What is the difference between Venture Capital and Private Equity?

Venture capital invests in businesses driving innovation and developing new technologies, while private equity focuses on enhancing operational efficiency and profitability in established companies within mature markets.

When it comes to early-stage startups, the choice between venture capital (VC) and private equity (PE) funding is often difficult.

Prominent consulting firm EY published 2022 reports on the significant amount of money invested by venture capital and private equity firms. According to the reports, venture capital and private equity are valuable funding options. Reportedly, $209.4 billion and $730 billion in funds were invested in 2022 by venture capital and private equity, respectively.

Both options offer a variety of advantages and disadvantages, and founders need to understand the differences between them to make an informed decision. One key difference is that venture capital is usually used as an early-stage form of financing, while private equity is typically used later in a startup’s life cycle.

This article will provide an overview of venture capital vs. private equity and discuss the advantages and disadvantages of each. We’ll also explore the differences between these two forms of financing so that you can choose the one that best fits your startup’s needs. By understanding what makes each approach unique, you can ensure that you make the right decision when seeking funding for your startup.

Control, Ownership, and Strategic Influence

When weighing venture capital vs private equity, founders must consider how much ownership they are willing to share. Venture capitalists typically take minority positions, providing funding and mentorship while expecting equitystakes that grow in value as the startup scales. This allows founders to remain the primary decision-makers in their company while leveraging the expertise of venture capital firms.

By contrast, private equity firms are more likely to seek majority control, restructuring firms and implementing operational changes to maximize profits and long-term growth. For entrepreneurs, the choice comes down to balancing independence against the resources and oversight that PE firms can bring.

What is Venture Capital Funding?

Venture capital funding is a form of private equity financing where venture capitalists (VCs) provide capital to early-stage startups in exchange for an ownership stake in the company. Venture capital firms typically offer this type of funding, which manage and invest large pools of money from various sources.

Venture capital deals generally are more extensive than traditional angel investments and offer more guidance and support than other forms of private equity. VCs typically choose portfolio companies or firms they will invest in based on their potential for growth and return on investment (ROI).

Venture capitalists expect higher returns on their investments than traditional investors due to the increased risk of investing in new and unproven businesses. Consequently, venture capitalists typically look for innovative products or services with strong market potential when making investment decisions.

Venture capital funds, which are pools of money from institutional investors managed by a team of professionals and advisors, provide the financing for venture capital deals. VC funds support promising startups to achieve long-term returns through capital appreciation. VCs also often offer additional resources such as mentorship, advice, introductions to industry contacts, and product development or marketing expertise.

Furthermore, venture capitalists often require that companies meet specific criteria concerning their financial health and management team before investing their funds. Ultimately, VC firms provide vital resources to entrepreneurs seeking to produce positive results from their venture or startup.

Venture capital investments for startups

Over the past decade, venture capital investments have become essential to the startup landscape, providing crucial funds and resources for young companies to grow and succeed.

Venture capitalists invest in early-stage companies, often those in the growth stages and with high potential for success. These investments can provide much-needed capital for entrepreneurs to finance their businesses and help them build operations that can scale up quickly. In addition, these investors often look for innovative ideas and disruptive business models with a high chance of generating a return on investment.

Venture capital investments can also provide startups with essential resources such as mentorship, networking opportunities, and access to strategic partnerships, which can be invaluable for helping them develop and grow.

What is Private Equity Funding?

Private equity funding is an essential source of capital for businesses and startups. It is a form of non-publicly traded investments, typically provided by private equity firms, investors, and funds. Private equity investors offer financial resources to support business growth and development in exchange for ownership or control interest in the company.

Unlike venture capital, private equity funding generally occurs later in a startup’s life cycle and involves more significant investments from experienced investors. Private equity firms typically buy entire companies or large portions of them, often intending to restructure and optimize operations before reselling them at a higher valuation.

When investors contribute capital to a business or asset, they become part owners and receive a particular share of profits from those investments. These profits may include dividends, returns on investment, or proceeds from sales of assets when they mature. Private equity firms buy companies with growth potential and can help shape them into more profitable businesses by restructuring operations, reducing costs, and exploiting new markets. By doing so, they hope to turn around undervalued assets into profitable investments that create much-needed returns for their investors.

Private equity firms also provide additional resources such as mentorship, advice, introductions to industry contacts, and product development or marketing expertise. For these reasons, private equity is often considered more hands-on than venture capital and can provide long-term investment opportunities based on exit strategies pre-determined by investors. As such, private equity can be a valuable funding source for startups looking to rapidly scale while having access to critical resources and support during their journey.

Private equity investment for startups

While private equity firms typically invest in businesses with a proven track record of success, private equity investments can still be an option for startups depending on the startup’s circumstances. While private equity investments may not be the most common source of funding for startups, these investors may decide to take an equity stake in a promising early-stage company if they believe it has the potential to become successful.

Therefore, when seeking private equity financing, founders should do their due diligence to demonstrate that they have a strong market potential, a solid business plan, a viable product or service, and the potential to multiply in value. Additionally, private equity firms may require that founders contribute some of their capital before investing.

Significant Differences between Private Equity and Venture Capital

Private equity firms and venture capital firms have many differences, but they also have several similarities. First, private equity and venture capital firms raise capital from outside investors, called Limited Partners (LPs) – pension funds, endowments, insurance firms, and high-net-worth individuals. Then, both firm types invest that capital in private companies and attempt to sell those investments in the future for a significant return on investment.

According to Investopedia, a significant difference between PE and VC is the amount of typically invested funding: “Private equity firms usually invest $100 million and up in a single company. These firms prefer to concentrate all their efforts on a single company since they invest in already established and mature companies. As a result, the chances of absolute losses from such an investment are minimal. Venture capitalists typically spend $10 million or less on each company since they mostly deal with startups with unpredictable chances of failure or success.”

Another significant difference is the ownership stake that the investors are seeking. Investopedia says, “Private equity firms mostly buy 100% ownership of the companies in which they invest. As a result, the firm is in total control of the companies after the buyout. Venture capital firms invest in 50% or less of the equity of the companies.”

When considering the differences between private equity and venture capital, founders should consider whether they want to maintain a controlling stake in their startup. Founders should also consider the pros and cons associated with each option to make the most informed decision for their unique situation.

Pros and Cons of Private Equity vs. Venture Capital

The private equity vs. venture capital debate can be complex, but it is crucial to understand the pros and cons of the two.

Pros for Private Equity:

- Access to large amounts of capital (tens to hundreds of millions, or even billions in some cases) that can help a company expand rapidly.

- Long-term investment horizon as there is no pressure from stock market investors for short-term gains. This lengthy timeline can give companies more time to grow before having to repay the debt or issue equity in the future.

- Gain expertise from private equity partners who can provide valuable advice on strategic planning, operational improvement, and financial management.

Cons for Private Equity:

- Highly competitive landscape and limited access to private equity pools, as most funds are open to accredited investors only.

- Before a PE investment, companies must meet strict criteria such as specific financial metrics and business objectives.

- More extended time frames are standard due to extensive due diligence processes, negotiations, etc., which can become expensive, time-consuming, and lead to delays in capital infusion.

- Strict terms and conditions may limit a company’s ability to operate freely or take advantage of new opportunities in the future.

Pros for Venture Capital:

- Early-stage companies have access to venture capital which can offer crucial resources, including financing, expertise, contacts, research, etc.

- Flexibility in terms such as deal structure, risk/reward ratios, liquidity preference rights, etc., allows startups to tailor the financing agreement according to their needs.

- No need for repayment during the lifetime as venture capitalists usually take an equity stake in return for their investment.

- Usually provides more hands-on involvement with companies they invest in than other investors (such as banks).

Cons for Venture Capital:

- High expectations from venture capitalists who are often looking for rapid growth and high returns on their investments, so startups must prove themselves quickly or risk not getting additional funding rounds.

- Limited exit options due to long lockup periods imposed by venture capitalists who want maximum returns before cashing out their investments.

- The very competitive environment for securing venture capital, with many applicants vying for limited funds from VC firms at any time.

The 5 Stages of Funding from VC to PE

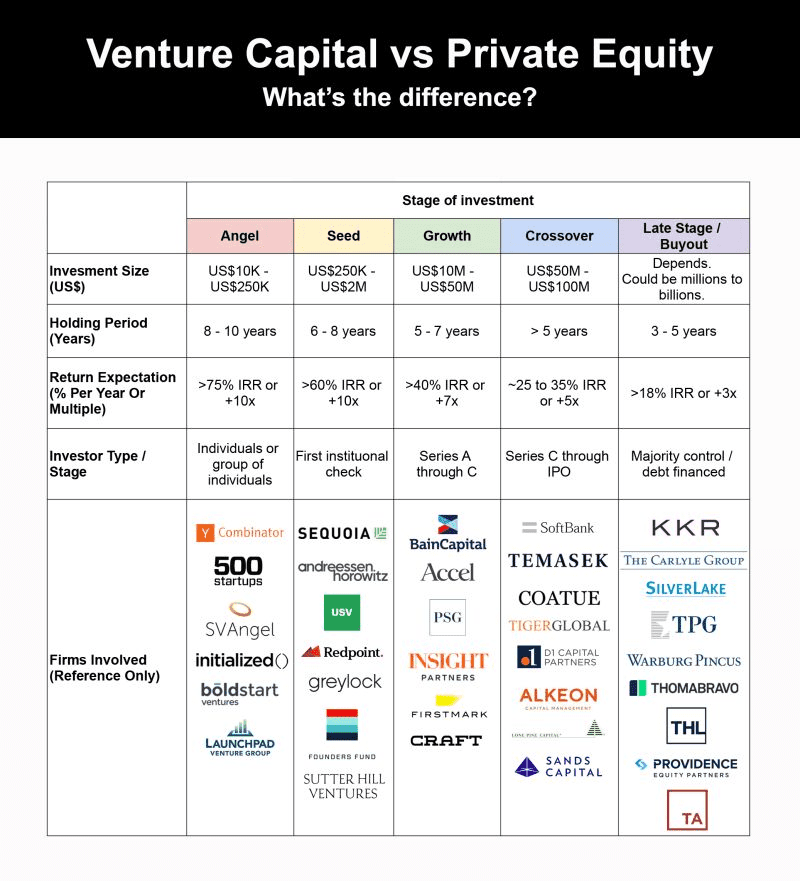

There are five stages from VC to PE investing: angel, seed, growth, crossover, and late stage/buyout.

Stage 1: Angel (pre-VC)

Ideal Company Type: These companies may have an ‘idea’ but must still validate and build it into a business properly. Since they have not validated their concept, institutional investors are typically unwilling to invest.

Funding Purpose: Typically, the funding is to validate their concept and build the idea into a business. To raise funds, these companies will ask friends or family to back them financially.

Investment size: $10K – $250K

Stage 2: Seed (VC)

Ideal Company Type: These companies have validated their product/service with consumers or convincing market research.

Funding Purpose: Commonly, the money is for product development and business expansion. Typically, this is when companies will hire their first full-time Sales & Marketing employees.

Investment size: $250K – $2M

Stage 3: Growth (VC/PE)

Ideal Company Type: At this stage, companies have figured out the positioning of their product/service in the market. However, they may still need to become profitable.

Funding Purpose: The money is mainly used for team and business expansion to continue gaining momentum in the market.

Investment size: $10M – $50M

Stage 4: Crossover (PE)

Ideal Company Type: Investors at this stage are looking for companies that have sustainable business models & profitability. Listing on a stock exchange (IPO) may be pretty close.

Funding Purpose: This funding may help expand into new international markets or develop multiple products/services.

Investment size: $50M – $100M

Stage 5: Late stage/buyout (PE)

Ideal Company Type: The company is close to an exit, either listing on a stock exchange (IPO) or getting “bought out.”

Funding Purpose: This funding may be most focused on making a mature company more efficient and profitable, so they can mark up its value and ‘flip it’ for a more significant multiple.

Investment size: Varies. $200M – $2B+

Key Takeaways & What You Need to Know About Investing in Early-Stage Startups

Ultimately, venture capital and private equity are both viable options when raising money for early-stage startups. However, each carries unique pros and cons that entrepreneurs should be aware of before making an investment decision.

That being said, any entrepreneur looking into these forms of funding should have a clear understanding of their company’s objectives and an exit strategy plan so they can make the most out of partnering with venture-backed companies or private equity funds. Nevertheless, with proper planning, leveraging the power of venture capital or private equity could pay off in significant ways for your business.

Financing Structures and Long-Term Outlook

Another difference lies in how capital is structured. Venture capital often supports high-risk innovation through staged financing, enabling startups to raise money in multiple rounds as they hit milestones. This incremental approach reduces risk for VC firms while fueling the growth trajectory of new companies.

Private equity, on the other hand, may combine equity investments with debt financing to optimize returns, especially when acquiring established companieswith stable revenue and proven markets. For founders, understanding these structures is critical: while venture capital funding is designed to accelerate disruptive innovation, private equity investment seeks efficiency, scalability, and a clear path toward an eventual exit.

Join our Free Sessions

Ready to take your entrepreneurial journey to the next level?

Join our free Founders Meetings and connect with a vibrant community of business leaders!

At these sessions, you’ll gain actionable strategies, unlock real-world insights, and discover our validated go-to-market frameworks—all designed to fuel your growth. Don’t miss this chance to network and learn from like-minded founders.

RSVP now at https://maccelerator.la/en/live-presentation/ and start transforming your business today!

For individuals interested in learning more about investing, M Accelerator has various resources available. Our platform hosts live sessions with hundreds of experts and investors.