In the ever-evolving landscape of investment opportunities, family offices are increasingly exploring avenues beyond traditional asset classes. One area gaining attention is the venture capital (VC) space, particularly through emerging venture funds.

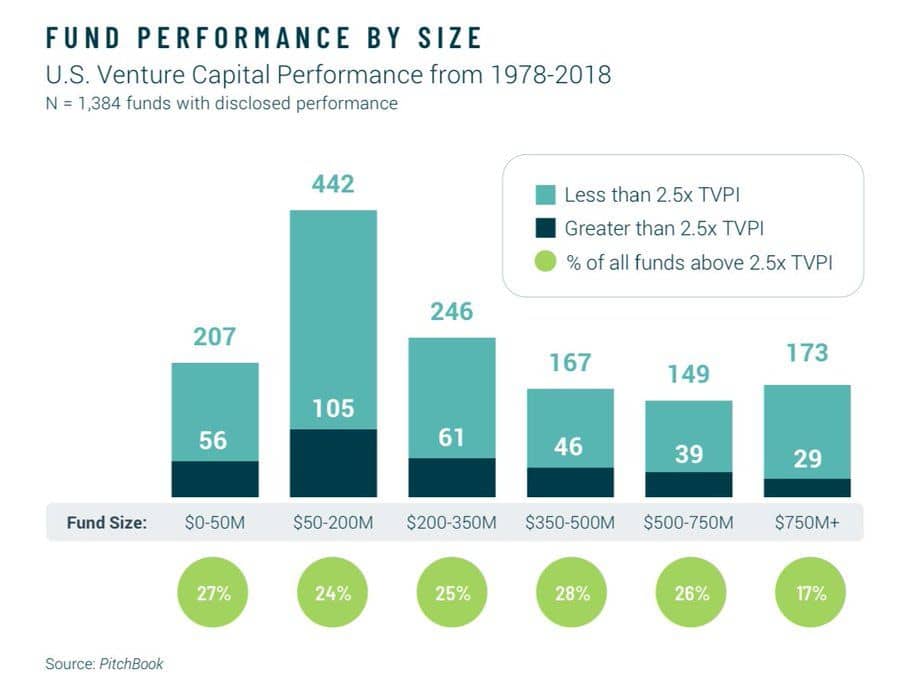

According to Pitchbook’s analysis of US VC fund performance since 1978, there’s a compelling case for family offices to consider these emerging funds, especially those with a size smaller than $350 million.

Key Findings

Pitchbook’s analysis reveals a noteworthy trend – venture funds with a size below $350 million exhibit a 50% higher likelihood of generating a 2.5x return compared to their larger counterparts exceeding $750 million. This raises a pertinent question: Why are smaller venture funds proving to be more successful in delivering substantial returns?

1. Prudent Investment Strategy

Smaller venture funds face constraints that can be transformed into advantages. With limited capital, they cannot afford to invest in too many failures. This necessitates a highly selective and meticulous investment strategy, where each investment is carefully scrutinized for its potential.

2. Streamlined Decision-Making

The streamlined decision-making process is a notable strength of smaller venture funds. Unlike larger funds, they can swiftly assess opportunities and make decisions, allowing them to act nimbly in dynamic markets.

3. Specialization in Sectors or Growth Stages

Many emerging funds choose to specialize in specific sectors or stages of growth. This focused approach allows them to develop deep expertise, staying ahead of trends and identifying promising opportunities within their niche.

4. Reduced Exit Pressure

Smaller funds face less pressure to exclusively pursue large exit potential. This freedom enables them to focus on businesses at earlier stages of development, fostering innovation and supporting startups with high growth potential.

5. Early Impact

Emerging venture funds often concentrate on the early stages of a company’s life cycle. This early engagement allows them to have a significant impact on the strategic direction and development of the businesses in which they invest.

6. Strong Founder Relationships

Smaller funds build closer relationships with their founders. This intimate connection fosters trust and collaboration, enabling the fund to provide valuable guidance and support throughout the company’s growth journey.

7. Hands-On Approach

A more hands-on approach is a common trait of smaller venture funds. This proactive involvement in portfolio companies sets them apart, as they actively contribute to the success of their investments beyond the infusion of capital.

Alignment with Family Offices

The characteristics that make emerging venture funds successful align closely with the preferences and requirements of family offices. These include:

– Need for trust and a personalized approach.

– Focus on value creation and impact.

– Long-term investment horizon.

Conclusion

In conclusion, the compelling performance data and the alignment of values make emerging venture funds an attractive proposition for family offices seeking to diversify into the venture capital space. The personalized approach, hands-on involvement, and focus on value creation make these funds well-suited for family offices looking to navigate the dynamic world of venture capital while staying true to their core investment principles.

For further insights, Jeremy Tan provides additional perspectives in his original post, which can be found here. As the landscape of venture capital continues to evolve, the question remains: Would you invest in an emerging fund?