In the fast-paced world of startups, mergers and acquisitions (M&A) often represent the most lucrative exit strategy. Whether it’s a tech giant absorbing innovative technology or a strategic move to dominate a market, M&A can be a game-changer for both startups and investors.

But how can investors discern if a startup has what it takes to exit via M&A? Here are key factors to consider.

Market Dynamics

Understanding the market landscape is crucial in assessing a startup’s potential for M&A. Investors should delve into market dynamics to gauge the likelihood of consolidation. Questions arise: Are there signs of consolidation within the industry? Who are the major players, and what are their acquisition strategies? Additionally, investors must evaluate if the startup offers novel or superior technology that could attract potential acquirers.

Commercial Viability

Commercial viability is another essential aspect to scrutinize. Investors should ascertain if the startup has the capability to penetrate new markets successfully. Moreover, the presence of intellectual property rights, such as patents, can bolster the startup’s attractiveness to potential acquirers. Additionally, investors must analyze whether the startup’s customer base is sustainable and profitable, indicating long-term growth potential.

Potential Synergies

Assessing potential synergies is paramount in evaluating a startup’s attractiveness for M&A. Investors should explore opportunities for cross-selling or upselling between the startup and potential acquirers. Furthermore, identifying potential cost savings or operational efficiencies post-acquisition can enhance the startup’s appeal. Understanding how the startup’s technology complements and enhances the capabilities of potential acquirers is crucial in assessing its M&A potential.

Timing of M&A

It’s essential to recognize that M&A activity can occur as early as the seed stage. Therefore, investors should integrate these evaluation criteria from the outset of their due diligence process. By considering market dynamics, commercial viability, and potential synergies, investors can better gauge a startup’s likelihood of attracting acquisition interest.

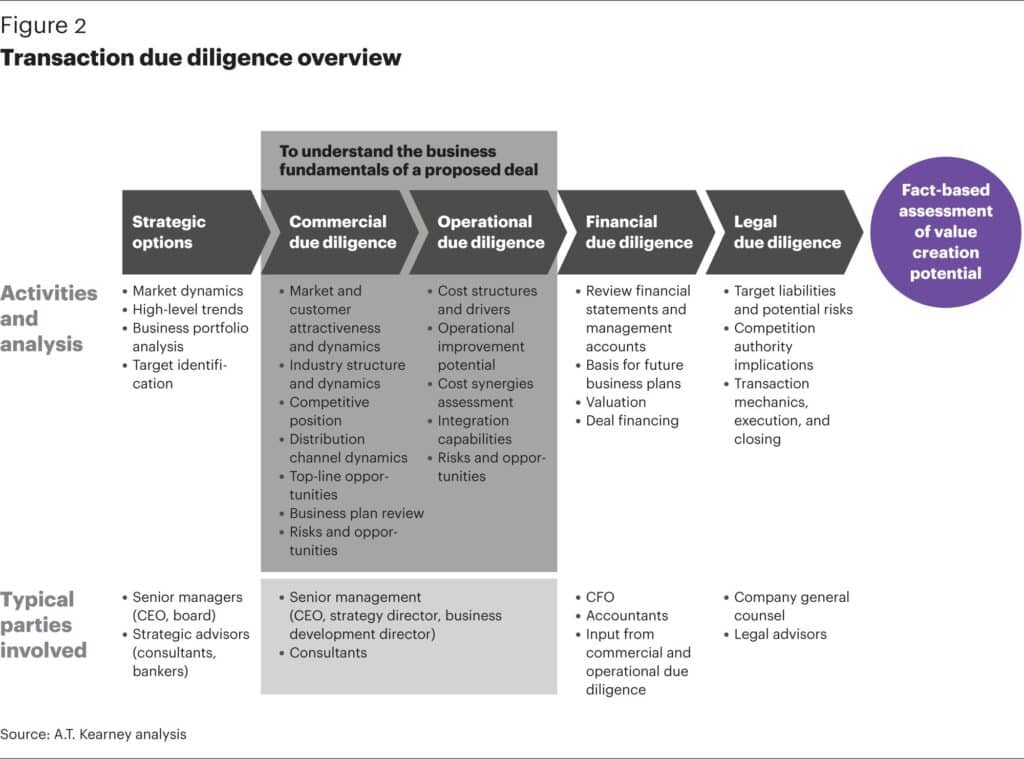

Image sourced from Kearney

Conclusion

Assessing a startup’s potential for a successful M&A exit requires a comprehensive evaluation of various factors. By examining market dynamics, commercial viability, and potential synergies, investors can make informed decisions regarding investment opportunities. Ultimately, being proactive in assessing these criteria can increase the likelihood of a favorable exit strategy for both startups and investors alike.