. Rename stages to reflect their progress, such as "Selection" instead of "Demo Scheduled" or "Negotiation" instead of "Proposal Sent." As The Harris Consulting Group wisely advises:

"Your stage names should reflect where your prospect is in their decision-making process, not where you want them to be."

Define clear exit criteria for each stage. For example, during the Discovery stage, require an introduction to the Executive Sponsor and a problem statement written in the buyer’s own words. For the Selection stage, ensure the proposal is acknowledged by the buyer, along with evidence that they’ve evaluated competing options. These criteria ensure deals move forward based on concrete buyer actions, not intuition.

Finally, evaluate the handoffs between Marketing, Sales, and Customer Success. Look for weak transitions, such as those without documented rules, Service Level Agreements (SLAs), or automated triggers. For instance, if your SDR-to-AE handoff relies on informal messages instead of a structured CRM workflow with clear lead-scoring criteria, you’ve identified a bottleneck.

Once your process is mapped and stages are buyer-focused, you’re ready to measure how effectively deals progress through these stages.

Step 2: Measure Conversion Rates at Each Stage

First, ensure your CRM data is accurate, with only qualified deals remaining in the pipeline. Organizations with a structured sales process generate 28% more revenue than those without one, so accuracy is key.

Calculate your stage conversion rates by dividing the number of deals moving to the next stage by the total deals in the current stage. For example, if 100 deals enter Discovery but only 30 advance to Selection, a 30% conversion rate could signal issues with qualification or value communication. For context, the average B2B SaaS win rate is 22%. Falling below this benchmark highlights where your team needs improvement.

Also, track how long deals spend in each stage. If a stage like Proposal consumes 47% of your total sales cycle, it’s likely a bottleneck. For example, in September 2024, a 23-person MarTech SaaS company cut its sales cycle from 97 to 79 days by implementing a 15-minute SLA for hot leads, creating vertical-specific demo environments, and requiring engagement with at least three stakeholders per deal. These changes boosted their win rate from 14% to 21% and increased quarterly revenue from $111K to $318K – a 186% jump without adding staff.

Switch from quarterly reviews to weekly tracking. As Optif.ai emphasizes:

"Revenue velocity is a leading indicator – it predicts what will happen tomorrow."

Armed with clear metrics, you can now focus on replicating and automating the behaviors that drive success.

Step 3: Document and Automate What Top Performers Do

Pinpoint the habits of your top 20% of reps. Do they engage multiple decision-makers in every deal? Do they handle legal reviews and security questionnaires alongside demos instead of waiting for one to finish before starting the other? Turn these winning strategies into required steps, not optional guidelines.

Automate actions triggered by high-intent signals. For instance, set up tools to alert your team when a prospect visits your pricing page multiple times in 24 hours. Research shows responding to a lead within 5 minutes can boost conversion rates by 2.5×. Use CRM workflows to assign hot leads based on territory and expertise, eliminating delays.

Run processes in parallel to shorten sales cycles. Instead of waiting until Week 7 to start legal reviews after a demo, initiate both steps in Weeks 2-4. This approach can slash cycle times from 84 to 35 days – a 58% reduction – without compromising deal quality. Automate these steps in your CRM so they launch as soon as a deal enters the Selection stage.

Finally, enforce weekly data hygiene rituals. Require reps to spend 30 minutes before pipeline reviews auditing stage accuracy. Set CRM alerts to flag deals that violate exit criteria or have overdue next steps. Clean, reliable data is the foundation for confident forecasting, which reassures investors about the scalability of your revenue engine.

A well-documented and automated system not only streamlines operations but also addresses investor concerns about scalability and over-reliance on the founder.

Conclusion

Investors don’t back founders who try to do it all – they back systems that scale. The distinction between a basic sales process and a fully functional revenue engine lies in two key factors: repeatability and measurement. If you can’t explain exactly what happens after each demo, track conversion rates at every stage, or prove that your top performers’ strategies work without your constant input, you’re not ready for serious investor scrutiny.

The solution? Start by mapping your entire process from start to finish. Measure conversion rates at every stage, document what makes your best team members succeed, and identify where things break down. From there, automate lead capture and tackle bottlenecks simultaneously. These steps can drive a 49% increase in revenue velocity, improving factors like win rates, average contract value, and sales cycle length. This structured approach is what investors expect.

What’s your AI strategy for automating your revenue engine? Subscribe to our AI Acceleration Newsletter for weekly insights designed to help founders build scalable, investor-ready systems.

What to Do Next

Take a fresh look at your mapped process and the metrics you’ve gathered. Start with a 30-minute review of your last 20 closed deals. Pinpoint where manual handoffs create delays, where deals tend to stall, and which stages have win rates below the industry average of 22%. Then, define clear, objective criteria for moving deals through each stage – eliminating any reliance on “gut instinct.”

If you’re gearing up for a Series A and need expert guidance in building a revenue engine that meets investor expectations, consider the M Accelerator Elite Founders program. Through live weekly sessions, we’ll help you implement automations that are fully operational by the end of each session. No waiting, no third-party developers – just systems you’ll own and control.

Get Weekly Revenue Engine Insights

Every week, we provide actionable frameworks for automating tasks like lead scoring, post-demo follow-ups, and pipeline velocity tracking. These tools can significantly shorten sales cycles and improve conversion rates. Founders who subscribe report conversion rate increases of 40% and sales cycle reductions of up to 50%.

Subscribe to the AI Acceleration Newsletter to receive practical go-to-market strategies, ready-to-use metrics templates, and AI-driven automation tips. Tailored for startups from pre-seed to Series A, this newsletter delivers systems that create predictable, scalable revenue – no fluff, just results.

FAQs

What’s the difference between a sales process and a revenue engine?

The key distinction between the two lies in their approach and scalability. A sales process involves a set of manual steps executed by sales representatives to close deals. This often demands considerable input from the founder or other key team members. On the other hand, a revenue engine is a scalable system built to operate independently of the founder, emphasizing consistency and measurability.

A sales process leans heavily on individual effort, while a revenue engine drives consistent outcomes by streamlining and automating workflows, closely monitoring critical metrics, and minimizing manual interventions. Investors tend to favor revenue engines because they demonstrate that a business can grow predictably without relying too much on the founder’s direct involvement.

Why do investors prioritize scalable revenue engines over founder-led sales?

Investors place a high value on revenue engines because they’re built to drive growth that’s scalable, repeatable, and easy to measure. A well-designed revenue engine runs smoothly without needing the founder to be directly involved, ensuring steady performance and reducing dependency on any one person. This independence not only makes the business more resilient but also more appealing to investors looking for long-term opportunities.

On the other hand, founder-led sales often depend heavily on personal networks and manual efforts, which can result in unpredictable outcomes. While a founder’s role in sales is critical in the early stages, investors expect companies to shift toward a system-driven model as they scale – especially when annual recurring revenue (ARR) surpasses $500,000. Without this transition, the business may seem harder to scale and riskier to invest in.

How do I move from founder-led sales to a scalable, repeatable revenue system?

Transitioning from founder-led sales to a scalable revenue system means moving away from processes that depend heavily on the founder’s involvement. Instead, the goal is to create a structured, predictable system that can operate independently. Start by thoroughly mapping out your sales process. Identify areas where manual handoffs occur or where the founder’s input is critical. This will highlight the steps that need to be automated or standardized.

The next step is to create a system built around repeatable and measurable actions. Define clear criteria for each stage of the sales cycle, and track key metrics like conversion rates, deal velocity, and CAC payback. Consistency is key – replace informal methods with well-documented procedures. Tools like CRM systems should be more than just tracking tools; they should function as part of an integrated workflow that supports the entire sales process.

To keep improving, establish a culture of regular performance reviews. Analyze pipeline trends, including customer lifetime value, to identify areas for refinement. As your system becomes more robust, bring in experienced sales leaders who can enhance and scale the process. This will not only make your revenue model more predictable but also more appealing to potential investors.